- Singapore

- /

- Energy Services

- /

- SGX:DU4

Mermaid Maritime Public Company Limited's (SGX:DU4) 27% Cheaper Price Remains In Tune With Earnings

Mermaid Maritime Public Company Limited (SGX:DU4) shares have had a horrible month, losing 27% after a relatively good period beforehand. Still, a bad month hasn't completely ruined the past year with the stock gaining 45%, which is great even in a bull market.

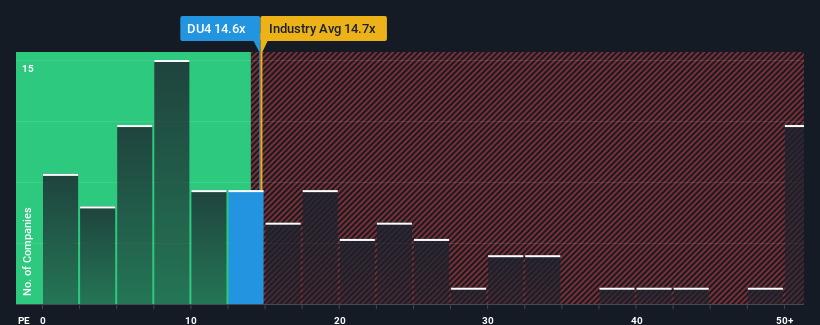

Although its price has dipped substantially, given around half the companies in Singapore have price-to-earnings ratios (or "P/E's") below 11x, you may still consider Mermaid Maritime as a stock to potentially avoid with its 14.6x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Mermaid Maritime as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Mermaid Maritime

Is There Enough Growth For Mermaid Maritime?

There's an inherent assumption that a company should outperform the market for P/E ratios like Mermaid Maritime's to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 9.8% last year. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 58% as estimated by the lone analyst watching the company. With the market only predicted to deliver 7.6%, the company is positioned for a stronger earnings result.

With this information, we can see why Mermaid Maritime is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Mermaid Maritime's P/E?

There's still some solid strength behind Mermaid Maritime's P/E, if not its share price lately. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Mermaid Maritime's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Mermaid Maritime (of which 1 can't be ignored!) you should know about.

If you're unsure about the strength of Mermaid Maritime's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:DU4

Mermaid Maritime

Provides subsea and offshore drilling services to the offshore oil and gas industries primarily in Saudi Arabia, Thailand, the United Arab Emirates, the United Kingdom, Qatar, Vietnam, Myanmar, and internationally.

Reasonable growth potential with acceptable track record.