Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, CH Offshore Ltd. (SGX:C13) does carry debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for CH Offshore

What Is CH Offshore's Net Debt?

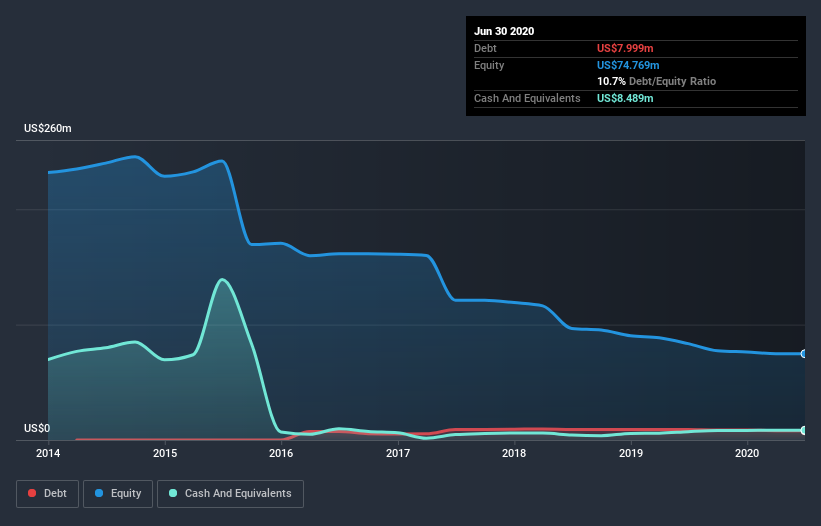

You can click the graphic below for the historical numbers, but it shows that CH Offshore had US$8.00m of debt in June 2020, down from US$9.04m, one year before. However, its balance sheet shows it holds US$8.49m in cash, so it actually has US$490.0k net cash.

How Healthy Is CH Offshore's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that CH Offshore had liabilities of US$16.9m due within 12 months and liabilities of US$5.83m due beyond that. On the other hand, it had cash of US$8.49m and US$13.2m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$950.0k.

Of course, CH Offshore has a market capitalization of US$18.4m, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Despite its noteworthy liabilities, CH Offshore boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since CH Offshore will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, CH Offshore reported revenue of US$24m, which is a gain of 66%, although it did not report any earnings before interest and tax. With any luck the company will be able to grow its way to profitability.

So How Risky Is CH Offshore?

Although CH Offshore had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of US$1.2m. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. One positive is that CH Offshore is growing revenue apace, which makes it easier to sell a growth story and raise capital if need be. But we still think it's somewhat risky. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for CH Offshore (of which 2 don't sit too well with us!) you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading CH Offshore or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SGX:C13

CH Offshore

An investment holding company, owns and charters vessels in Singapore, Malaysia, Indonesia, Mexico, Africa, India, and Brunei.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026