Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that CosmoSteel Holdings Limited (SGX:B9S) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for CosmoSteel Holdings

What Is CosmoSteel Holdings's Debt?

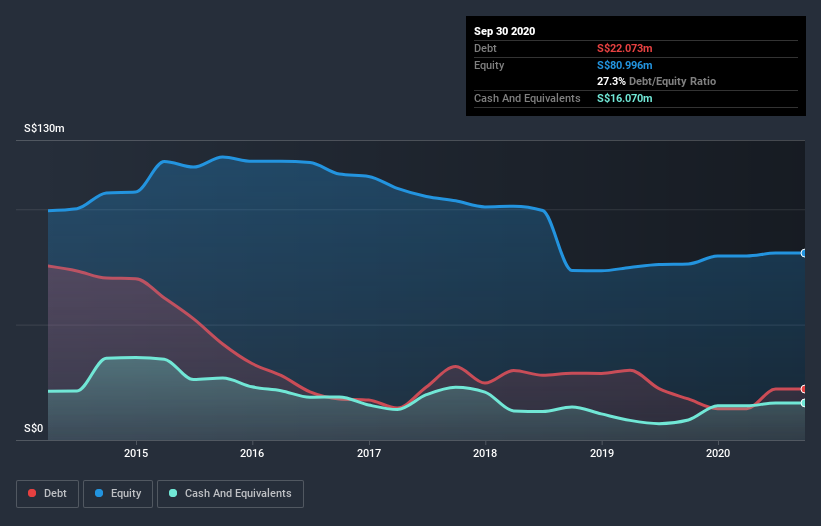

As you can see below, at the end of September 2020, CosmoSteel Holdings had S$22.1m of debt, up from S$17.8m a year ago. Click the image for more detail. On the flip side, it has S$16.1m in cash leading to net debt of about S$6.00m.

How Strong Is CosmoSteel Holdings' Balance Sheet?

We can see from the most recent balance sheet that CosmoSteel Holdings had liabilities of S$22.0m falling due within a year, and liabilities of S$8.59m due beyond that. Offsetting this, it had S$16.1m in cash and S$26.0m in receivables that were due within 12 months. So it can boast S$11.6m more liquid assets than total liabilities.

This excess liquidity is a great indication that CosmoSteel Holdings' balance sheet is almost as strong as Fort Knox. On this view, lenders should feel as safe as the beloved of a black-belt karate master.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

CosmoSteel Holdings has a low net debt to EBITDA ratio of only 0.65. And its EBIT covers its interest expense a whopping 10.2 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. On top of that, CosmoSteel Holdings grew its EBIT by 52% over the last twelve months, and that growth will make it easier to handle its debt. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since CosmoSteel Holdings will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Happily for any shareholders, CosmoSteel Holdings actually produced more free cash flow than EBIT over the last two years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

The good news is that CosmoSteel Holdings's demonstrated ability to convert EBIT to free cash flow delights us like a fluffy puppy does a toddler. And the good news does not stop there, as its EBIT growth rate also supports that impression! After looking at a variety of factors, it's pretty clear to us that CosmoSteel Holdings has a very strong balance sheet. We're no more concerned about its debt than sailing off the edge of the earth. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 2 warning signs we've spotted with CosmoSteel Holdings .

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade CosmoSteel Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:B9S

CosmoSteel Holdings

An investment holding company, sources and distributes piping system components in Singapore, Brunei, Vietnam, and internationally.

Moderate and slightly overvalued.

Market Insights

Community Narratives