- Singapore

- /

- Oil and Gas

- /

- SGX:AJ2

Here's Why Ouhua Energy Holdings (SGX:AJ2) Is Weighed Down By Its Debt Load

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Ouhua Energy Holdings Limited (SGX:AJ2) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Ouhua Energy Holdings

How Much Debt Does Ouhua Energy Holdings Carry?

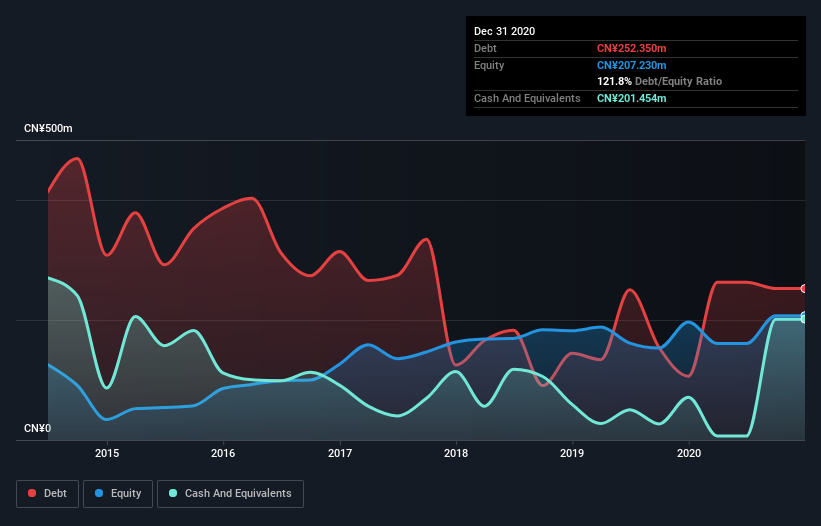

As you can see below, at the end of December 2020, Ouhua Energy Holdings had CN¥252.4m of debt, up from CN¥106.4m a year ago. Click the image for more detail. However, it also had CN¥201.5m in cash, and so its net debt is CN¥50.9m.

A Look At Ouhua Energy Holdings' Liabilities

The latest balance sheet data shows that Ouhua Energy Holdings had liabilities of CN¥401.4m due within a year, and liabilities of CN¥23.9m falling due after that. Offsetting these obligations, it had cash of CN¥201.5m as well as receivables valued at CN¥97.7m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥126.1m.

The deficiency here weighs heavily on the CN¥78.7m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, Ouhua Energy Holdings would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Given net debt is only 1.4 times EBITDA, it is initially surprising to see that Ouhua Energy Holdings's EBIT has low interest coverage of 1.5 times. So while we're not necessarily alarmed we think that its debt is far from trivial. Shareholders should be aware that Ouhua Energy Holdings's EBIT was down 50% last year. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. There's no doubt that we learn most about debt from the balance sheet. But it is Ouhua Energy Holdings's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Considering the last three years, Ouhua Energy Holdings actually recorded a cash outflow, overall. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

On the face of it, Ouhua Energy Holdings's EBIT growth rate left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at managing its debt, based on its EBITDA,; that's encouraging. Considering all the factors previously mentioned, we think that Ouhua Energy Holdings really is carrying too much debt. To our minds, that means the stock is rather high risk, and probably one to avoid; but to each their own (investing) style. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for Ouhua Energy Holdings (of which 1 is a bit unpleasant!) you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Ouhua Energy Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:AJ2

Ouhua Energy Holdings

Operates as an importer of liquefied petroleum gas (LPG) in the People’s Republic of China.

Slight risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026