David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Mencast Holdings Ltd. (SGX:5NF) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Mencast Holdings

How Much Debt Does Mencast Holdings Carry?

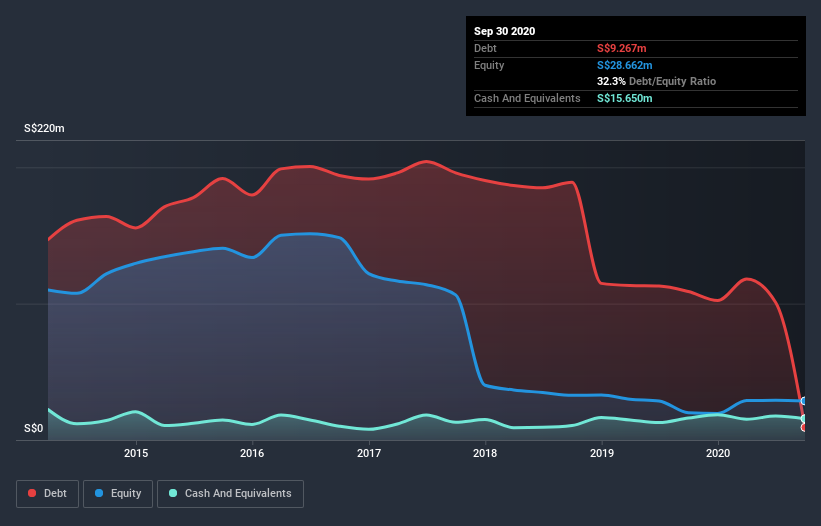

As you can see below, Mencast Holdings had S$9.27m of debt at September 2020, down from S$108.9m a year prior. But it also has S$15.7m in cash to offset that, meaning it has S$6.38m net cash.

How Strong Is Mencast Holdings' Balance Sheet?

The latest balance sheet data shows that Mencast Holdings had liabilities of S$97.5m due within a year, and liabilities of S$110.8m falling due after that. Offsetting this, it had S$15.7m in cash and S$15.5m in receivables that were due within 12 months. So it has liabilities totalling S$177.2m more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the S$11.9m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, Mencast Holdings would likely require a major re-capitalisation if it had to pay its creditors today. Given that Mencast Holdings has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total. When analysing debt levels, the balance sheet is the obvious place to start. But it is Mencast Holdings's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Mencast Holdings reported revenue of S$64m, which is a gain of 25%, although it did not report any earnings before interest and tax. With any luck the company will be able to grow its way to profitability.

So How Risky Is Mencast Holdings?

Although Mencast Holdings had an earnings before interest and tax (EBIT) loss over the last twelve months, it made a statutory profit of S$12m. So taking that on face value, and considering the cash, we don't think its very risky in the near term. One positive was the revenue growth of 25% over the last year. But we genuinely do think the balance sheet is a risky. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 4 warning signs for Mencast Holdings (2 can't be ignored) you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Mencast Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About Catalist:5NF

Mencast Holdings

An investment holding company, provides engineering and maintenance, repair, and overhaul solutions in Singapore, rest of Asia, and internationally.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026