- Singapore

- /

- Capital Markets

- /

- SGX:YF8

Yangzijiang Financial Holding (SGX:YF8) Reports Net Income Growth To S$138 Million

Reviewed by Simply Wall St

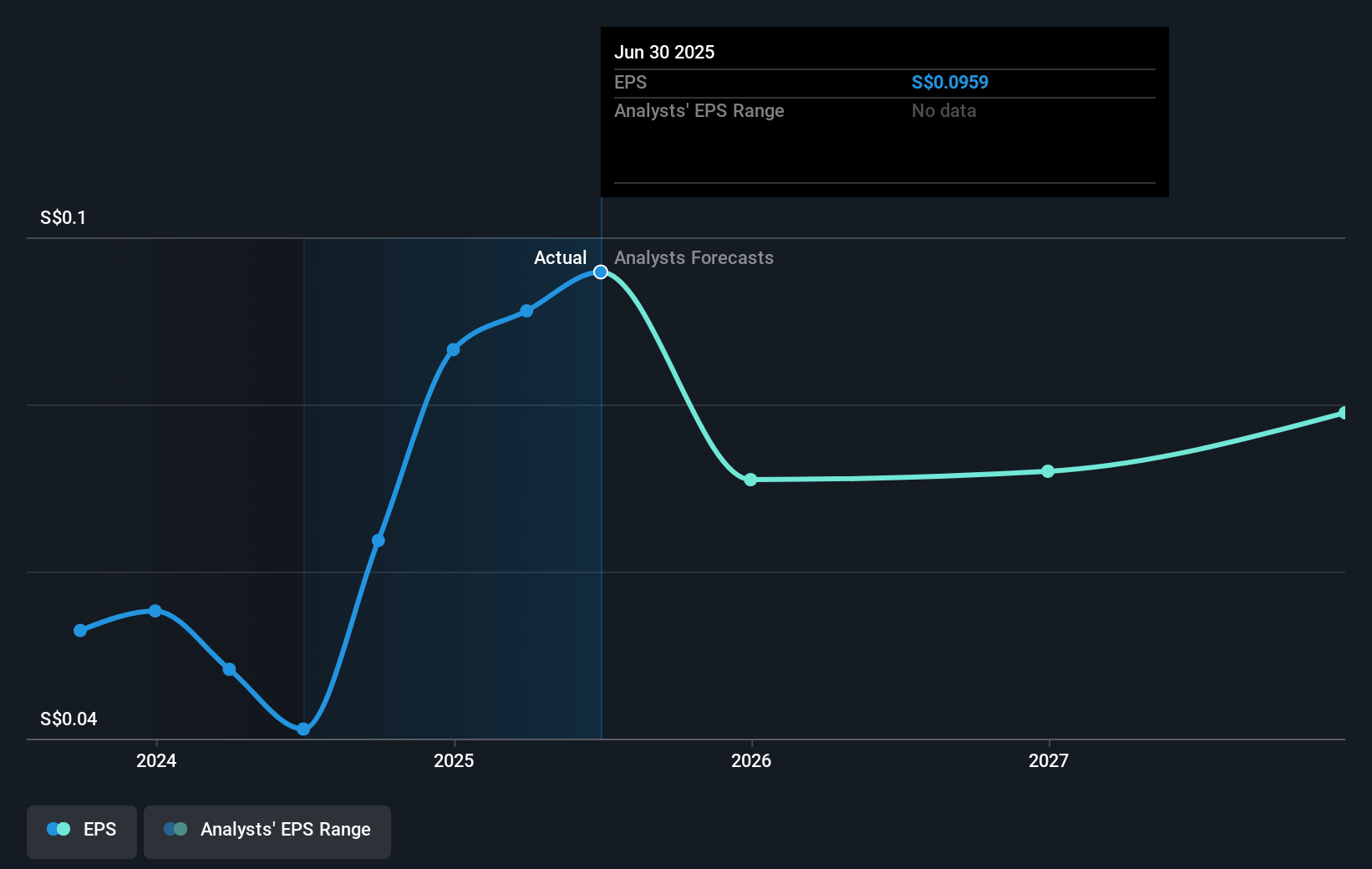

Yangzijiang Financial Holding (SGX:YF8) has seen its share price rise by 61% over the last quarter. Key events during this period include the announcement of their earnings on August 12, 2025, where net income increased to SGD 138 million, despite a revenue dip. This positive earnings result may have bolstered investor confidence. Additionally, corporate governance activities, such as the proposed spin-off and capital reduction discussions in a meeting slated for September 4, contributed context to the market’s perception of the stock. In a market where indices like the Nasdaq hit record highs, Yangzijiang's movements align with broader positive trends, taking into account investor optimism about future rate cuts.

Yangzijiang Financial Holding Ltd. has achieved a substantial total shareholder return of 258.22% over the past year. This performance notably surpasses both the SG Capital Markets industry return of 56.7% and the broader SG Market return of 21.8% during the same period. The sharp rise in share price, alongside a strengthening of the company's fundamentals, points to robust market confidence.

The company's recent earnings report, revealing a significant increase in net income despite a revenue dip, could influence future revenue and earnings forecasts as investors potentially reassess the company's growth trajectory. The upcoming shareholders' meeting, with discussions on the proposed spin-off and capital reduction, is poised to shape Yangzijiang's strategic direction and potentially impact its operational efficiency. Currently trading at SGD 1.16, Yangzijiang's share price is near the consensus analyst price target of SGD 1.25, suggesting limited upside based on current forecasts.

Evaluate Yangzijiang Financial Holding's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:YF8

Yangzijiang Financial Holding

An investment holding company, engages in the investment-related activities in the People's Republic of China and Singapore.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success