- Singapore

- /

- Capital Markets

- /

- SGX:U10

We Think Some Shareholders May Hesitate To Increase UOB-Kay Hian Holdings Limited's (SGX:U10) CEO Compensation

Key Insights

- UOB-Kay Hian Holdings to hold its Annual General Meeting on 25th of April

- CEO Ee-Chao Wee's total compensation includes salary of S$486.2k

- The total compensation is 996% higher than the average for the industry

- UOB-Kay Hian Holdings' three-year loss to shareholders was 7.4% while its EPS was down 0.5% over the past three years

In the past three years, shareholders of UOB-Kay Hian Holdings Limited (SGX:U10) have seen a loss on their investment. In addition, the company's per-share earnings growth is not looking good, despite growing revenues. The AGM coming up on 25th of April will be an opportunity for shareholders to have their concerns addressed by the board and for them to exercise their influence on management through voting on resolutions such as executive remuneration. We think shareholders may be cautious of approving a pay rise for the CEO at the moment, based on our analysis below.

View our latest analysis for UOB-Kay Hian Holdings

Comparing UOB-Kay Hian Holdings Limited's CEO Compensation With The Industry

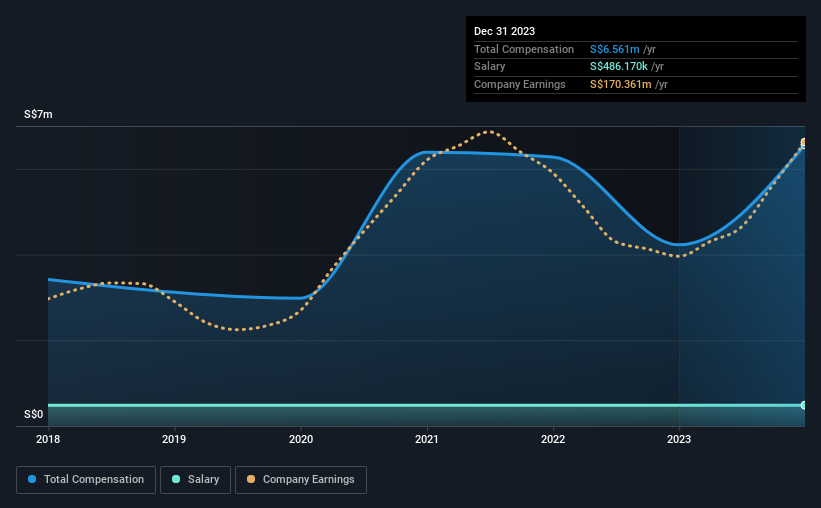

Our data indicates that UOB-Kay Hian Holdings Limited has a market capitalization of S$1.2b, and total annual CEO compensation was reported as S$6.6m for the year to December 2023. We note that's an increase of 55% above last year. While we always look at total compensation first, our analysis shows that the salary component is less, at S$486k.

On examining similar-sized companies in the Singapore Capital Markets industry with market capitalizations between S$545m and S$2.2b, we discovered that the median CEO total compensation of that group was S$599k. This suggests that Ee-Chao Wee is paid more than the median for the industry. Furthermore, Ee-Chao Wee directly owns S$260m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | S$486k | S$486k | 7% |

| Other | S$6.1m | S$3.7m | 93% |

| Total Compensation | S$6.6m | S$4.2m | 100% |

Talking in terms of the industry, salary represented approximately 94% of total compensation out of all the companies we analyzed, while other remuneration made up 6% of the pie. UOB-Kay Hian Holdings pays a modest slice of remuneration through salary, as compared to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at UOB-Kay Hian Holdings Limited's Growth Numbers

Over the last three years, UOB-Kay Hian Holdings Limited has not seen its earnings per share change much, though they have deteriorated slightly. In the last year, its revenue is up 18%.

The reduction in EPS, over three years, is arguably concerning. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has UOB-Kay Hian Holdings Limited Been A Good Investment?

With a three year total loss of 7.4% for the shareholders, UOB-Kay Hian Holdings Limited would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

The company's earnings haven't grown and possibly because of that, the stock has performed poorly, resulting in a loss for the company's shareholders. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 2 warning signs for UOB-Kay Hian Holdings that investors should be aware of in a dynamic business environment.

Switching gears from UOB-Kay Hian Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:U10

UOB-Kay Hian Holdings

An investment holding company, provides stockbroking, futures broking, structured lending, investment trading, margin financing, and nominee and research services.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives