- Singapore

- /

- Capital Markets

- /

- SGX:U10

UOB-Kay Hian Holdings (SGX:U10): Valuation Insights Following Thai Subsidiary Delisting Plans

Reviewed by Simply Wall St

UOB-Kay Hian Holdings (SGX:U10) has unveiled plans to voluntarily delist its Thai subsidiary, UOB Kay Hian Securities (Thailand), from the Stock Exchange of Thailand after non-compliance with free float rules led to a trading suspension.

See our latest analysis for UOB-Kay Hian Holdings.

UOB-Kay Hian Holdings’ recent move to streamline its subsidiary operations comes against a backdrop of robust momentum in its own shares, with a 50% year-to-date share price return and an impressive 71.8% total shareholder return over the past 12 months. The company’s longer-term performance highlights strong value creation. These strategic steps may be fueling optimism among investors.

If this shift in strategy has you thinking about broader market opportunities, now’s an ideal moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

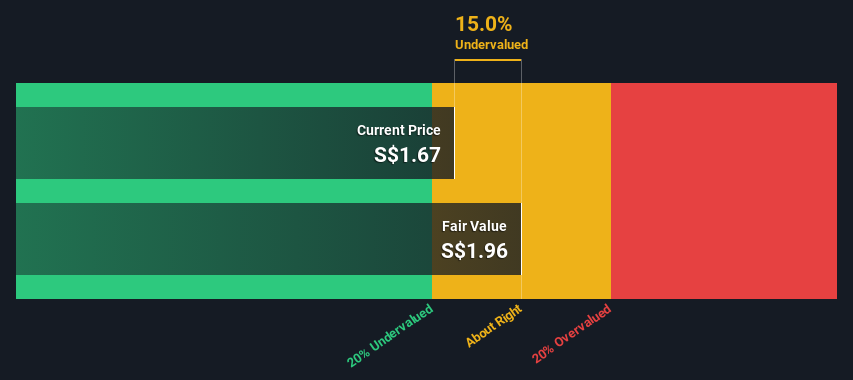

With such impressive gains, the question now is whether UOB-Kay Hian Holdings’ shares remain undervalued in the market or if investors are already pricing in the company’s next phase of growth. Could this be a new buying opportunity?

Price-to-Earnings of 11.7x: Is it justified?

UOB-Kay Hian Holdings is trading at a price-to-earnings (P/E) ratio of 11.7 times, which is noticeably below the Singapore market average of 14.5x and well under both its Asian capital markets industry average (21.1x) and peer group average (15.3x). This positions the stock as attractively valued on a relative basis as of the last close at SGD2.52.

The P/E ratio measures what investors are willing to pay today for a dollar of current earnings, and it is a standard indicator for companies in the financial sector. For UOB-Kay Hian Holdings, a lower P/E might imply investors are cautious about the company's short-term earnings outlook or see sector-specific risks at play.

However, compared to both its immediate peers and the wider region, this lower valuation stands out. The market could be overlooking the company’s long-term profit-generating abilities, past growth profile, or its leading market position. Given its P/E is well below the typical industry benchmark, there may be room for a market re-rating should sentiment or fundamentals shift.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 11.7x (UNDERVALUED)

However, slower revenue or profit growth, or unexpected market volatility, could reduce the recent optimism surrounding UOB-Kay Hian Holdings shares.

Find out about the key risks to this UOB-Kay Hian Holdings narrative.

Another View: Discounted Cash Flow Perspective

While UOB-Kay Hian Holdings appears undervalued based on its earnings relative to peers, the SWS DCF model suggests a different story. According to our DCF analysis, the shares are currently trading above the estimated fair value of SGD2.27. This indicates the stock may not be as cheap as it looks through the earnings lens. Which approach offers the truer picture for long-term investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out UOB-Kay Hian Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own UOB-Kay Hian Holdings Narrative

If you want to see the numbers from your own perspective or believe in your own research, you can build your own take in just a few minutes. Do it your way

A great starting point for your UOB-Kay Hian Holdings research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take your investment strategy to the next level by seizing timely opportunities others might overlook. The right stock could be just a click away.

- Unleash potential growth as you tap into these 25 AI penny stocks, which are reshaping industries with breakthroughs in artificial intelligence and automation.

- Capture reliable income streams by targeting these 14 dividend stocks with yields > 3%, which consistently offer attractive yields above 3%.

- Stay ahead of the innovation curve and secure exposure to these 27 quantum computing stocks, which are driving the next wave of computing technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:U10

UOB-Kay Hian Holdings

An investment holding company, provides stockbroking, futures broking, structured lending, investment trading, margin financing, and nominee and research services.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives