- Singapore

- /

- Capital Markets

- /

- SGX:U10

November 2024 Penny Stocks With Promising Potential

Reviewed by Simply Wall St

Global markets have recently experienced a significant rally, with U.S. stocks reaching record highs following the Republican "red sweep" in the elections, which has fueled optimism around growth and tax policies. Amidst this backdrop, investors are increasingly exploring diverse opportunities, including penny stocks—an investment area that remains relevant despite its somewhat outdated terminology. Penny stocks often represent smaller or newer companies that can offer unique value propositions and growth potential; this article will explore several such stocks that stand out for their financial strength and potential for long-term success.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.22 | MYR343.4M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.78 | MYR135.97M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.475 | MYR2.36B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$545.92M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.25 | £847.72M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB1.92 | THB1.67B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.615 | A$71.21M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.87 | MYR287.13M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.55 | MYR761.86M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$140.36M | ★★★★☆☆ |

Click here to see the full list of 5,769 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Vista Land & Lifescapes (PSE:VLL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Vista Land & Lifescapes, Inc. is an investment holding company that functions as an integrated property developer and homebuilder in the Philippines, with a market cap of ₱19.94 billion.

Operations: The company's revenue segment is primarily derived from the Philippines, amounting to ₱35.41 billion.

Market Cap: ₱19.94B

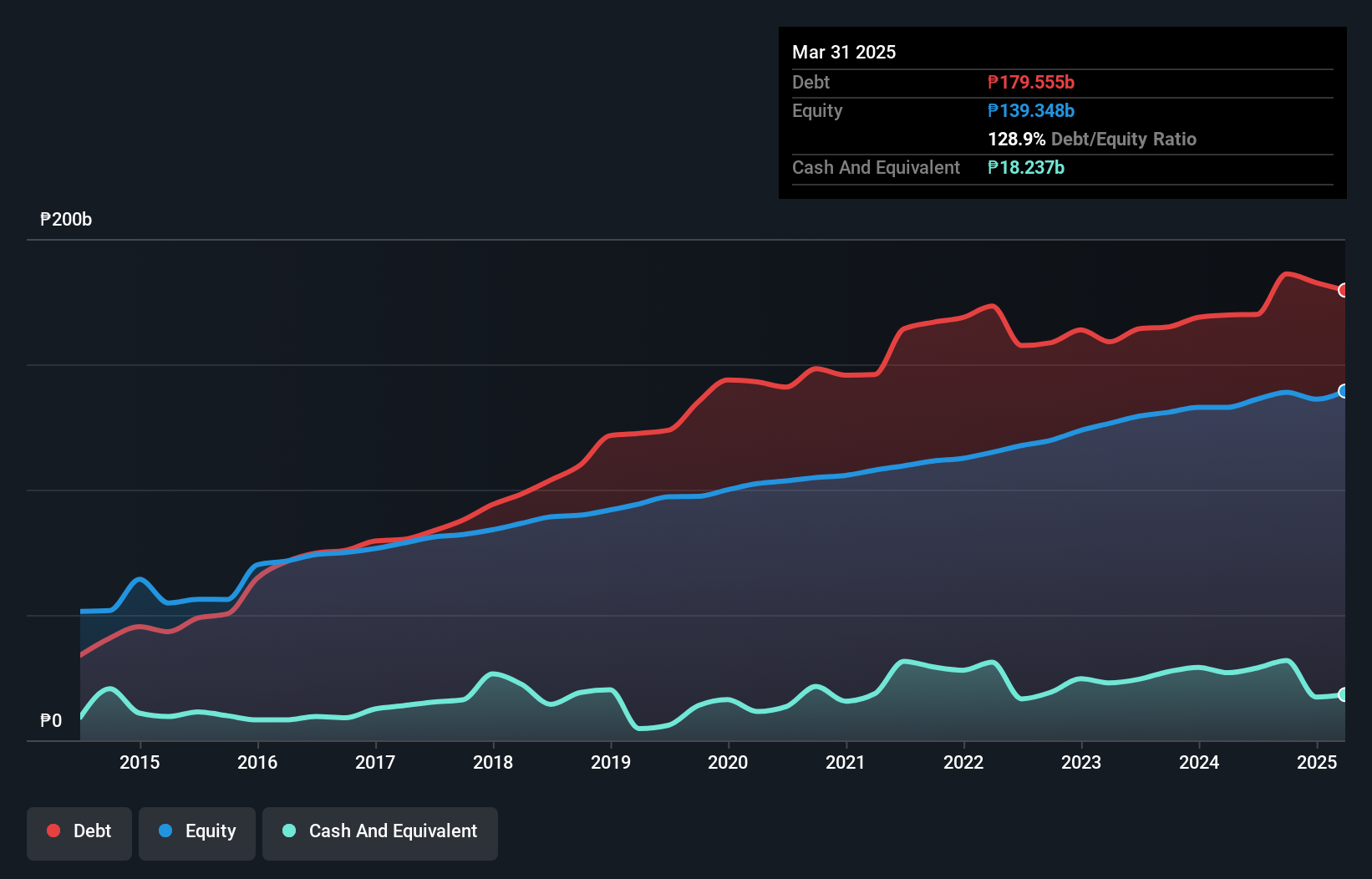

Vista Land & Lifescapes demonstrates a stable financial position, with short-term assets exceeding both short and long-term liabilities. The company has managed to reduce its debt-to-equity ratio slightly over five years, yet the net debt remains high and is not well covered by operating cash flow. Despite this, interest payments are well covered by EBIT. Earnings growth has accelerated in recent years but lags behind industry averages. Trading at a low price-to-earnings ratio suggests good relative value compared to peers. However, the dividend history is unstable and profit margins have declined slightly from last year.

- Dive into the specifics of Vista Land & Lifescapes here with our thorough balance sheet health report.

- Learn about Vista Land & Lifescapes' future growth trajectory here.

UOB-Kay Hian Holdings (SGX:U10)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: UOB-Kay Hian Holdings Limited is an investment holding company offering stockbroking, futures broking, structured lending, investment trading, margin financing, and research services across Singapore, Hong Kong, Thailand, Malaysia and internationally with a market cap of SGD1.47 billion.

Operations: The company generates SGD581.07 million from its securities and futures broking and related services segment.

Market Cap: SGD1.47B

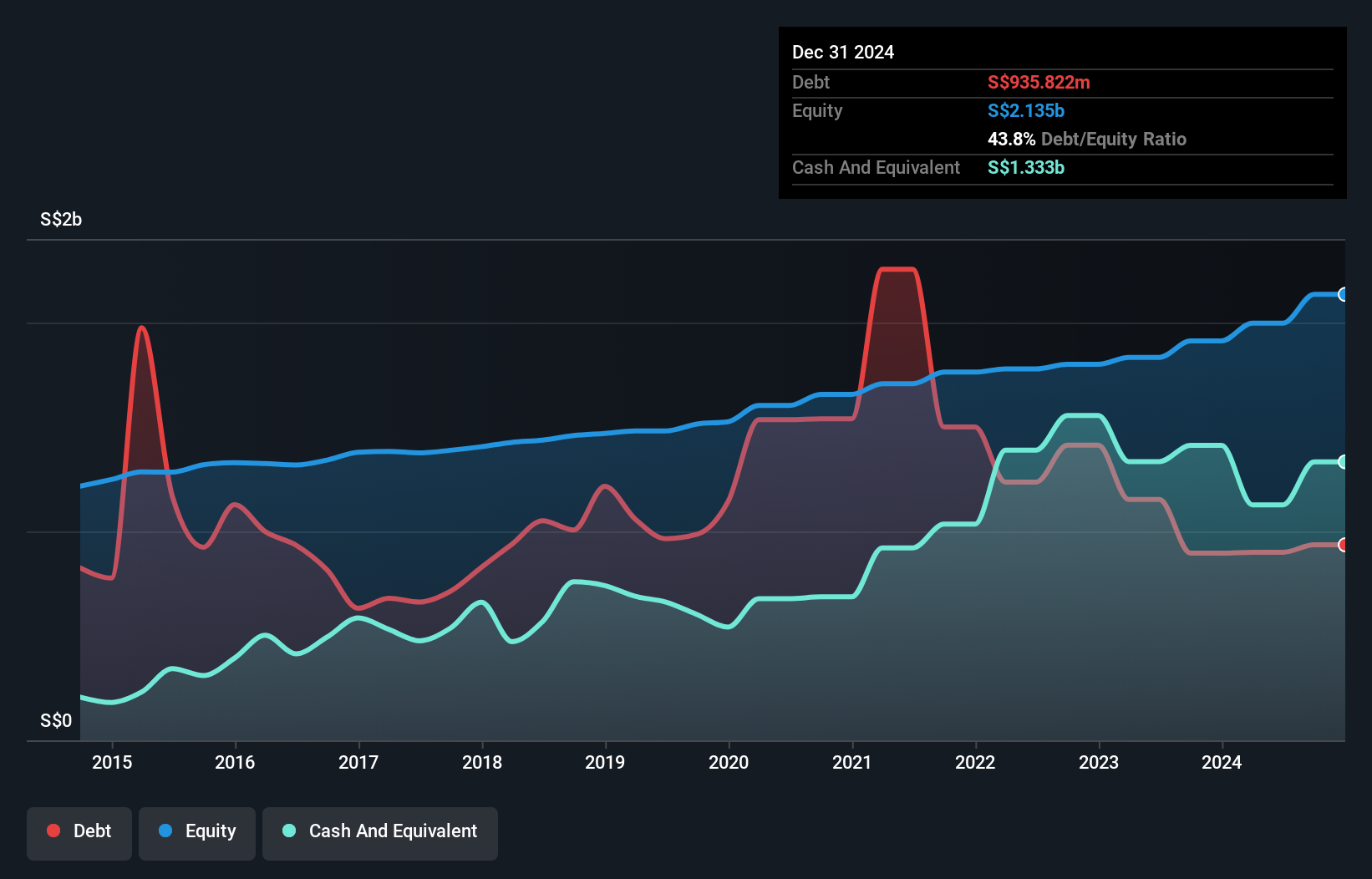

UOB-Kay Hian Holdings shows a robust financial position, with short-term assets significantly exceeding liabilities. Earnings have grown impressively by 80% over the past year, outpacing the industry average of 24.2%. Despite this growth, the company's return on equity remains low at 10.8%, and its debt is not well covered by operating cash flow. The dividend yield of 5.82% is unsustainably high relative to free cash flows. Recent board changes indicate a shift in management dynamics, while shareholders experienced dilution with an increase in shares outstanding by 3.9%. The stock trades below estimated fair value, suggesting potential undervaluation.

- Click to explore a detailed breakdown of our findings in UOB-Kay Hian Holdings' financial health report.

- Review our historical performance report to gain insights into UOB-Kay Hian Holdings' track record.

Wing Tai Holdings (SGX:W05)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wing Tai Holdings Limited is an investment holding company involved in property investment and development across Singapore, Malaysia, Australia, Japan, and China with a market cap of SGD1.01 billion.

Operations: The company's revenue is primarily derived from development properties at SGD75.09 million, investment properties contributing SGD42.82 million, and retail operations generating SGD40.79 million.

Market Cap: SGD1.01B

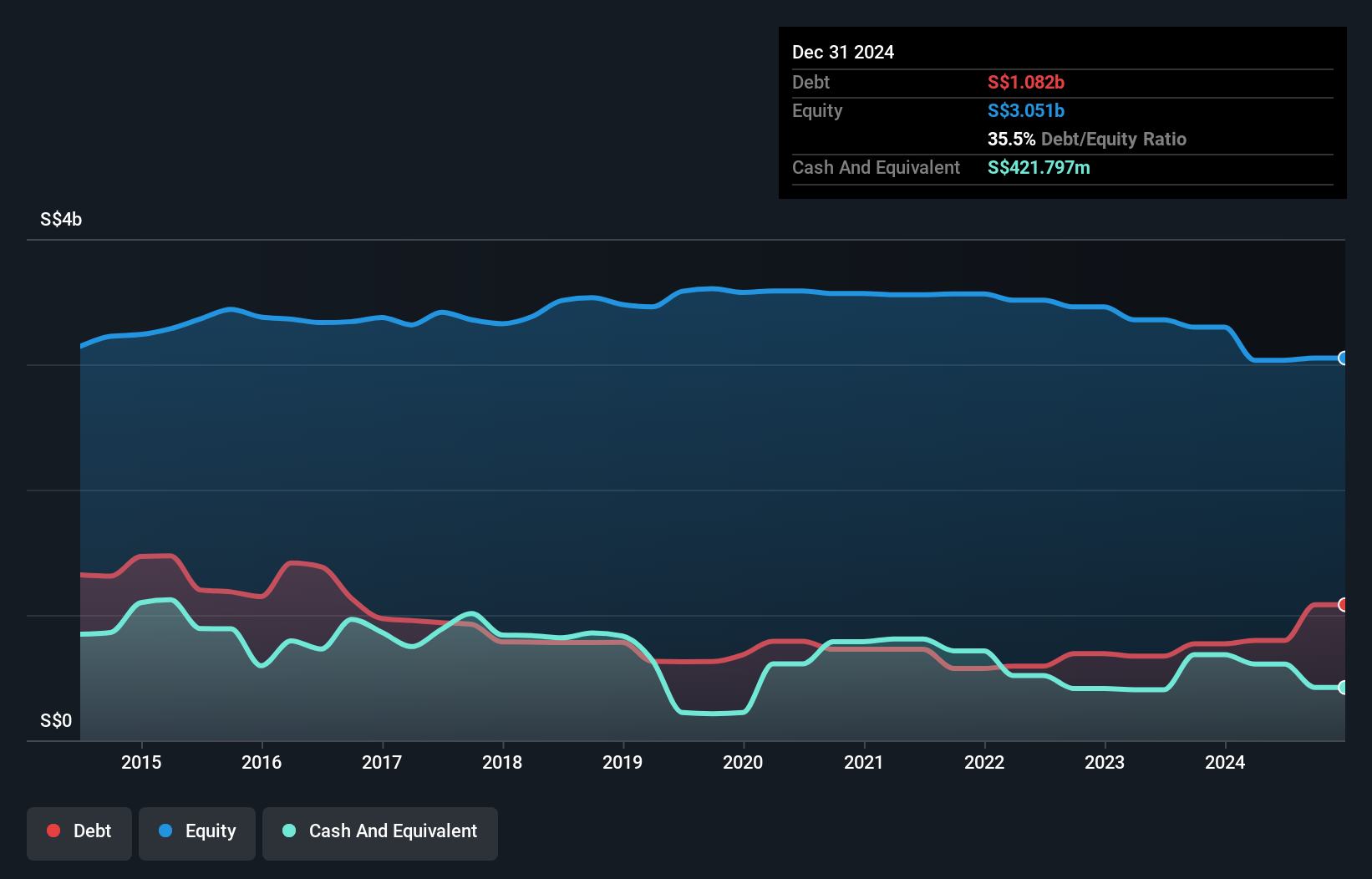

Wing Tai Holdings faces challenges with profitability, reporting a net loss of SGD78.69 million for the fiscal year ending June 2024, compared to a profit the previous year. Despite this, its financial structure remains solid, with short-term assets of SGD1.3 billion comfortably covering both short and long-term liabilities. The company's debt is well managed, supported by operating cash flow at 39.9% coverage and a satisfactory net debt to equity ratio of 6.2%. Recent dividend affirmations highlight shareholder returns amidst financial struggles; however, interest payments are not adequately covered by EBIT at only 0.3 times coverage.

- Unlock comprehensive insights into our analysis of Wing Tai Holdings stock in this financial health report.

- Assess Wing Tai Holdings' previous results with our detailed historical performance reports.

Make It Happen

- Jump into our full catalog of 5,769 Penny Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:U10

UOB-Kay Hian Holdings

An investment holding company, provides stockbroking, futures broking, structured lending, investment trading, margin financing, and nominee and research services in Singapore, Hong Kong, Thailand, Malaysia, and internationally.

Solid track record and good value.