- Singapore

- /

- Consumer Finance

- /

- SGX:T6I

If You Like EPS Growth Then Check Out ValueMax Group (SGX:T6I) Before It's Too Late

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

So if you're like me, you might be more interested in profitable, growing companies, like ValueMax Group (SGX:T6I). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for ValueMax Group

ValueMax Group's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. As a tree reaches steadily for the sky, ValueMax Group's EPS has grown 19% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

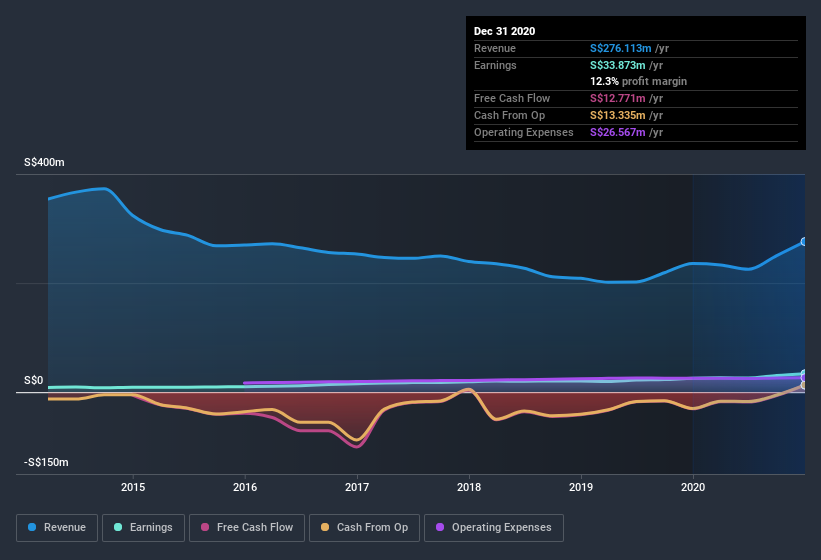

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note ValueMax Group's EBIT margins were flat over the last year, revenue grew by a solid 17% to S$276m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

ValueMax Group isn't a huge company, given its market capitalization of S$233m. That makes it extra important to check on its balance sheet strength.

Are ValueMax Group Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

ValueMax Group top brass are certainly in sync, not having sold any shares, over the last year. But the bigger deal is that the MD, CEO & Executive Director, Hiang Nam Yeah, paid S$185k to buy shares at an average price of S$0.24.

The good news, alongside the insider buying, for ValueMax Group bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold S$45m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 19% of the company; visible skin in the game.

Should You Add ValueMax Group To Your Watchlist?

You can't deny that ValueMax Group has grown its earnings per share at a very impressive rate. That's attractive. Better still, insiders own a large chunk of the company and one has even been buying more shares. So I do think this is one stock worth watching. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with ValueMax Group (at least 1 which is potentially serious) , and understanding these should be part of your investment process.

As a growth investor I do like to see insider buying. But ValueMax Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade ValueMax Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:T6I

ValueMax Group

An investment holding company, engages in the pawnbroking, moneylending, jewelry and watches retailing, and gold trading businesses primarily in Singapore.

Solid track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026