- Singapore

- /

- Consumer Finance

- /

- SGX:T6I

Discover 3 Asian Penny Stocks With Market Caps Of US$400M

Reviewed by Simply Wall St

In the backdrop of fluctuating global trade policies and easing inflation rates, Asian markets are navigating a complex economic landscape. Amid these conditions, penny stocks—often seen as relics from past market eras—continue to capture attention for their potential to offer both affordability and growth. These smaller or newer companies can present unique opportunities when they exhibit strong financial health, making them intriguing options for investors seeking untapped potential in the market.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Halcyon Technology (SET:HTECH) | THB2.66 | THB798M | ✅ 2 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.435 | SGD176.3M | ✅ 4 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.176 | SGD35.06M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.21 | SGD8.7B | ✅ 5 ⚠️ 0 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.13 | SGD858.72M | ✅ 3 ⚠️ 1 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.90 | HK$3.28B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.39 | HK$50.26B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.15 | HK$725.59M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.23 | HK$2.05B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$1.99 | HK$1.66B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,159 stocks from our Asian Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

UNQ Holdings (SEHK:2177)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: UNQ Holdings Limited operates as a brand e-commerce retail and wholesale solutions provider in the People's Republic of China, with a market cap of HK$588.93 million.

Operations: The company generates revenue through various channels, including CN¥478.70 million from B2B General Trade, CN¥421.56 million from B2C General Trade, CN¥11.58 million from services rendered, CN¥170.31 million from B2B Cross-Border E-Commerce, and CN¥266.26 million from B2C Cross-Border E-Commerce.

Market Cap: HK$588.93M

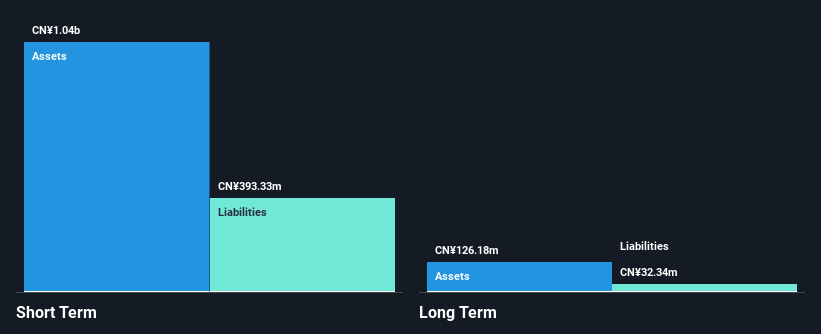

UNQ Holdings, with a market cap of HK$588.93 million, has shown financial improvements by becoming profitable in the past year, generating CN¥1.35 billion in sales for 2024 compared to CN¥1.74 billion previously and achieving a net income of CN¥37.89 million versus a prior net loss. Despite its low Return on Equity at 5.1%, the company maintains strong liquidity with short-term assets exceeding liabilities and cash surpassing total debt levels, indicating solid financial management amidst volatility concerns. The board's recent restructuring aligns with strategic governance adjustments as UNQ prepares to release its Q1 2025 results shortly.

- Click here and access our complete financial health analysis report to understand the dynamics of UNQ Holdings.

- Gain insights into UNQ Holdings' historical outcomes by reviewing our past performance report.

Sipai Health Technology (SEHK:314)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sipai Health Technology Co., Ltd. is a medical technology and health management company operating in the People’s Republic of China with a market cap of HK$2.93 billion.

Operations: The company's revenue is primarily derived from its Specialty Pharmacy Business, which generated CN¥3.97 billion, followed by the Physician Research Assistance Business at CN¥397.61 million, and the Health Insurance Services Business contributing CN¥192.96 million.

Market Cap: HK$2.93B

Sipai Health Technology, with a market cap of HK$2.93 billion, remains unprofitable despite generating CN¥4.57 billion in revenue for 2024, slightly down from the previous year. The company reported a net loss of CN¥323.74 million and has not diluted shareholders recently. Its short-term assets exceed both short- and long-term liabilities significantly, reflecting strong liquidity management alongside being debt-free. While Sipai's cash runway is sufficient for over three years if free cash flow continues to grow historically, its negative Return on Equity highlights ongoing profitability challenges amidst stable weekly volatility and an experienced management team averaging 5.7 years tenure.

- Unlock comprehensive insights into our analysis of Sipai Health Technology stock in this financial health report.

- Examine Sipai Health Technology's past performance report to understand how it has performed in prior years.

ValueMax Group (SGX:T6I)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ValueMax Group Limited is an investment holding company involved in pawnbroking, moneylending, jewelry and watches retailing, and gold trading primarily in Singapore, with a market capitalization of SGD528.32 million.

Operations: The company's revenue is primarily derived from the retail and trading of jewellery and gold, generating SGD343.78 million, followed by pawnbroking at SGD82.01 million and moneylending contributing SGD63.46 million.

Market Cap: SGD528.32M

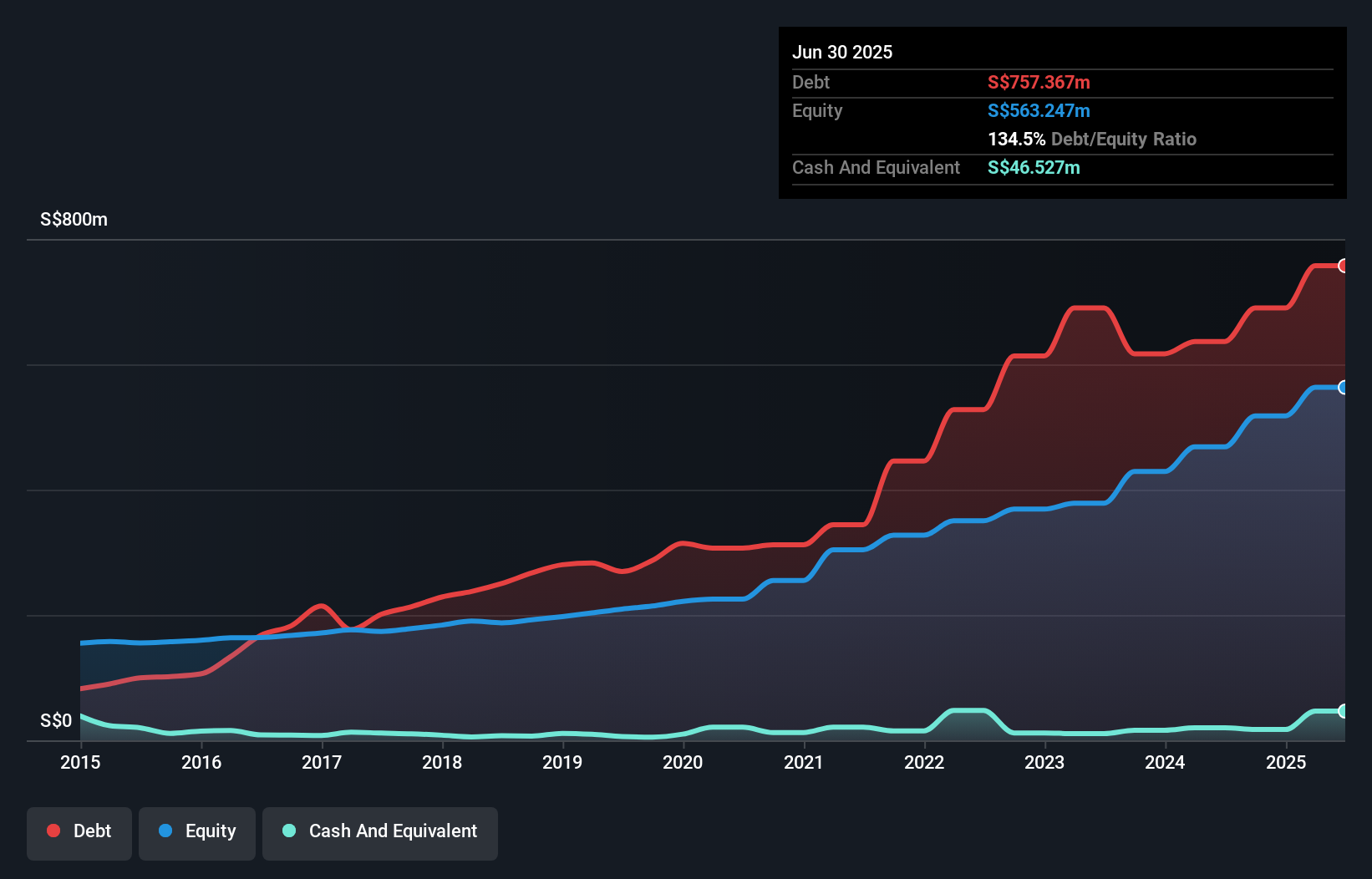

ValueMax Group, with a market cap of SGD528.32 million, has shown strong earnings growth, increasing by 56.7% over the past year, surpassing its five-year average of 19.4%. Despite high net debt to equity at 129.9%, short-term assets comfortably cover both short- and long-term liabilities. The company recently launched a digital securities issuance on the SDAX Exchange to raise funds between SGD5 million and SGD25 million at an interest rate of 3.9% per annum, reflecting active financial management strategies amidst stable weekly volatility and experienced leadership with an average tenure of 3.4 years in management and 4.8 years on the board.

- Click here to discover the nuances of ValueMax Group with our detailed analytical financial health report.

- Understand ValueMax Group's track record by examining our performance history report.

Where To Now?

- Click through to start exploring the rest of the 1,156 Asian Penny Stocks now.

- Ready For A Different Approach? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:T6I

ValueMax Group

An investment holding company, engages in the pawnbroking, moneylending, jewelry and watches retailing, and gold trading businesses primarily in Singapore.

Solid track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives