This article will reflect on the compensation paid to Boon Chye Loh who has served as CEO of Singapore Exchange Limited (SGX:S68) since 2015. This analysis will also assess whether Singapore Exchange pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for Singapore Exchange

How Does Total Compensation For Boon Chye Loh Compare With Other Companies In The Industry?

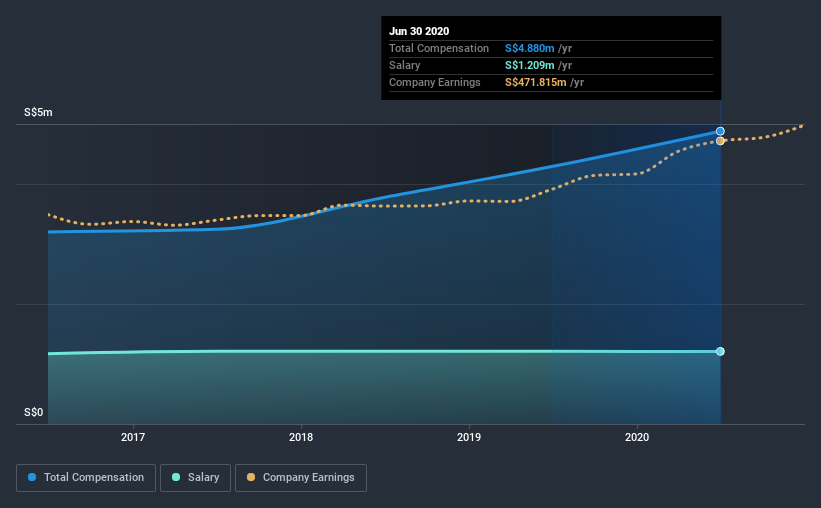

According to our data, Singapore Exchange Limited has a market capitalization of S$11b, and paid its CEO total annual compensation worth S$4.9m over the year to June 2020. Notably, that's an increase of 14% over the year before. While we always look at total compensation first, our analysis shows that the salary component is less, at S$1.2m.

In comparison with other companies in the industry with market capitalizations ranging from S$5.3b to S$16b, the reported median CEO total compensation was S$769k. Accordingly, our analysis reveals that Singapore Exchange Limited pays Boon Chye Loh north of the industry median. What's more, Boon Chye Loh holds S$4.5m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | S$1.2m | S$1.2m | 25% |

| Other | S$3.7m | S$3.1m | 75% |

| Total Compensation | S$4.9m | S$4.3m | 100% |

Speaking on an industry level, nearly 99% of total compensation represents salary, while the remainder of 1.0% is other remuneration. It's interesting to note that Singapore Exchange allocates a smaller portion of compensation to salary in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Singapore Exchange Limited's Growth

Singapore Exchange Limited has seen its earnings per share (EPS) increase by 13% a year over the past three years. Its revenue is up 15% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Singapore Exchange Limited Been A Good Investment?

Boasting a total shareholder return of 39% over three years, Singapore Exchange Limited has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

As we touched on above, Singapore Exchange Limited is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Importantly though, EPS growth and shareholder returns are very impressive over the last three years. Considering such exceptional results for the company, we'd venture to say CEO compensation is fair. The pleasing shareholder returns are the cherry on top. We wouldn't be wrong in saying that shareholders feel that Boon Chye's performance creates value for the company.

If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at Singapore Exchange.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade Singapore Exchange, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:S68

Singapore Exchange

An investment holding, engages in the operation of integrated securities and derivatives exchange, related clearing houses, and an electricity market in Singapore.

Excellent balance sheet established dividend payer.