- Singapore

- /

- Consumer Finance

- /

- SGX:S35

Exploring Three SGX Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As the Singapore market continues to navigate through varying economic conditions, investors are increasingly looking for stable investment opportunities. Dividend stocks on the SGX present an option for those seeking potential income generation and relative security amidst market fluctuations. In light of current events emphasizing the importance of vigilance and informed decision-making, selecting dividend stocks that demonstrate consistent performance and strong management could be more crucial than ever.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| Singapore Exchange (SGX:S68) | 3.69% | ★★★★★☆ |

| Civmec (SGX:P9D) | 6.27% | ★★★★★☆ |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | 3.69% | ★★★★★☆ |

| BRC Asia (SGX:BEC) | 7.62% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.92% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.59% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.82% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.09% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.70% | ★★★★★☆ |

| Sing Investments & Finance (SGX:S35) | 6.15% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top SGX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

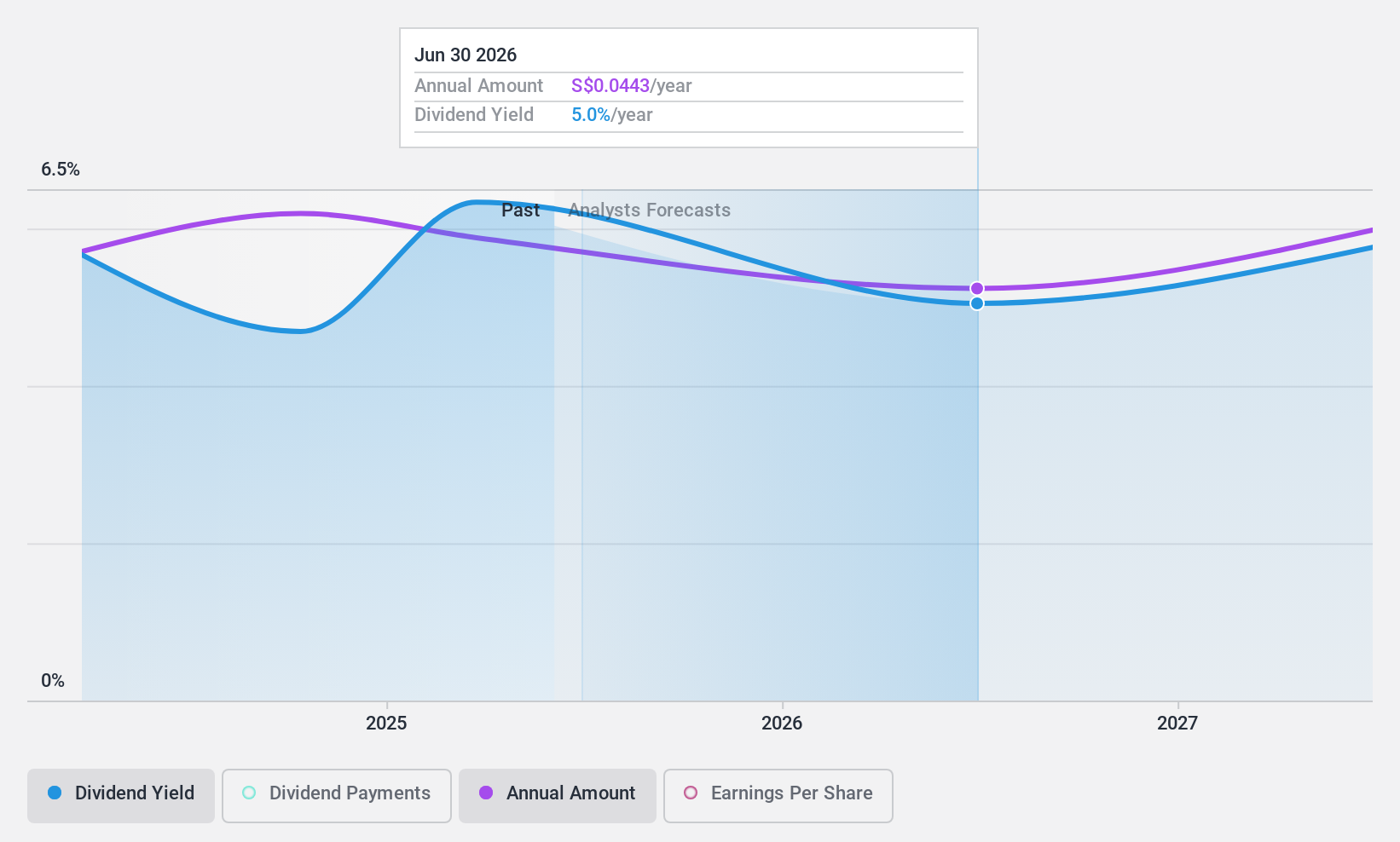

Bumitama Agri (SGX:P8Z)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bumitama Agri Ltd. is an investment holding company based in Indonesia, specializing in the production and trade of crude palm oil and palm kernel, with a market capitalization of approximately SGD 1.21 billion.

Operations: Bumitama Agri Ltd. generates IDR 15.44 billion from its plantations and palm oil mills segment.

Dividend Yield: 6.8%

Bumitama Agri has displayed a mixed track record in dividend reliability, with payments showing volatility over the past decade. Despite this, both earnings and cash flows provide adequate coverage for current dividends, with a payout ratio of 40.4% and a cash payout ratio of 60.8%. Recent corporate governance enhancements include the appointment of Ms Ng Yi Wayn as an Independent Non-Executive Director, potentially stabilizing management oversight. However, investors should note forecasted average annual earnings declines of 5.5% over the next three years which could pressure future dividend sustainability.

- Click here and access our complete dividend analysis report to understand the dynamics of Bumitama Agri.

- Our valuation report unveils the possibility Bumitama Agri's shares may be trading at a discount.

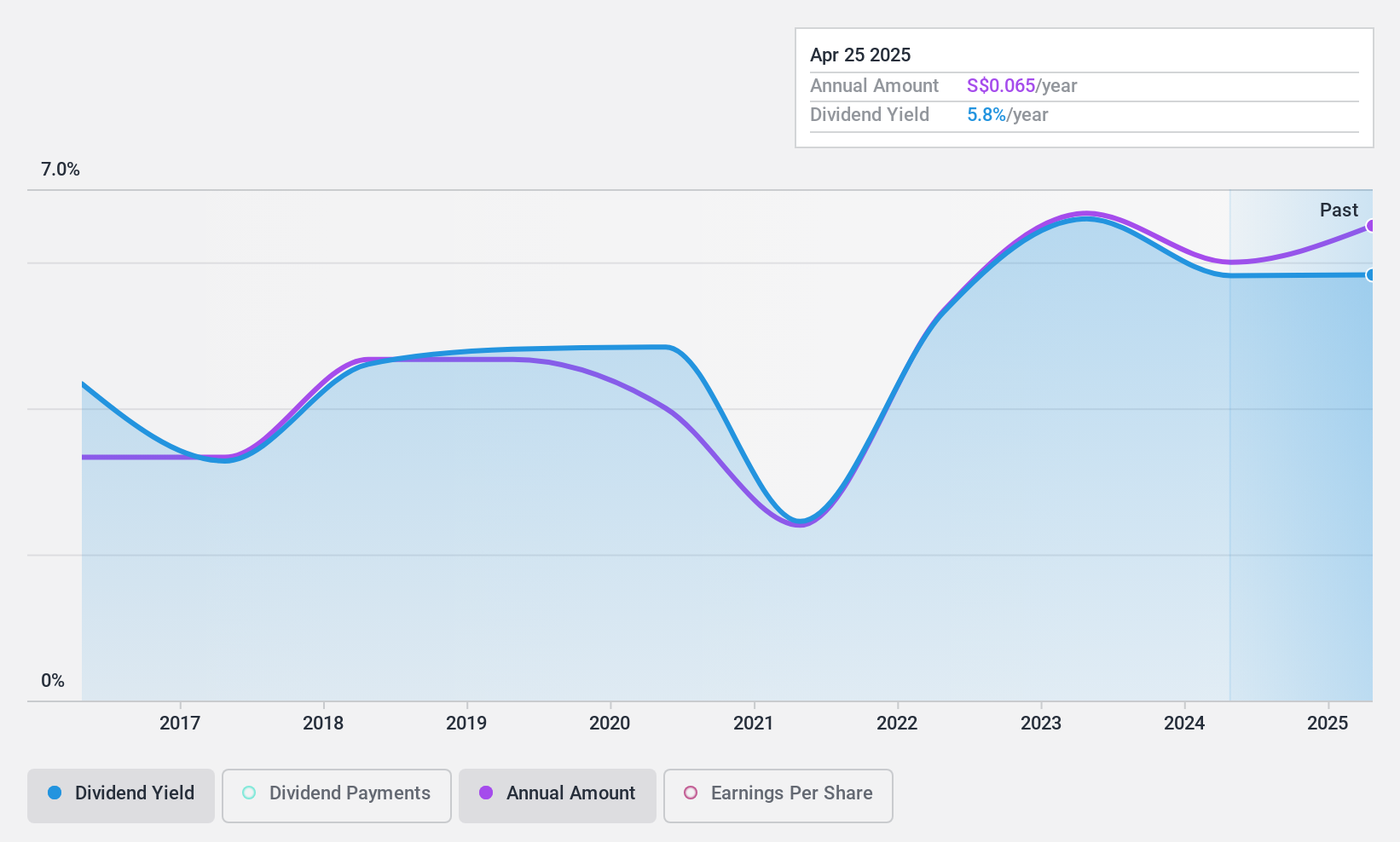

Civmec (SGX:P9D)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Civmec Limited, an investment holding company, offers construction and engineering services across sectors like energy, resources, infrastructure, and marine defense in Australia, with a market capitalization of approximately SGD 400.10 million.

Operations: Civmec Limited generates revenue primarily through three segments: Energy (A$46.02 million), Resources (A$752.82 million), and Infrastructure, Marine & Defence (A$105.52 million).

Dividend Yield: 6.3%

Civmec offers a stable dividend yield of 6.27%, underpinned by a history of reliable payments over the past decade. The dividends are well-supported with a payout ratio of 45.4% and an even more conservative cash payout ratio of 27%, ensuring sustainability from both earnings and cash flow perspectives. Additionally, the stock is trading at a significant discount, 48.3% below its estimated fair value, potentially offering attractive entry points for investors. Earnings have demonstrated robust growth, increasing by 37.3% annually over the past five years, with future earnings expected to grow at 3.93% per year.

- Get an in-depth perspective on Civmec's performance by reading our dividend report here.

- Our expertly prepared valuation report Civmec implies its share price may be lower than expected.

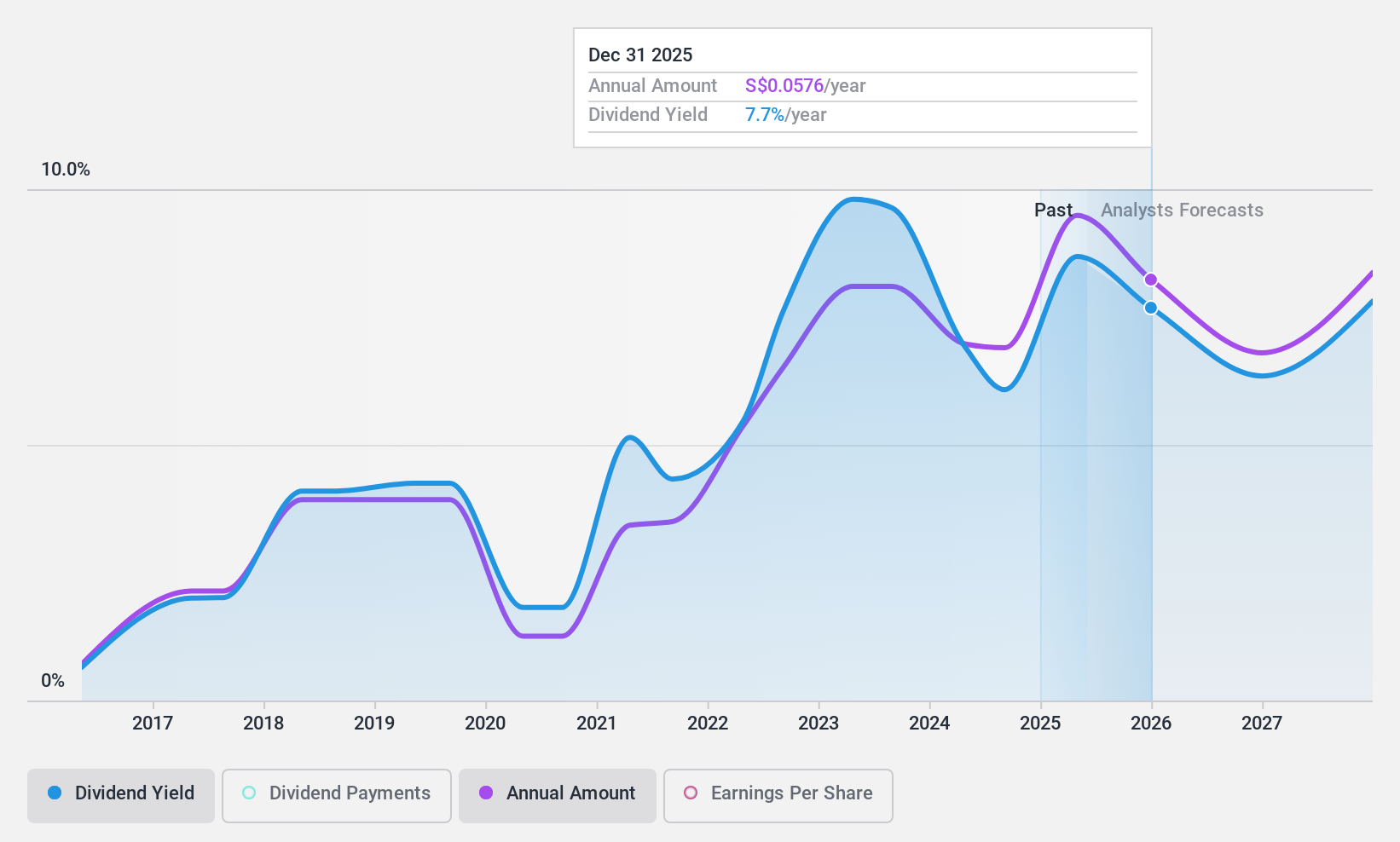

Sing Investments & Finance (SGX:S35)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sing Investments & Finance Limited, operating in Singapore, offers financing services to both individuals and corporations with a market capitalization of SGD 230.53 million.

Operations: Sing Investments & Finance Limited generates its revenue primarily through credit and lending services, amounting to SGD 68.26 million.

Dividend Yield: 6.2%

Sing Investments & Finance has a mixed dividend profile, with a history of volatile payments over the past decade. Despite this, its dividends are well-covered by both earnings and cash flows, with payout ratios of 42.7% and 9.6% respectively. Recently, the company proposed a dividend of S$0.06 per share for FY 2023 at its upcoming annual general meeting on April 25, 2024. However, it is trading below our estimated fair value by 43.4%, suggesting potential undervaluation compared to market peers.

- Dive into the specifics of Sing Investments & Finance here with our thorough dividend report.

- Upon reviewing our latest valuation report, Sing Investments & Finance's share price might be too pessimistic.

Summing It All Up

- Navigate through the entire inventory of 20 Top SGX Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:S35

Sing Investments & Finance

Provides f financial products and services to individuals and corporations in Singapore.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives