- Singapore

- /

- Capital Markets

- /

- SGX:CHJ

Forecast: Analysts Think Uni-Asia Group Limited's (SGX:CHJ) Business Prospects Have Improved Drastically

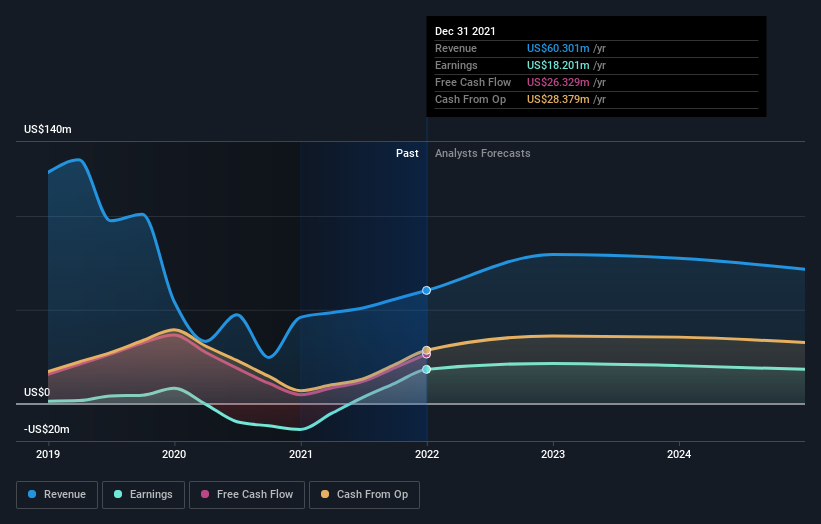

Shareholders in Uni-Asia Group Limited (SGX:CHJ) may be thrilled to learn that the analysts have just delivered a major upgrade to their near-term forecasts. Consensus estimates suggest investors could expect greatly increased statutory revenues and earnings per share, with analysts modelling a real improvement in business performance. Uni-Asia Group has also found favour with investors, with the stock up an impressive 16% to S$1.23 over the past week. We'll be curious to see if these new estimates convince the market to lift the stock price higher still.

After the upgrade, the twin analysts covering Uni-Asia Group are now predicting revenues of US$79m in 2022. If met, this would reflect a huge 32% improvement in sales compared to the last 12 months. Statutory earnings per share are presumed to expand 17% to US$0.27. Prior to this update, the analysts had been forecasting revenues of US$71m and earnings per share (EPS) of US$0.24 in 2022. There has definitely been an improvement in perception recently, with the analysts substantially increasing both their earnings and revenue estimates.

Check out our latest analysis for Uni-Asia Group

Although the analysts have upgraded their earnings estimates, there was no change to the consensus price target of US$1.53, suggesting that the forecast performance does not have a long term impact on the company's valuation. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. Currently, the most bullish analyst values Uni-Asia Group at US$2.48 per share, while the most bearish prices it at US$1.66. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. For example, we noticed that Uni-Asia Group's rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 32% growth to the end of 2022 on an annualised basis. That is well above its historical decline of 17% a year over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 8.6% annually. Not only are Uni-Asia Group's revenues expected to improve, it seems that the analysts are also expecting it to grow faster than the wider industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. They also upgraded their revenue estimates for this year, and sales are expected to grow faster than the wider market. Some investors might be disappointed to see that the price target is unchanged, but we feel that improving fundamentals are usually a positive - assuming these forecasts are met! So Uni-Asia Group could be a good candidate for more research.

Analysts are clearly in love with Uni-Asia Group at the moment, but before diving in - you should be aware that we've identified some warning flags with the business, such as recent substantial insider selling. For more information, you can click through to our platform to learn more about this and the 4 other flags we've identified .

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:CHJ

Uni-Asia Group

Operates as an alternative investment company in Japan, Asia, and internationally.

Adequate balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success