- Singapore

- /

- Hospitality

- /

- SGX:S85

Spotlight On January 2025's Top Penny Stocks

Reviewed by Simply Wall St

As global markets navigate mixed performances and economic uncertainties, investors are increasingly exploring diverse opportunities to enhance their portfolios. Penny stocks, often associated with smaller or newer companies, continue to capture attention despite the term's somewhat outdated connotation. These stocks can offer surprising value and growth potential when they boast strong balance sheets and solid fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.54 | MYR2.64B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.085 | £785.66M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.66 | HK$40.08B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.18B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$545.92M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.968 | £152.69M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.46 | £185.93M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.58 | £68.28M | ★★★★☆☆ |

Click here to see the full list of 5,803 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Frontier Services Group (SEHK:500)

Simply Wall St Financial Health Rating: ★★★★★☆

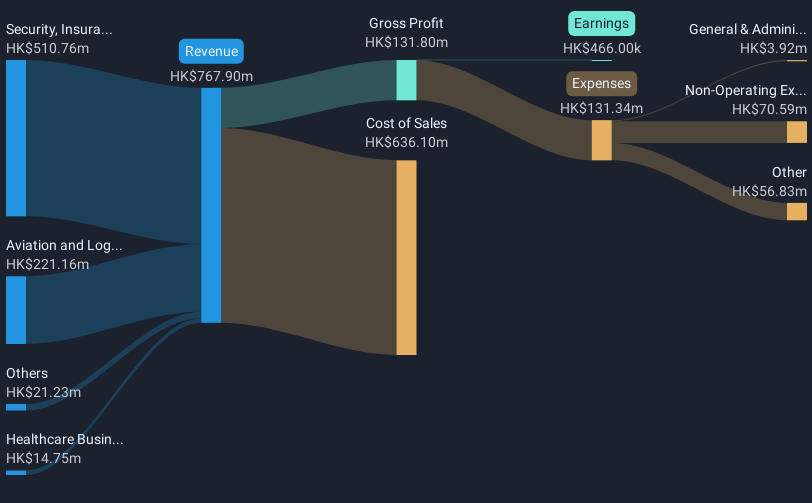

Overview: Frontier Services Group Limited is an investment holding company offering aviation, logistics, security, insurance, and infrastructure-related services with a market cap of HK$348.49 million.

Operations: The company's revenue is primarily derived from the Security, Insurance and Infrastructure Business at HK$510.76 million, followed by the Aviation and Logistics Business contributing HK$221.16 million, and the Healthcare Business generating HK$14.75 million.

Market Cap: HK$348.49M

Frontier Services Group Limited, with a market cap of HK$348.49 million, has shown mixed financial performance. The company is profitable with earnings growth over the past five years but faced challenges last year, including a significant one-off loss of HK$69.4 million impacting results to June 2024 and negative earnings growth of -99.4%. Despite these setbacks, it maintains satisfactory debt coverage and liquidity, as short-term assets exceed liabilities. Trading significantly below its estimated fair value might attract some investors; however, low profit margins and recent executive changes could signal caution for those considering this investment avenue in penny stocks.

- Dive into the specifics of Frontier Services Group here with our thorough balance sheet health report.

- Understand Frontier Services Group's track record by examining our performance history report.

Straco (SGX:S85)

Simply Wall St Financial Health Rating: ★★★★★★

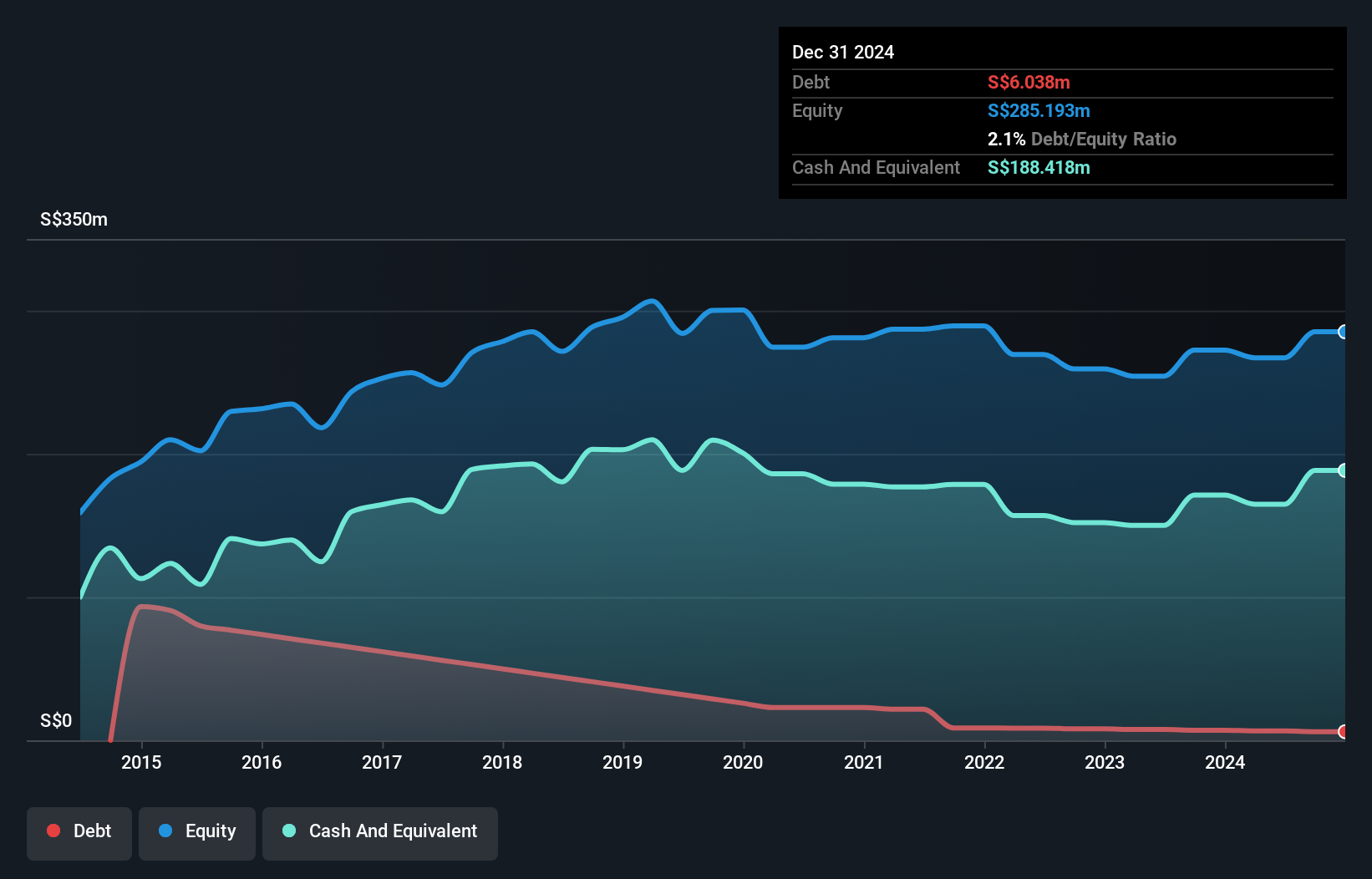

Overview: Straco Corporation Limited, with a market cap of SGD376.40 million, develops and manages tourism-related businesses in Singapore and China.

Operations: The company generates revenue from its aquariums segment, which accounts for SGD50.86 million, and the Giant Observation Wheel (GOW) segment, contributing SGD30.42 million.

Market Cap: SGD376.4M

Straco Corporation Limited, with a market cap of SGD376.40 million, presents a mixed picture for investors interested in penny stocks. The company trades significantly below its estimated fair value and has not diluted shareholder value recently. Its earnings surged by 638.6% over the past year, outpacing the hospitality industry average; however, this growth diverges from its five-year trend of declining earnings by 20.9% annually. Straco's financial health is bolstered by high-quality earnings and more cash than total debt, ensuring strong debt coverage through operating cash flow, though it faces challenges with an unstable dividend track record and low return on equity at 11.9%.

- Take a closer look at Straco's potential here in our financial health report.

- Evaluate Straco's historical performance by accessing our past performance report.

CNNC Hua Yuan Titanium Dioxide (SZSE:002145)

Simply Wall St Financial Health Rating: ★★★★☆☆

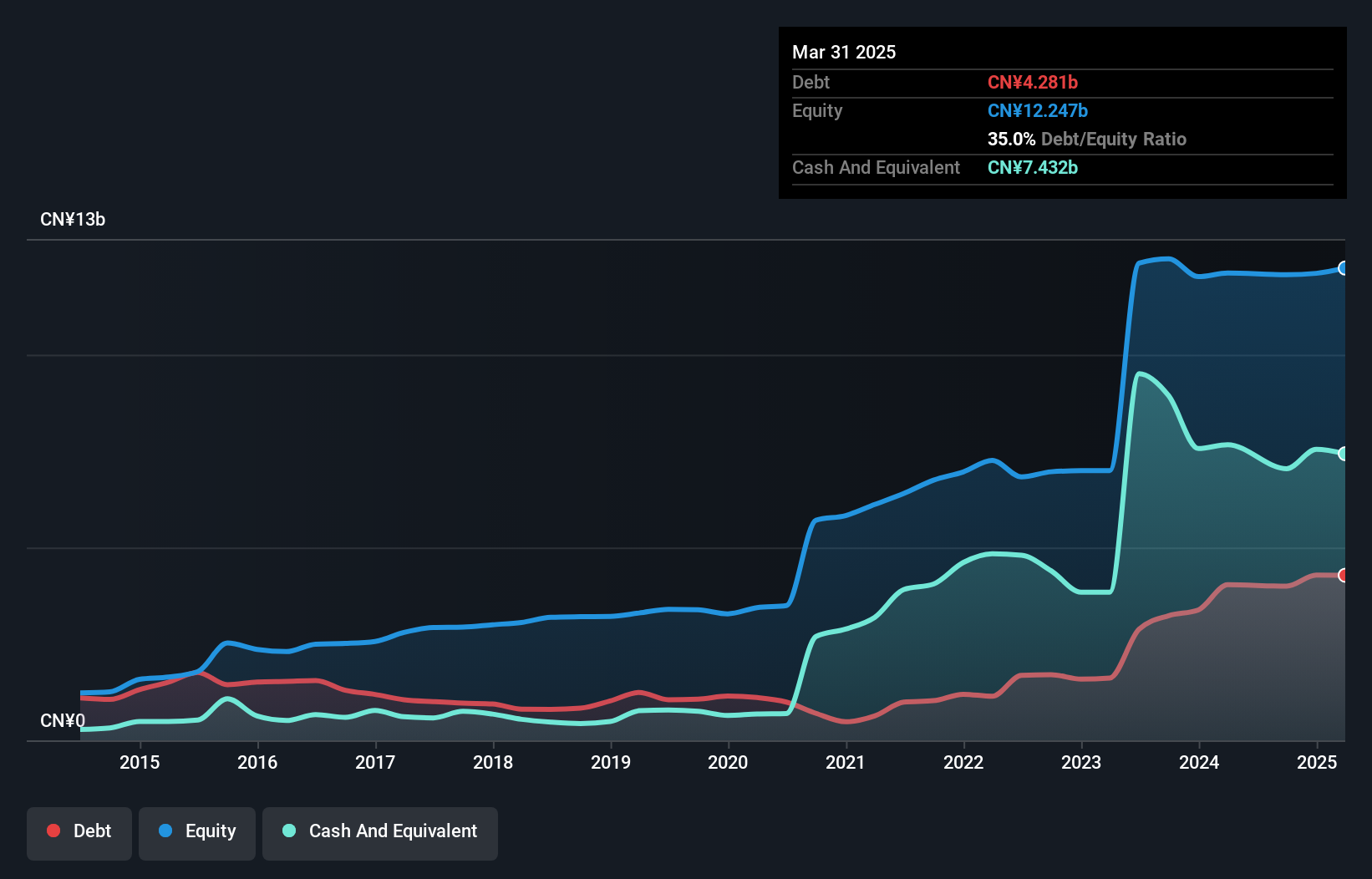

Overview: CNNC Hua Yuan Titanium Dioxide Co., Ltd specializes in the production and sale of rutile titanium dioxide in China, with a market cap of CN¥14.98 billion.

Operations: There are no specific revenue segments reported for CNNC Hua Yuan Titanium Dioxide Co., Ltd.

Market Cap: CN¥14.98B

CNNC Hua Yuan Titanium Dioxide Co., Ltd, with a market cap of CN¥14.98 billion, shows potential for investors exploring penny stocks. The company's earnings grew by 47.8% over the past year, surpassing the chemicals industry's decline. It maintains a solid financial position with more cash than total debt and short-term assets exceeding liabilities. However, challenges include low return on equity at 4.4% and negative operating cash flow impacting debt coverage. Recent earnings report highlights revenue growth to CN¥5,149.13 million for nine months ending September 2024 compared to previous year’s CN¥3,594.33 million, indicating robust sales performance amidst industry headwinds.

- Get an in-depth perspective on CNNC Hua Yuan Titanium Dioxide's performance by reading our balance sheet health report here.

- Learn about CNNC Hua Yuan Titanium Dioxide's historical performance here.

Key Takeaways

- Explore the 5,803 names from our Penny Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:S85

Straco

Develops and operates tourism-related businesses in Singapore and China.

Flawless balance sheet and good value.

Market Insights

Community Narratives