- Singapore

- /

- Consumer Services

- /

- SGX:NR7

The Raffles Education (SGX:NR7) Share Price Is Down 73% So Some Shareholders Are Rather Upset

Statistically speaking, long term investing is a profitable endeavour. But unfortunately, some companies simply don't succeed. For example the Raffles Education Corporation Limited (SGX:NR7) share price dropped 73% over five years. That's not a lot of fun for true believers. And some of the more recent buyers are probably worried, too, with the stock falling 63% in the last year. Shareholders have had an even rougher run lately, with the share price down 24% in the last 90 days.

Check out our latest analysis for Raffles Education

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

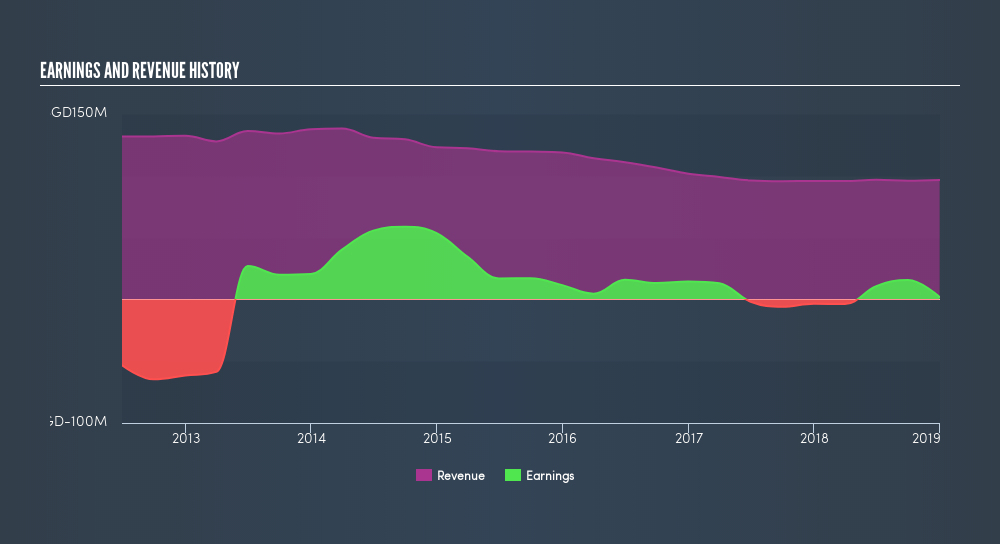

During five years of share price growth, Raffles Education moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

Arguably, the revenue drop of 8.3% a year for half a decade suggests that the company can't grow in the long term. That could explain the weak share price.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

Balance sheet strength is crucual. It might be well worthwhile taking a look at our freereport on how its financial position has changed over time.

A Dividend Lost

It's important to keep in mind that we've been talking about the share price returns, which don't include dividends, while the total shareholder return does. By accounting for the value of dividends paid, the TSR can be seen as a more complete measure of the value a company brings to its shareholders. Over the last 5 years, Raffles Education generated a TSR of -68%, which is, of course, better than the share price return. Although the company had to cut dividends, it has paid cash to shareholders in the past.

A Different Perspective

We regret to report that Raffles Education shareholders are down 63% for the year. Unfortunately, that's worse than the broader market decline of 1.6%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 20% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Is Raffles Education cheap compared to other companies? These 3 valuation measures might help you decide.

If you like to buy stocks alongside management, then you might just love this freelist of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SGX:NR7

Raffles Education

An investment holding company, provides education and related services in the regions of ASEAN, North Asia, South Asia, Australasia, and Europe.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives