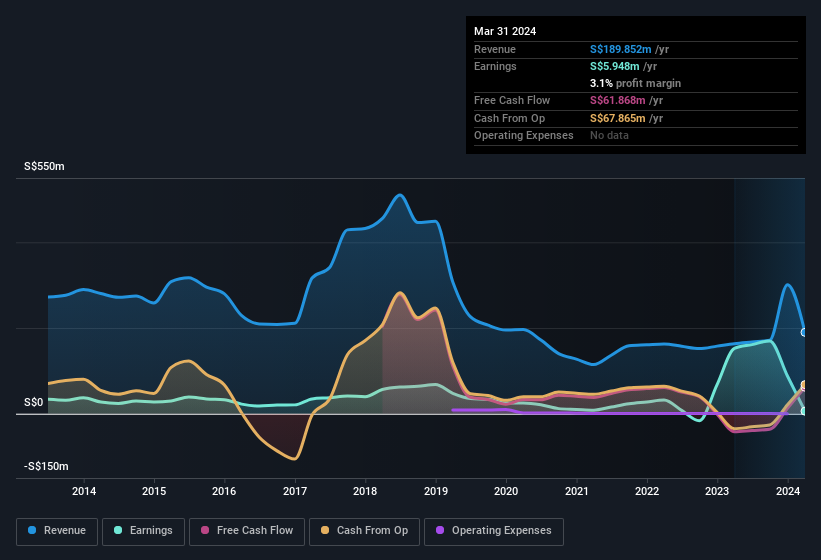

A lackluster earnings announcement from Stamford Land Corporation Ltd (SGX:H07) last week didn't sink the stock price. We think that investors are worried about some weaknesses underlying the earnings.

Check out our latest analysis for Stamford Land

The Power Of Non-Operating Revenue

Companies will classify their revenue streams as either operating revenue or other revenue. Generally speaking, operating revenue is a more reliable guide to the sustainable revenue generating capacity of the business. Importantly, the non-operating revenue often comes without associated ongoing costs, so it can boost profit by letting it fall straight to the bottom line, making the operating business seem better than it really is. Notably, Stamford Land had a significant increase in non-operating revenue over the last year. Indeed, its non-operating revenue rose from S$11.7m last year to S$32.9m this year. If that non-operating revenue fails to manifest in the current year, then there's a real risk the bottom line profit result will be impacted negatively. Sometimes, you can get a better idea of the underlying earnings potential of a company by excluding unusual boosts to non-operating revenue.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Stamford Land.

How Do Unusual Items Influence Profit?

On top of the non-operating revenue spike, we should also consider the S$81m impact of unusual items in the last year, which had the effect of suppressing profit. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. Stamford Land took a rather significant hit from unusual items in the year to March 2024. As a result, we can surmise that the unusual items made its statutory profit significantly weaker than it would otherwise be.

Our Take On Stamford Land's Profit Performance

In its last report Stamford Land benefitted from a spike in non-operating revenue which may have boosted its profit in a way that may be no more sustainable than low quality coal mining. But on the other hand, it also saw an unusual item depress its profit, suggesting the statutory profit number will actually improve next year, if the unusual expenses are not repeated, and all else stays equal. Based on these factors, it's hard to tell if Stamford Land's profits are a reasonable reflection of its underlying profitability. If you'd like to know more about Stamford Land as a business, it's important to be aware of any risks it's facing. For example - Stamford Land has 2 warning signs we think you should be aware of.

Our examination of Stamford Land has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:H07

Stamford Land

An investment holding company, owns, operates, and manages hotels in Singapore, Australia, and the United Kingdom.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives