- Singapore

- /

- Specialty Stores

- /

- SGX:AGS

SGX Dividend Stocks Hour Glass And 2 Others To Boost Your Portfolio

Reviewed by Simply Wall St

In recent months, the Singapore market has shown resilience amid global economic uncertainties, with investors keenly observing the performance of various indices and sectors. As dividend stocks continue to attract attention for their potential to provide steady income, understanding what makes a good dividend stock—such as consistent payouts and strong financial health—can be crucial in navigating these dynamic market conditions.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 6.72% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.41% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.42% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.36% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.07% | ★★★★★☆ |

| QAF (SGX:Q01) | 5.99% | ★★★★★☆ |

| Aztech Global (SGX:8AZ) | 10.00% | ★★★★☆☆ |

| Oversea-Chinese Banking (SGX:O39) | 5.77% | ★★★★☆☆ |

| Delfi (SGX:P34) | 6.59% | ★★★★☆☆ |

| Nordic Group (SGX:MR7) | 4.18% | ★★★★☆☆ |

Click here to see the full list of 19 stocks from our Top SGX Dividend Stocks screener.

We'll examine a selection from our screener results.

Hour Glass (SGX:AGS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Hour Glass Limited is an investment holding company that focuses on the retailing and distribution of watches, jewelry, and other luxury products across several countries including Singapore, Hong Kong, Japan, Australia, New Zealand, Malaysia, Thailand, and Vietnam with a market cap of SGD1.10 billion.

Operations: The Hour Glass Limited generates SGD1.13 billion in revenue from its retailing and distribution activities in watches, jewelry, and luxury products.

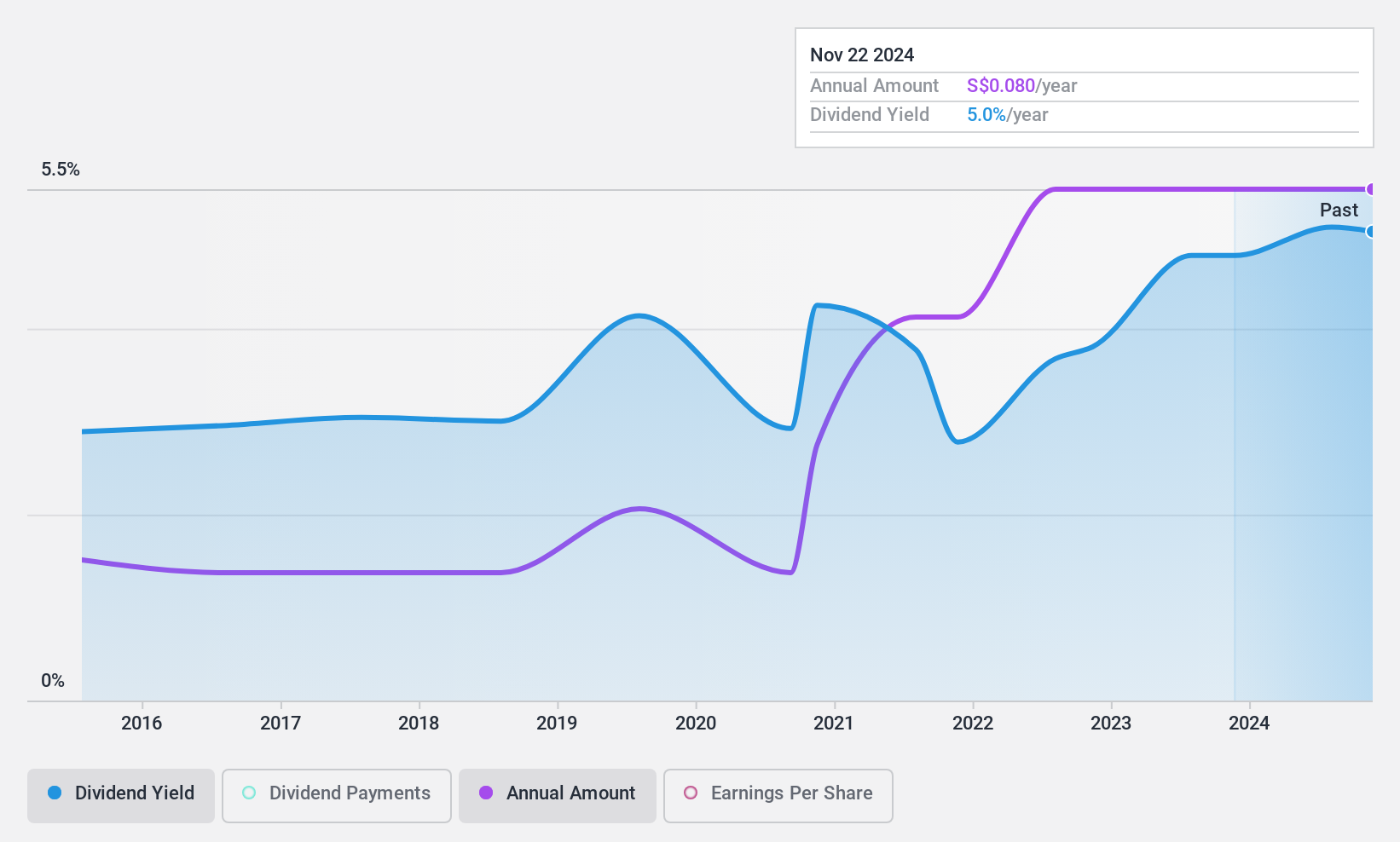

Dividend Yield: 4.7%

Hour Glass's dividend payments have been volatile over the past decade, yet they are well covered by both earnings and cash flows, with a payout ratio of 33.5% and a cash payout ratio of 46.2%. Recently, a final dividend of S$0.06 per share was approved for FY2024. Despite offering a lower yield compared to top-tier Singaporean dividend stocks, its low price-to-earnings ratio suggests potential value for investors seeking income stability amidst board changes and share repurchase activities.

- Click to explore a detailed breakdown of our findings in Hour Glass' dividend report.

- Upon reviewing our latest valuation report, Hour Glass' share price might be too optimistic.

Genting Singapore (SGX:G13)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Genting Singapore Limited is an investment holding company focused on the construction, development, and operation of integrated resort destinations in Asia, with a market cap of SGD10.26 billion.

Operations: Genting Singapore Limited generates revenue primarily from its integrated resort destinations in Asia.

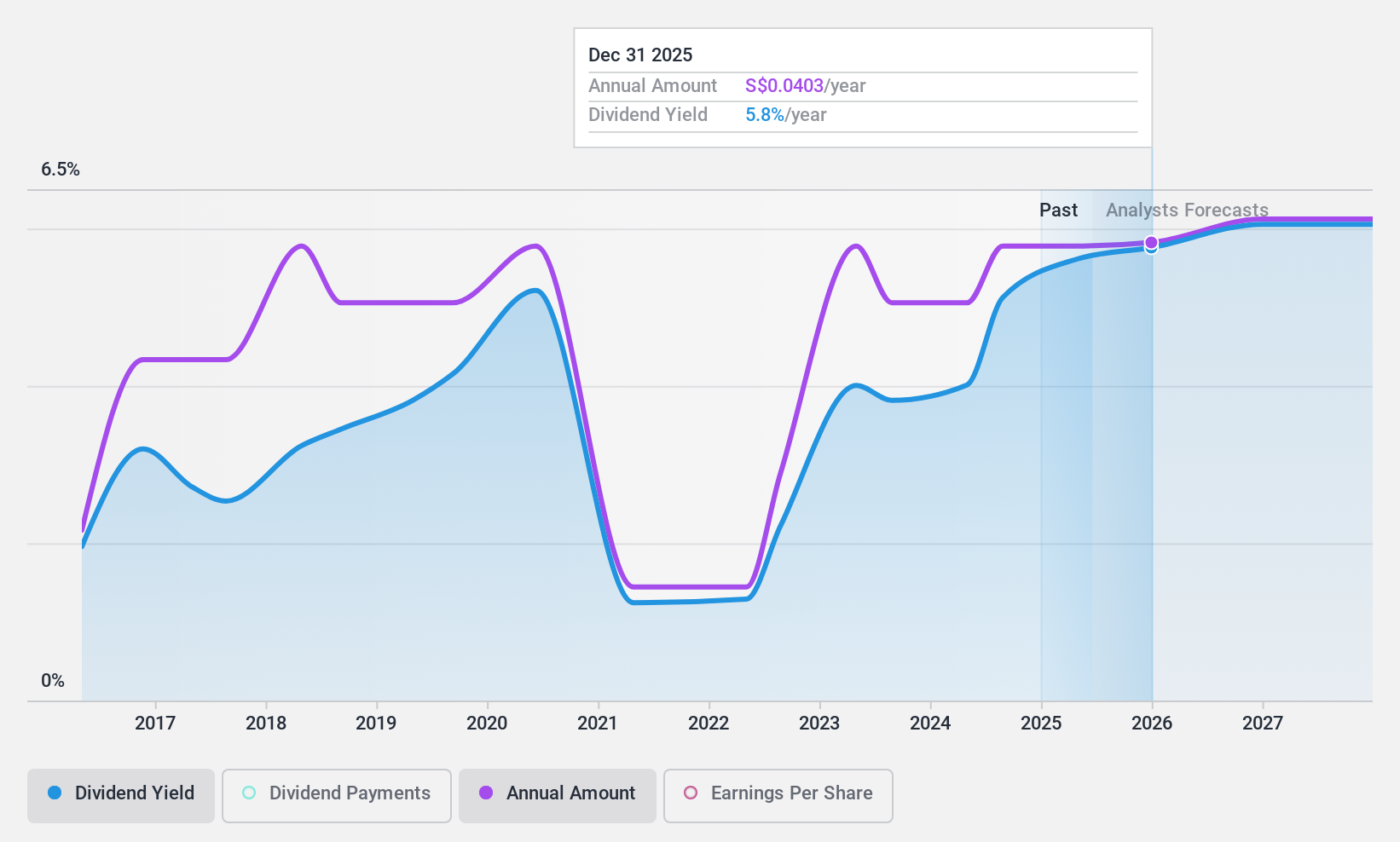

Dividend Yield: 4.7%

Genting Singapore's recent interim dividend of S$0.02 per share reflects its ongoing commitment to shareholder returns, despite a historically volatile dividend track record. The company's earnings growth, with net income rising to S$356.91 million for the half-year ending June 2024, supports its dividend sustainability with a payout ratio of 69.8%. While the yield is below top-tier levels in Singapore, its price-to-earnings ratio of 14.8x suggests potential value compared to industry peers.

- Click here to discover the nuances of Genting Singapore with our detailed analytical dividend report.

- Our valuation report here indicates Genting Singapore may be undervalued.

China Sunsine Chemical Holdings (SGX:QES)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Sunsine Chemical Holdings Ltd. is an investment holding company that manufactures and sells specialty chemicals across the People’s Republic of China, Asia, the United States, Europe, and other international markets, with a market cap of SGD457.62 million.

Operations: China Sunsine Chemical Holdings Ltd. generates revenue primarily from its Rubber Chemicals segment, which accounts for CN¥4.39 billion, supplemented by its Heating Power and Waste Treatment segments contributing CN¥202.99 million and CN¥25.06 million respectively.

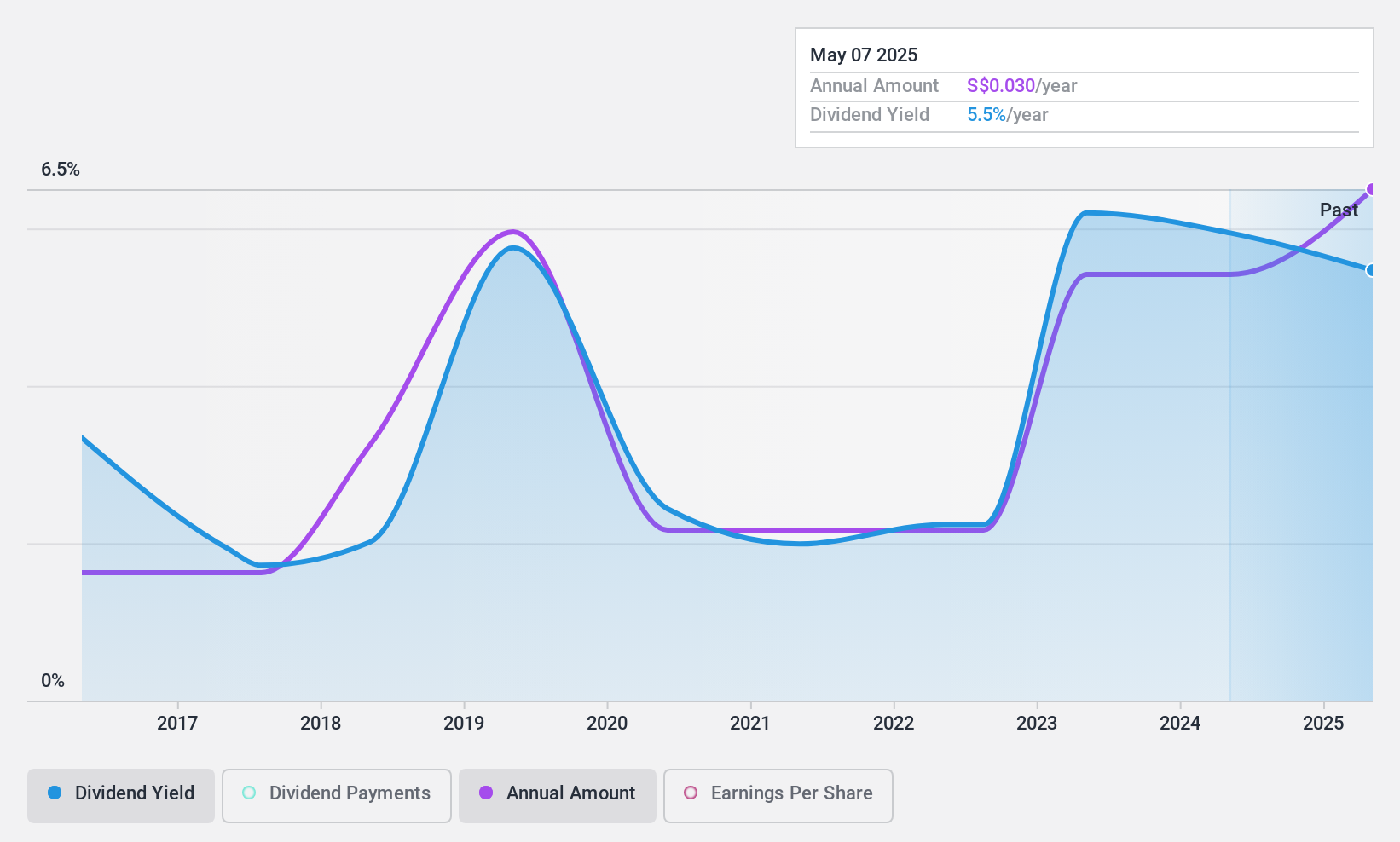

Dividend Yield: 5.1%

China Sunsine Chemical Holdings' dividend payments have been unstable over the past decade, with a low payout ratio of 21.1% indicating strong earnings coverage. Despite its dividends being well covered by cash flows (34% cash payout ratio), the yield is below top-tier levels in Singapore. The company's recent half-year results showed stable sales at CNY 1.75 billion and a slight decrease in net income to CNY 188.8 million, reflecting modest financial performance stability amidst market volatility.

- Get an in-depth perspective on China Sunsine Chemical Holdings' performance by reading our dividend report here.

- Our expertly prepared valuation report China Sunsine Chemical Holdings implies its share price may be lower than expected.

Seize The Opportunity

- Navigate through the entire inventory of 19 Top SGX Dividend Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hour Glass might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:AGS

Hour Glass

An investment holding company, engages in the retailing and distribution of watches, jewellry, and other luxury products in Singapore, Hong Kong, Japan, Australia, New Zealand, Malaysia, Thailand, and Vietnam.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives