- Singapore

- /

- Food and Staples Retail

- /

- SGX:VC2

Steering Clear Of Olam Group On SGX For One Better Dividend Stock Option

Reviewed by Sasha Jovanovic

In the pursuit of reliable dividend stocks on the Singapore Exchange, investors often encounter a mix of opportunities. However, it's crucial to scrutinize whether high dividend yields are supported by sustainable financial practices. For instance, companies like Olam Group with excessively high payout ratios might pose risks, suggesting potential overextension rather than financial robustness. This article will compare two such companies to help investors make informed choices.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 6.99% | ★★★★★☆ |

| Multi-Chem (SGX:AWZ) | 8.50% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.80% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.81% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.71% | ★★★★★☆ |

| Civmec (SGX:P9D) | 5.66% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.55% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 6.88% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.77% | ★★★★★☆ |

| Sing Investments & Finance (SGX:S35) | 6.00% | ★★★★☆☆ |

Click here to see the full list of 21 stocks from our Top SGX Dividend Stocks screener.

Let's explore one of the standout options from the results in the screener and examine one not meeting the grade.

Top Pick

Aztech Global (SGX:8AZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aztech Global Ltd. operates in the research, development, engineering, and manufacturing of IoT devices, data-communication products, and LED lighting across various global markets including Singapore, North America, China, and Europe with a market capitalization of approximately SGD 0.77 billion.

Operations: The company generates its revenue primarily from the production and sale of IoT devices, data-communication products, and LED lighting.

Dividend Yield: 8%

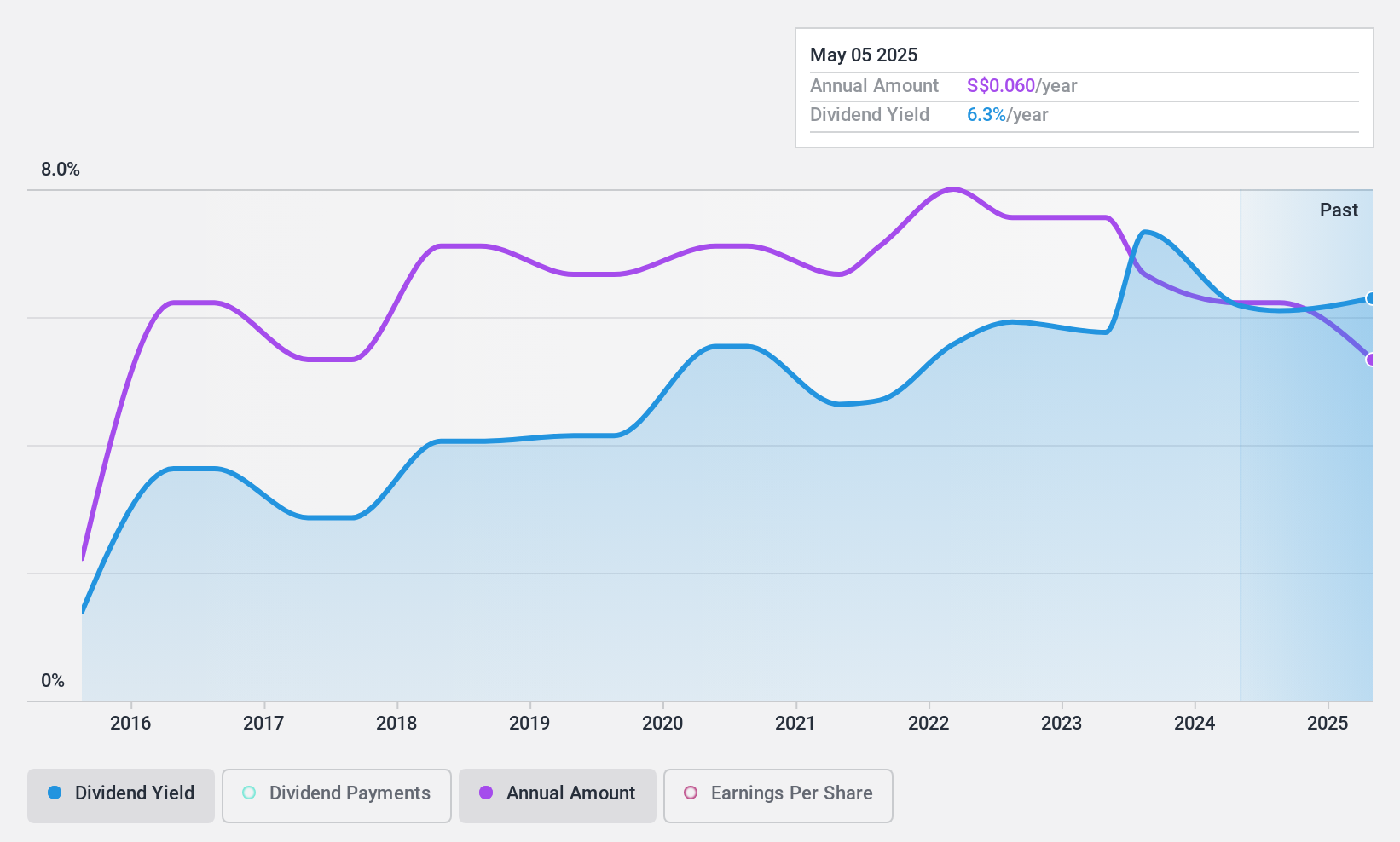

Aztech Global, despite a volatile dividend history over its short 3-year payout period, shows promise with a current yield of 8.04%, ranking in the top quartile within the Singapore market. The firm's dividends are well-supported with a payout ratio of 61.7% and a cash payout ratio of 77.9%, ensuring sustainability from both earnings and cash flow perspectives. Recent earnings growth at 53.7% year-over-year and positive forecasts suggest potential stability ahead, contrasting sharply with firms facing overly high payout issues.

- Click here to discover the nuances of Aztech Global with our detailed analytical dividend report.

- According our valuation report, there's an indication that Aztech Global's share price might be on the cheaper side.

One To Reconsider

Olam Group (SGX:VC2)

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Olam Group Limited is a global agribusiness company specializing in the sourcing, processing, packaging, and merchandising of agricultural products, with a market capitalization of approximately SGD 4.29 billion.

Operations: The company's revenue is primarily derived from three segments: Olam Agri generating SGD 31.32 billion, Olam Food Ingredients (Ofi) contributing SGD 15.58 billion, and the remaining group activities adding SGD 1.37 billion.

Dividend Yield: 6.2%

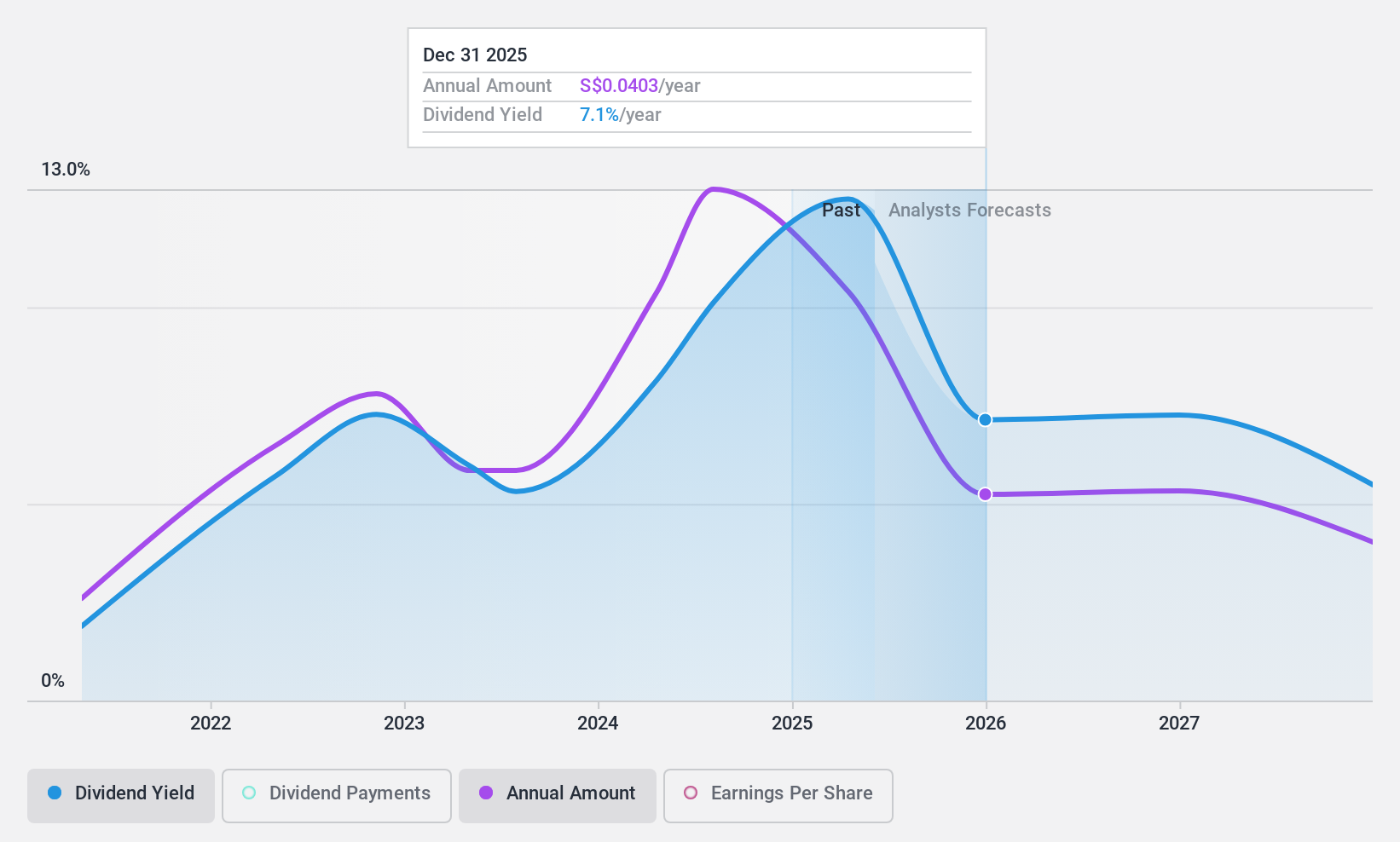

Olam Group's recent dividend reduction to 4.0 cents per share, alongside a high payout ratio of 107.8%, signals potential sustainability issues with its dividends. Despite a history of dividend payments, the lack of coverage by earnings or cash flows, coupled with volatile dividends over the past decade, raises concerns. Recent board changes and a share buyback program suggest attempts at restructuring, yet these do not directly mitigate the fundamental challenges in maintaining its dividend payouts.

Taking Advantage

- Gain an insight into the universe of 21 Top SGX Dividend Stocks by clicking here.

- Have you diversified into one of these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:VC2

Olam Group

Engages in the sourcing, processing, packaging, and merchandising of agricultural products worldwide.

Moderate second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives