- Singapore

- /

- Food and Staples Retail

- /

- SGX:OV8

October 2025's Global Penny Stocks: Emerging Opportunities

Reviewed by Simply Wall St

As global markets navigate the complexities of renewed U.S.-China trade tensions and concerns over a prolonged U.S. government shutdown, investors are increasingly seeking opportunities that offer both growth and stability. Penny stocks, though a somewhat outdated term, remain relevant as they often represent smaller or newer companies with the potential for substantial returns when backed by strong financials. In this article, we'll explore several penny stocks that stand out for their financial strength and long-term potential amidst today's challenging market conditions.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.45 | HK$878.3M | ✅ 4 ⚠️ 1 View Analysis > |

| IVE Group (ASX:IGL) | A$2.67 | A$412.63M | ✅ 4 ⚠️ 3 View Analysis > |

| HSS Engineers Berhad (KLSE:HSSEB) | MYR0.61 | MYR310.17M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.53 | HK$2.15B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.30 | SGD526.88M | ✅ 4 ⚠️ 1 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.33 | MYR534.07M | ✅ 5 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.40 | SGD13.38B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.485 | $281.94M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.125 | £179.1M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 3,588 stocks from our Global Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Sheng Siong Group (SGX:OV8)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sheng Siong Group Ltd is an investment holding company that operates a chain of supermarket retail stores in Singapore, with a market cap of SGD3.22 billion.

Operations: The company generates revenue from its supermarket operations selling consumer goods, amounting to SGD1.48 billion.

Market Cap: SGD3.22B

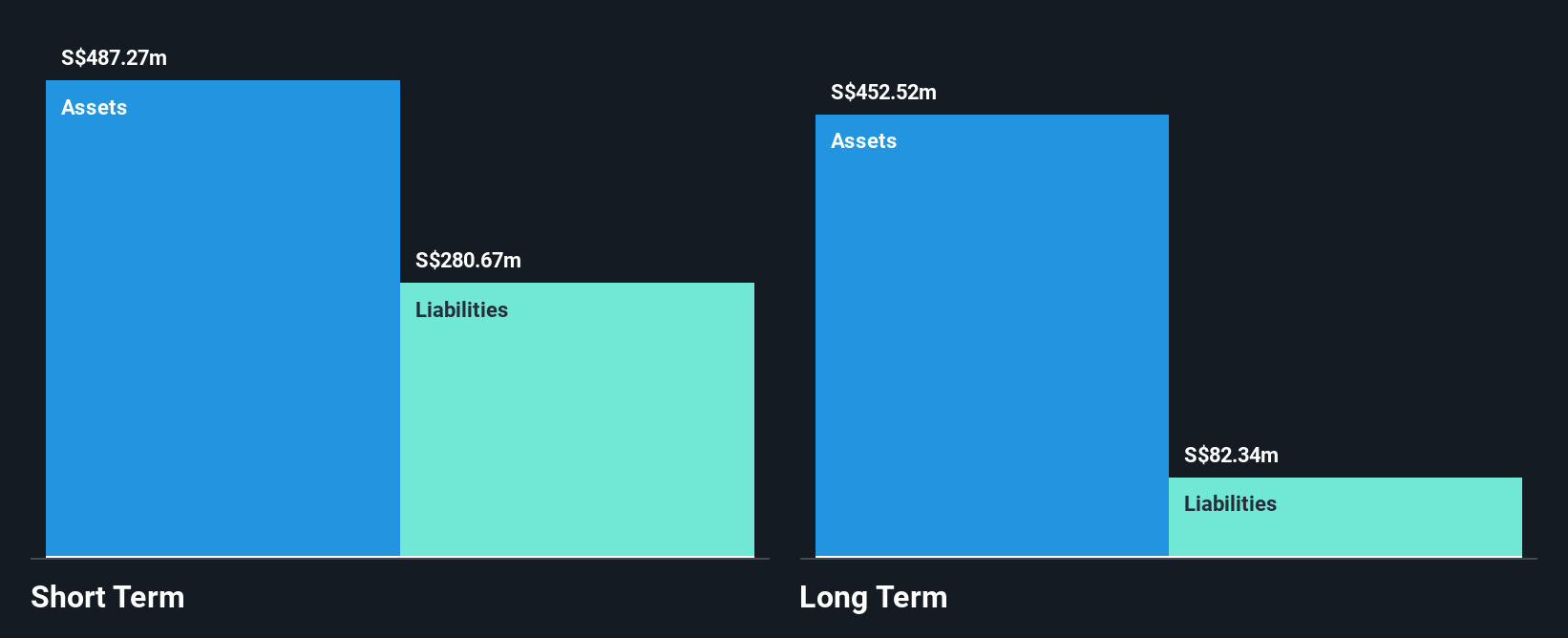

Sheng Siong Group, with a market cap of SGD3.22 billion, has demonstrated stable financial health and growth potential. Despite earnings growth of 1.3% over the past year lagging behind the industry average, the company remains debt-free and maintains a high return on equity at 24.9%. Its management and board are seasoned, with average tenures exceeding industry norms. Recent earnings reports show an increase in sales to SGD764.68 million for H1 2025 compared to last year, although profit margins slightly declined from 9.9% to 9.5%. The company is trading significantly below its estimated fair value but has an unstable dividend track record despite recent affirmations of interim dividends payable in August 2025.

- Get an in-depth perspective on Sheng Siong Group's performance by reading our balance sheet health report here.

- Understand Sheng Siong Group's earnings outlook by examining our growth report.

Yunnan Yunwei (SHSE:600725)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Yunnan Yunwei Company Limited is involved in the production and operation of coal coke and chemical products in China, with a market capitalization of approximately CN¥4.39 billion.

Operations: The company generates revenue of CN¥690.34 million from its operations in China.

Market Cap: CN¥4.39B

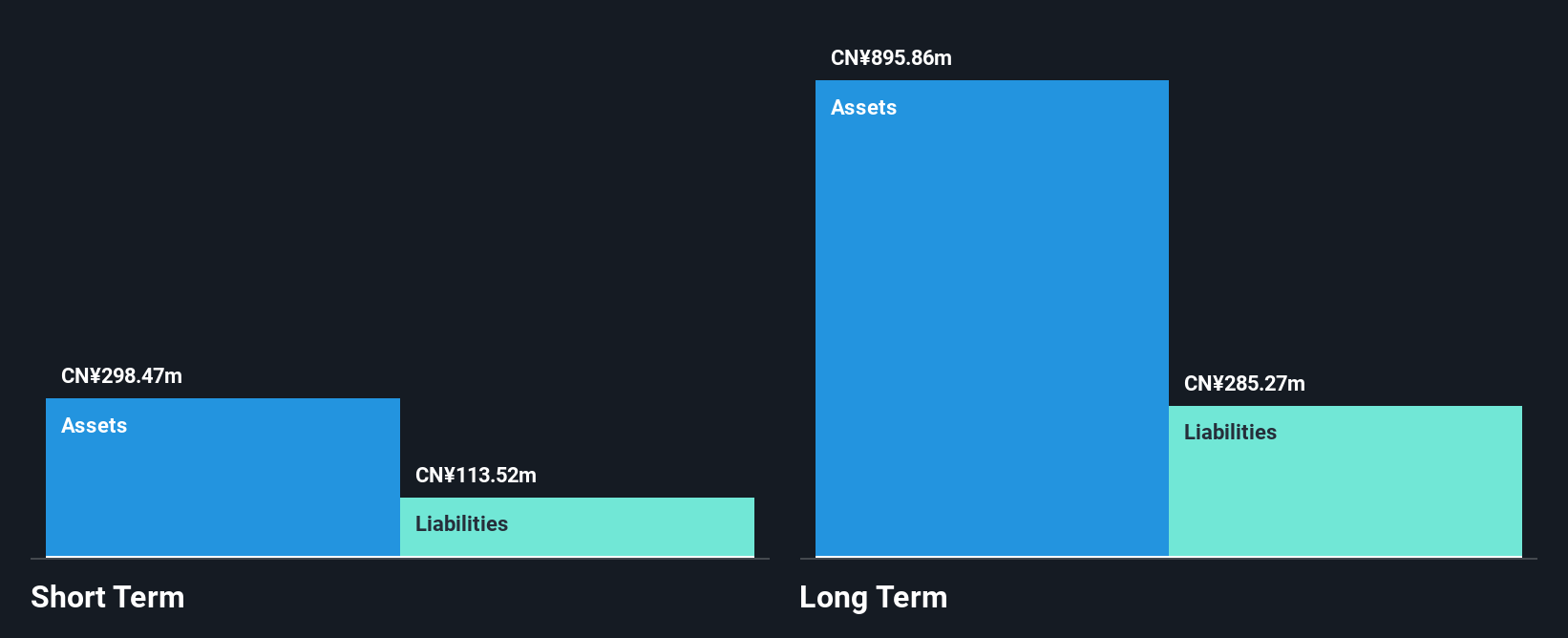

Yunnan Yunwei, with a market cap of CN¥4.39 billion, faces challenges as its recent earnings report shows a decline in revenue to CN¥326.61 million for H1 2025 from CN¥394.82 million the previous year, alongside an increased net loss of CN¥14.53 million. Despite being unprofitable, the company is debt-free and maintains a positive cash flow with sufficient runway for over three years. Its short-term assets significantly exceed both short and long-term liabilities, providing some financial stability; however, the management team lacks experience with an average tenure of 1.8 years, which may impact strategic execution moving forward.

- Take a closer look at Yunnan Yunwei's potential here in our financial health report.

- Review our historical performance report to gain insights into Yunnan Yunwei's track record.

Hainan Shennong Seed Industry Technology (SZSE:300189)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hainan Shennong Seed Industry Technology Co., Ltd. operates in the agricultural sector, focusing on the development and sale of seeds, with a market cap of CN¥4.57 billion.

Operations: Hainan Shennong Seed Industry Technology Co., Ltd. does not report specific revenue segments.

Market Cap: CN¥4.57B

Hainan Shennong Seed Industry Technology, with a market cap of CN¥4.57 billion, reported an increase in revenue to CN¥87.22 million for the first half of 2025 from CN¥62.9 million the previous year, alongside a reduced net loss of CN¥14.36 million. The company's short-term assets comfortably cover both its short and long-term liabilities, indicating solid financial positioning despite being unprofitable with a negative return on equity of -5.97%. While its cash runway is limited to just over one year, the management and board are experienced with an average tenure of 3.4 years each, which may support strategic continuity amidst high share price volatility.

- Jump into the full analysis health report here for a deeper understanding of Hainan Shennong Seed Industry Technology.

- Assess Hainan Shennong Seed Industry Technology's previous results with our detailed historical performance reports.

Taking Advantage

- Embark on your investment journey to our 3,588 Global Penny Stocks selection here.

- Ready To Venture Into Other Investment Styles? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:OV8

Sheng Siong Group

An investment holding company, operates a chain of supermarket retail stores in Singapore.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026