Exploring Three Top Dividend Stocks On SGX For Stable Income

Reviewed by Simply Wall St

Amidst a landscape of fluctuating global markets, the Singapore Exchange (SGX) continues to offer a realm of opportunities for investors seeking stability and income. In this context, dividend stocks stand out as appealing options due to their potential to provide regular income streams and relative resilience during market uncertainties.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| Civmec (SGX:P9D) | 5.97% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.52% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.97% | ★★★★★☆ |

| China Sunsine Chemical Holdings (SGX:QES) | 6.26% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.72% | ★★★★★☆ |

| BRC Asia (SGX:BEC) | 7.62% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 7.02% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.06% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.63% | ★★★★★☆ |

| Sing Investments & Finance (SGX:S35) | 6.03% | ★★★★☆☆ |

Click here to see the full list of 19 stocks from our Top SGX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

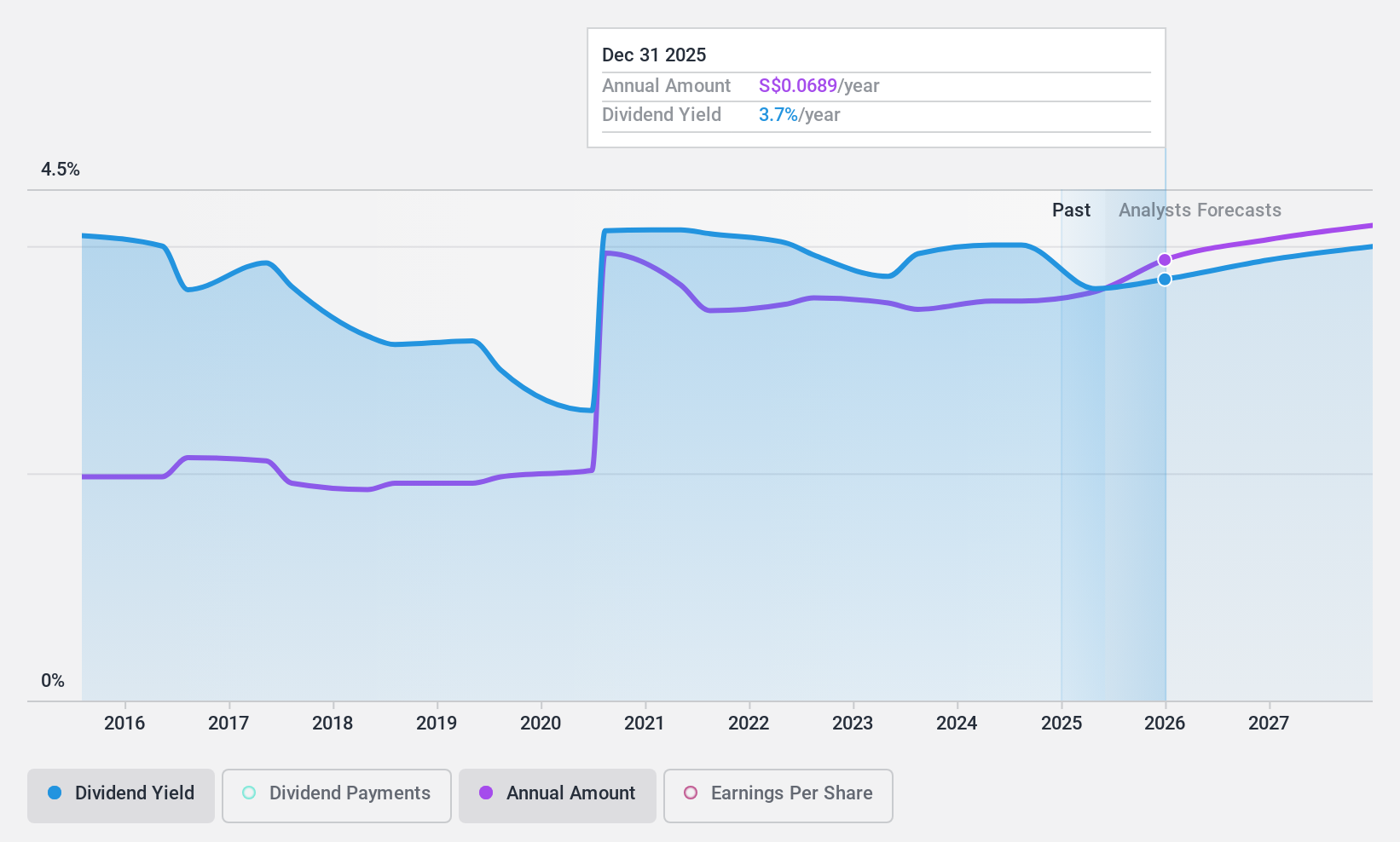

Sheng Siong Group (SGX:OV8)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sheng Siong Group Ltd is an investment holding company that operates a supermarket retail chain in Singapore, with a market capitalization of approximately SGD 2.29 billion.

Operations: Sheng Siong Group Ltd generates its revenue primarily through supermarket operations selling consumer goods, which amounted to SGD 1.39 billion.

Dividend Yield: 4.1%

Sheng Siong Group's dividend sustainability is moderately strong, with a payout ratio of 68.7% and a cash payout ratio at 50.1%, indicating coverage by both earnings and cash flows. However, the dividend track record over the past decade has been unstable, reflecting some volatility in payments. Despite recent executive appointments potentially signaling strategic shifts, the dividend yield of 4.11% remains lower compared to top payers in Singapore's market. Recent financials show a steady increase in sales and net income as of Q1 2024, supporting ongoing dividend commitments.

- Get an in-depth perspective on Sheng Siong Group's performance by reading our dividend report here.

- Our valuation report here indicates Sheng Siong Group may be undervalued.

Delfi (SGX:P34)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Delfi Limited is an investment holding company that specializes in manufacturing, marketing, distributing, and selling chocolate and chocolate confectionery products across Indonesia, the Philippines, Malaysia, Singapore, and other international markets with a market capitalization of SGD 534.76 million.

Operations: Delfi Limited generates revenue primarily from its operations in Indonesia, which brought in SGD 370.41 million, and its regional markets contributing SGD 185.07 million.

Dividend Yield: 6.7%

Delfi Limited, with a dividend yield of 6.67%, faces challenges in sustaining its payouts, as indicated by a high cash payout ratio of 17.77 and only partial coverage by earnings at a 50.2% payout ratio. Despite this, the company has seen an earnings growth of 5.4% over the past year and forecasts suggest a modest annual increase of 3.07%. Recent board changes aim to enhance governance and strategy, potentially impacting future financial stability and dividend policies.

- Navigate through the intricacies of Delfi with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Delfi's share price might be too pessimistic.

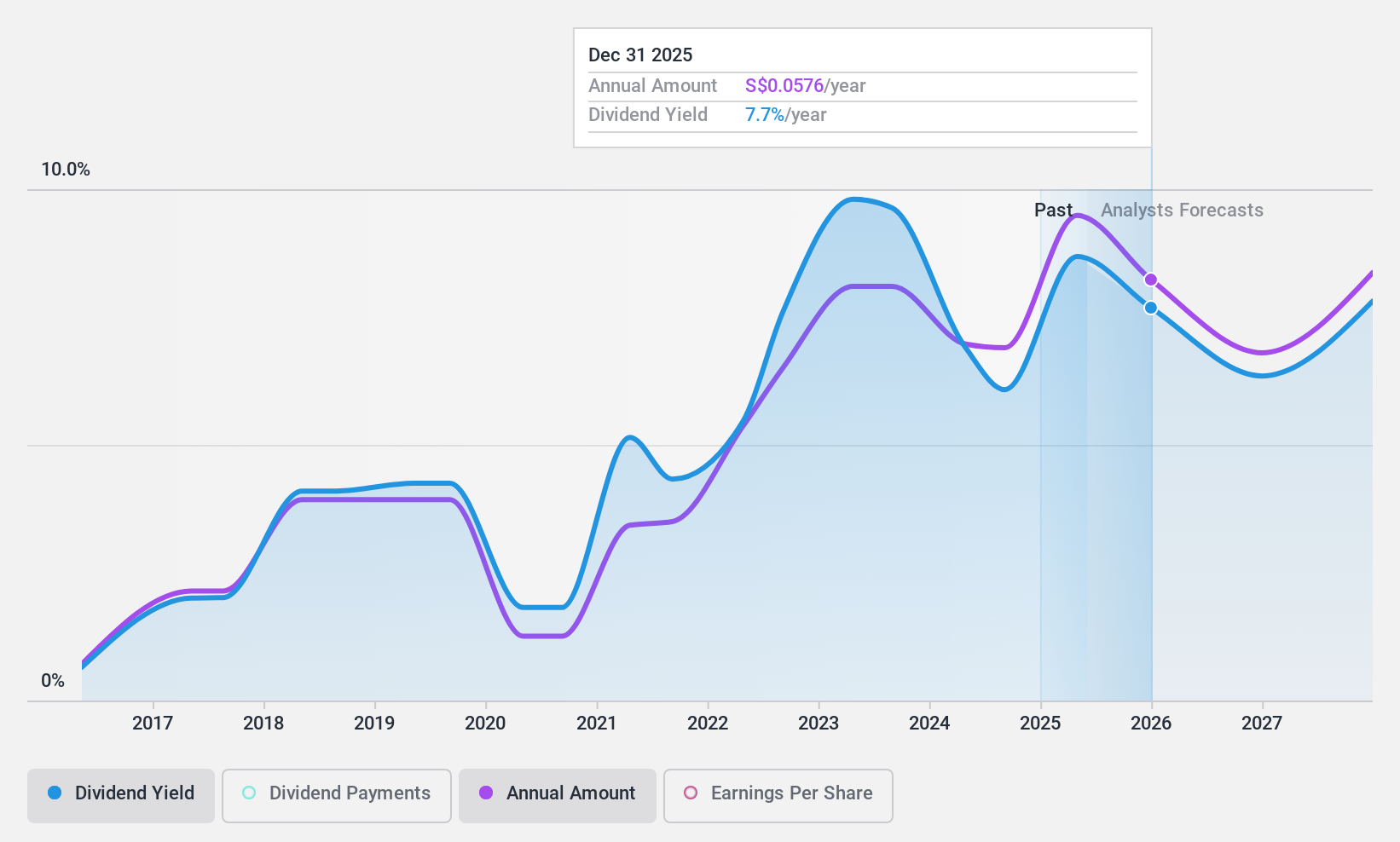

Bumitama Agri (SGX:P8Z)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bumitama Agri Ltd. is an investment holding company focused on the production and trade of crude palm oil and palm kernel in Indonesia, with a market capitalization of approximately SGD 1.17 billion.

Operations: Bumitama Agri Ltd. generates IDR 15.44 billion primarily from its plantations and palm oil mills segment.

Dividend Yield: 7.0%

Bumitama Agri Ltd. has increased its dividend over the past decade, though with notable fluctuations, including drops over 20% in some years. Currently trading at 58% below estimated fair value and having a high yield of 7.02%, it ranks well among SG market payers. Despite forecasts suggesting a potential earnings decline by an average of 5.5% annually over the next three years, both earnings and cash flows adequately cover the payouts, with payout ratios at 40.4% and cash payout ratio at 60.8%, respectively. Recent board enhancements could positively influence future governance and risk management.

- Take a closer look at Bumitama Agri's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Bumitama Agri is trading behind its estimated value.

Key Takeaways

- Embark on your investment journey to our 19 Top SGX Dividend Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Bumitama Agri might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:P8Z

Bumitama Agri

An investment holding company, engages in the production and trading of crude palm oil (CPO) and palm kernel (PK) in Indonesia.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)