- Singapore

- /

- Food and Staples Retail

- /

- SGX:D01

DFI Retail Group Holdings (SGX:D01) adds US$379m to market cap in the past 7 days, though investors from five years ago are still down 34%

DFI Retail Group Holdings Limited (SGX:D01) shareholders should be happy to see the share price up 20% in the last month. But over the last half decade, the stock has not performed well. After all, the share price is down 44% in that time, significantly under-performing the market.

On a more encouraging note the company has added US$379m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

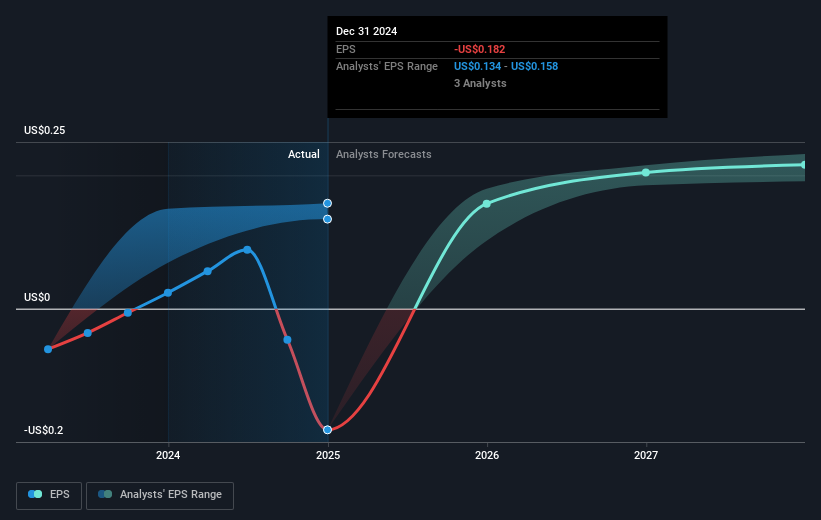

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over five years DFI Retail Group Holdings' earnings per share dropped significantly, falling to a loss, with the share price also lower. This was, in part, due to extraordinary items impacting earnings. At present it's hard to make valid comparisons between EPS and the share price. However, we can say we'd expect to see a falling share price in this scenario.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into DFI Retail Group Holdings' key metrics by checking this interactive graph of DFI Retail Group Holdings's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, DFI Retail Group Holdings' TSR for the last 5 years was -34%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that DFI Retail Group Holdings shareholders have received a total shareholder return of 49% over the last year. That's including the dividend. That certainly beats the loss of about 6% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand DFI Retail Group Holdings better, we need to consider many other factors. For example, we've discovered 2 warning signs for DFI Retail Group Holdings (1 is a bit concerning!) that you should be aware of before investing here.

But note: DFI Retail Group Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Singaporean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:D01

DFI Retail Group Holdings

Operates as a retailer in Hong Kong, Mainland China, Macau, Taiwan, Singapore, Cambodia, Malaysia, Indonesia, and Brunei.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives