- Singapore

- /

- Food and Staples Retail

- /

- SGX:D01

Could DFI Retail Group (SGX:D01) Shift Its Capital Strategy to Address Stagnant Returns?

Reviewed by Sasha Jovanovic

- Recently, DFI Retail Group Holdings faced investor scrutiny after reports showed stagnant returns on capital employed and a 26% drop in capital deployment over the past five years, with returns trailing industry averages.

- An important concern highlighted is DFI’s high reliance on short-term creditors, as reflected by current liabilities making up 45% of total assets, raising questions about the company’s capital efficiency and exposure to financial risks.

- To better understand the broader impact, we'll consider how weak capital allocation and returns could reshape DFI's current investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

DFI Retail Group Holdings Investment Narrative Recap

To remain confident holding DFI Retail Group Holdings, I need to believe the company's pivot to higher-margin segments and digital channels can eventually offset legacy pressures in convenience and food retail. The recent spotlight on flat returns and shrinking capital base brings sharper focus to DFI’s ability to generate operating improvements in the short term, while highlighting the elevated risk of balance sheet fragility should macro or competitive conditions worsen, though the immediate relevance of these factors depends on sustained progress with digital and core segment renewal.

Among recent announcements, the declaration of a special dividend in July 2025 stands out amid ongoing net losses, hinting at a tension between rewarding shareholders in the present and maintaining flexibility for reinvestment. This payout is especially relevant as weaker capital returns and high current liabilities could constrain DFI’s ability to fund growth initiatives, just as transformation remains a key catalyst for the business.

Yet, despite the business’s evolution, the company’s sizable reliance on short-term creditors remains a risk that all investors should be aware of if...

Read the full narrative on DFI Retail Group Holdings (it's free!)

DFI Retail Group Holdings is projected to reach $8.6 billion in revenue and $509.9 million in earnings by 2028. This outlook reflects a -0.8% annual decline in revenue and an increase in earnings of $887.1 million from current earnings of -$377.2 million.

Uncover how DFI Retail Group Holdings' forecasts yield a $3.71 fair value, a 10% upside to its current price.

Exploring Other Perspectives

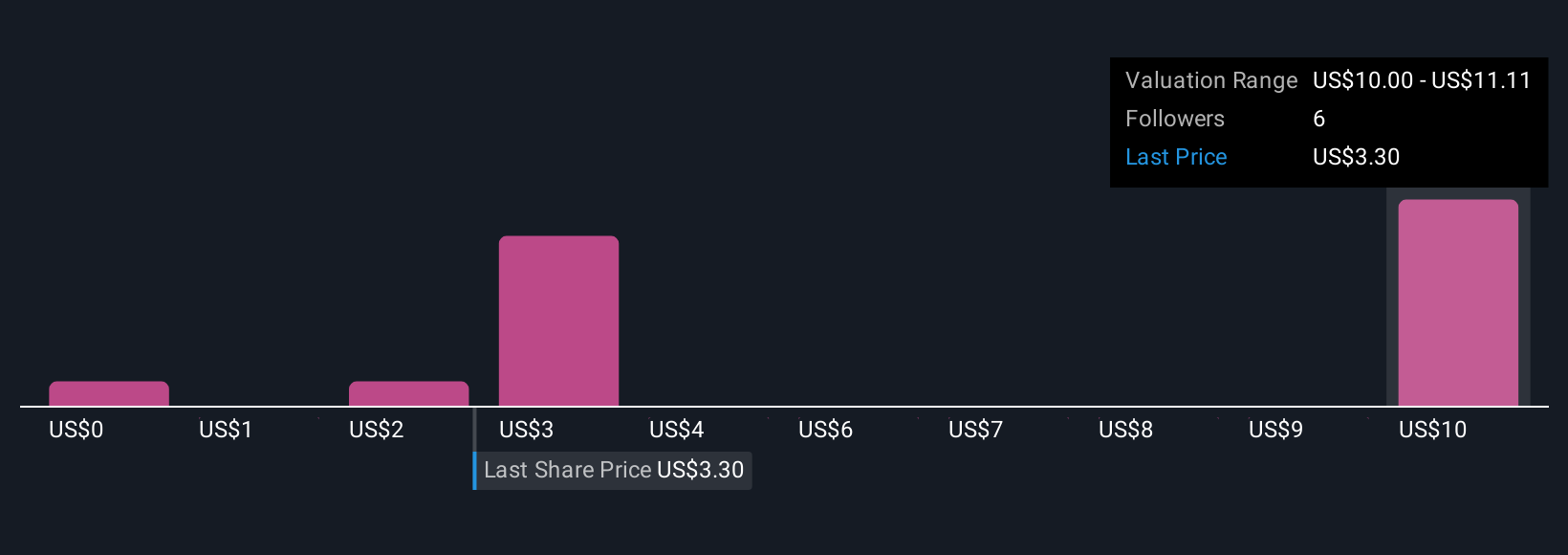

Four recent fair value estimates from the Simply Wall St Community span US$1.12 to US$11.17, revealing broad differences in investor conviction. With many expecting a shift toward profitable growth, persistent capital structure concerns invite you to review multiple views on how DFI’s strategy could play out.

Explore 4 other fair value estimates on DFI Retail Group Holdings - why the stock might be worth less than half the current price!

Build Your Own DFI Retail Group Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DFI Retail Group Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DFI Retail Group Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DFI Retail Group Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:D01

DFI Retail Group Holdings

Operates as a retailer in Hong Kong, Mainland China, Macau, Taiwan, Singapore, Cambodia, Malaysia, Indonesia, and Brunei.

Good value with reasonable growth potential.

Market Insights

Community Narratives