Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Qian Hu Corporation Limited (SGX:BCV) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Qian Hu

What Is Qian Hu's Net Debt?

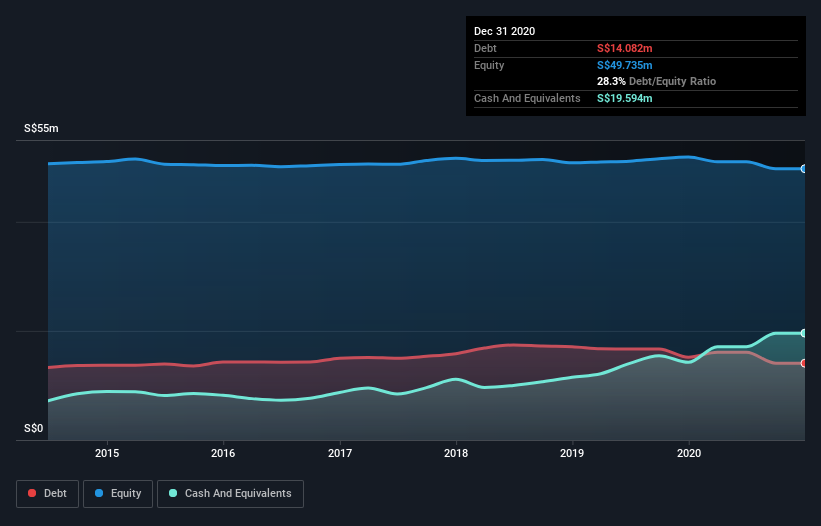

The image below, which you can click on for greater detail, shows that Qian Hu had debt of S$14.1m at the end of December 2020, a reduction from S$15.2m over a year. However, its balance sheet shows it holds S$19.6m in cash, so it actually has S$5.51m net cash.

How Healthy Is Qian Hu's Balance Sheet?

We can see from the most recent balance sheet that Qian Hu had liabilities of S$26.7m falling due within a year, and liabilities of S$1.34m due beyond that. Offsetting this, it had S$19.6m in cash and S$14.1m in receivables that were due within 12 months. So it actually has S$5.68m more liquid assets than total liabilities.

This excess liquidity suggests that Qian Hu is taking a careful approach to debt. Given it has easily adequate short term liquidity, we don't think it will have any issues with its lenders. Simply put, the fact that Qian Hu has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is Qian Hu's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Qian Hu made a loss at the EBIT level, and saw its revenue drop to S$75m, which is a fall of 2.2%. We would much prefer see growth.

So How Risky Is Qian Hu?

Although Qian Hu had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of S$8.7m. So taking that on face value, and considering the net cash situation, we don't think that the stock is too risky in the near term. With mediocre revenue growth in the last year, we're don't find the investment opportunity particularly compelling. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 2 warning signs we've spotted with Qian Hu (including 1 which is potentially serious) .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade Qian Hu, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Qian Hu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:BCV

Qian Hu

Provides ornamental fish services primarily in Singapore, rest of Asian countries, Europe, and internationally.

Excellent balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026