- Singapore

- /

- Professional Services

- /

- SGX:CHZ

HRnetGroup's(SGX:CHZ) Share Price Is Down 33% Over The Past Three Years.

While not a mind-blowing move, it is good to see that the HRnetGroup Limited (SGX:CHZ) share price has gained 19% in the last three months. But that cannot eclipse the less-than-impressive returns over the last three years. After all, the share price is down 33% in the last three years, significantly under-performing the market.

Check out our latest analysis for HRnetGroup

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

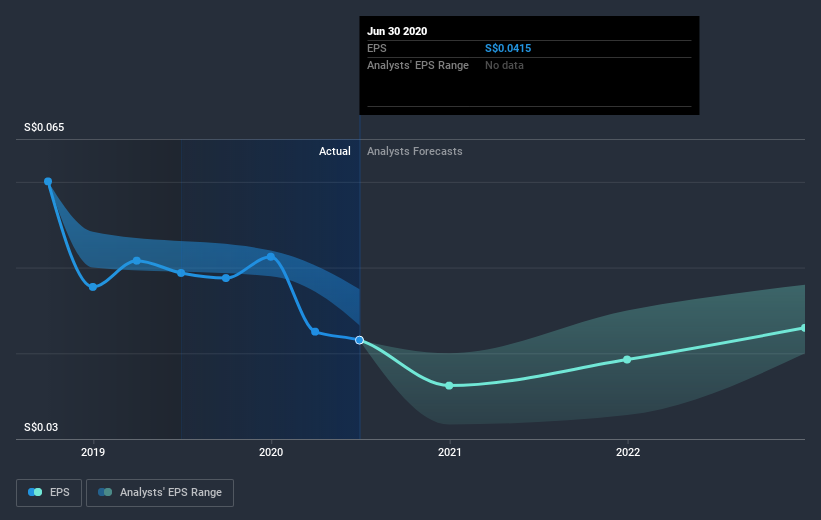

During the three years that the share price fell, HRnetGroup's earnings per share (EPS) dropped by 5.1% each year. This reduction in EPS is slower than the 13% annual reduction in the share price. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Dive deeper into HRnetGroup's key metrics by checking this interactive graph of HRnetGroup's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of HRnetGroup, it has a TSR of -25% for the last 3 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that HRnetGroup shareholders have gained 1.0% (in total) over the last year. That's including the dividend. What is absolutely clear is that is far preferable to the dismal 8% average annual loss suffered over the last three years. We're generally cautious about putting too much weigh on shorter term data, but the recent improvement is definitely a positive. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 1 warning sign for HRnetGroup you should be aware of.

Of course HRnetGroup may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

If you decide to trade HRnetGroup, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if HRnetGroup might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:CHZ

HRnetGroup

An investment holding company, engages in the recruitment and staffing business in Singapore, Hong Kong, Taiwan, the People’s Republic of China, Japan, South Korea, Malaysia, Thailand, and Indonesia.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives