- Australia

- /

- Capital Markets

- /

- ASX:MFF

Exploring 3 Undervalued Small Caps In Asian Markets With Insider Buying

Reviewed by Simply Wall St

In recent weeks, Asian markets have experienced a positive shift, buoyed by optimism surrounding trade negotiations between the U.S. and China and supportive monetary policies in key regions like China. As small-cap indexes continue to gain traction, investors are increasingly focusing on stocks with strong fundamentals and significant insider buying activity, which can indicate confidence from those closest to the company's operations.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.7x | 1.1x | 36.34% | ★★★★★★ |

| Atturra | 29.4x | 1.2x | 35.91% | ★★★★★☆ |

| Hansen Technologies | 290.0x | 2.8x | 23.31% | ★★★★★☆ |

| Viva Energy Group | NA | 0.1x | 47.83% | ★★★★★☆ |

| Puregold Price Club | 9.3x | 0.4x | 26.77% | ★★★★☆☆ |

| Dicker Data | 19.8x | 0.7x | -39.95% | ★★★★☆☆ |

| Sing Investments & Finance | 7.0x | 3.5x | 43.93% | ★★★★☆☆ |

| PWR Holdings | 36.4x | 5.0x | 22.80% | ★★★☆☆☆ |

| Integral Diagnostics | 168.3x | 1.9x | 40.68% | ★★★☆☆☆ |

| Charter Hall Long WALE REIT | NA | 11.7x | 21.20% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

Iluka Resources (ASX:ILU)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Iluka Resources is a leading mineral sands company engaged in the exploration, project development, operations, and marketing of zircon and titanium dioxide products with a market cap of A$5.82 billion.

Operations: Iluka Resources generates revenue primarily from its Mineral Sands segment, with a recent gross profit margin of 56.64%. Operating expenses are significant, including general and administrative costs of A$83.9 million and sales & marketing expenses of A$74.3 million, impacting the net income margin which stands at 19.76%.

PE: 7.6x

Iluka Resources, a notable player in the mineral sands industry, is currently trading as part of the S&P/ASX Small Ordinaries Index. Despite a drop in annual sales to A$1.17 billion and net income to A$231 million for 2024, insider confidence remains strong with recent share purchases. The appointment of James Mactier as Chair brings extensive experience from Macquarie's Metals and Energy Capital division, potentially steering future growth amidst low-risk funding concerns tied to external borrowing.

- Click to explore a detailed breakdown of our findings in Iluka Resources' valuation report.

Examine Iluka Resources' past performance report to understand how it has performed in the past.

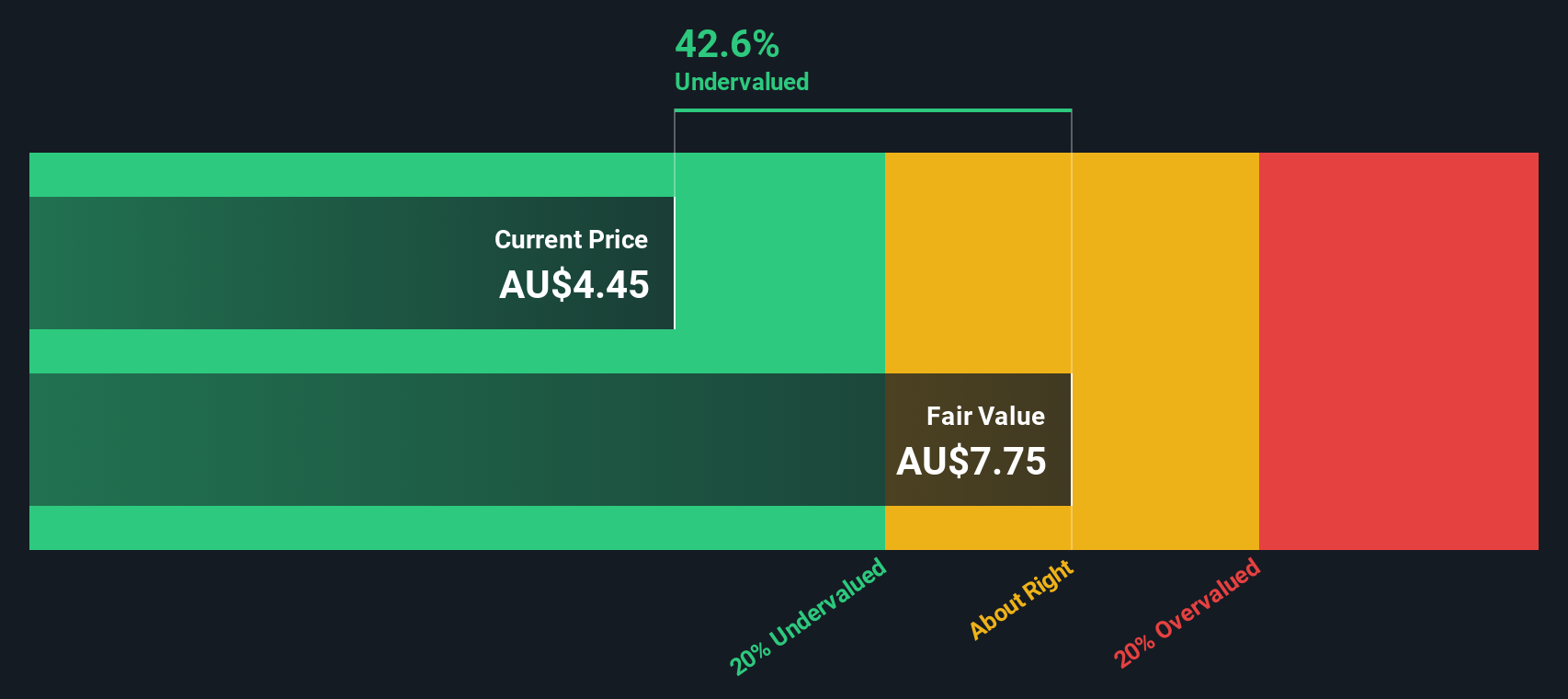

MFF Capital Investments (ASX:MFF)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MFF Capital Investments is a company focused on equity investments with a market capitalization of A$1.89 billion.

Operations: The company generates revenue primarily through equity investments, with a reported revenue of A$1.01 billion as of the latest period. It consistently achieves a gross profit margin of 100%, indicating no cost of goods sold is recorded against its revenue streams. Operating expenses are relatively low compared to total revenue, contributing to a net income margin that has varied over time but was last noted at 67.44%.

PE: 3.5x

MFF Capital Investments, a small player in Asia's market, has caught attention due to insider confidence. Christopher MacKay recently purchased 1,299,779 shares for A$5.03 million between January and March 2025, indicating belief in the company's potential despite its reliance on external borrowing. This financial structure might pose higher risks compared to customer deposits but also suggests strategic positioning for growth opportunities within the region's dynamic investment landscape.

- Click here and access our complete valuation analysis report to understand the dynamics of MFF Capital Investments.

Assess MFF Capital Investments' past performance with our detailed historical performance reports.

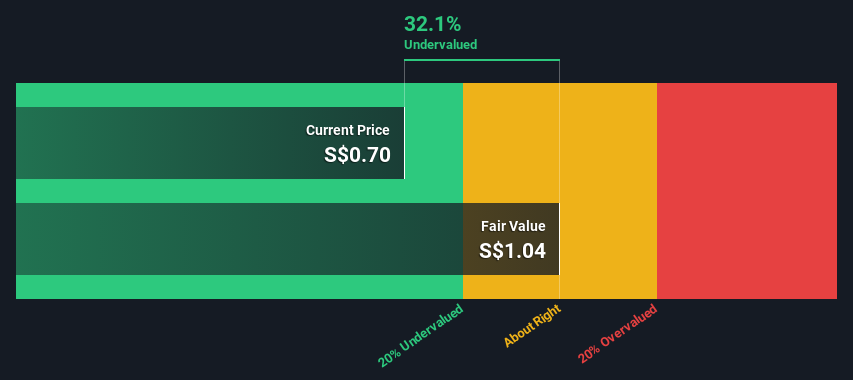

HRnetGroup (SGX:CHZ)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: HRnetGroup is a company specializing in flexible staffing and professional recruitment services with a market capitalization of approximately SGD 1.15 billion.

Operations: Flexible Staffing is the primary revenue stream, generating SGD 507.96 million, while Professional Recruitment contributes SGD 54.94 million. The company's gross profit margin has shown a declining trend from 39.64% in December 2014 to 21.55% in December 2024, indicating changes in cost structures or pricing strategies over time.

PE: 15.0x

HRnetGroup, a small cap in Asia, has shown insider confidence with recent share purchases. Despite a dip in net income to S$44.52 million for 2024 from S$63.56 million the previous year, earnings are projected to grow annually by 12.53%. The company declared a final dividend of S$0.0213 per share for 2024, reflecting its commitment to shareholder returns amidst leadership changes and ongoing strategic shifts within its board and management team.

- Navigate through the intricacies of HRnetGroup with our comprehensive valuation report here.

Evaluate HRnetGroup's historical performance by accessing our past performance report.

Make It Happen

- Delve into our full catalog of 60 Undervalued Asian Small Caps With Insider Buying here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MFF

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives