- Singapore

- /

- Commercial Services

- /

- SGX:BQC

We're Not Very Worried About A-Smart Holdings' (SGX:BQC) Cash Burn Rate

We can readily understand why investors are attracted to unprofitable companies. By way of example, A-Smart Holdings (SGX:BQC) has seen its share price rise 158% over the last year, delighting many shareholders. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

Given its strong share price performance, we think it's worthwhile for A-Smart Holdings shareholders to consider whether its cash burn is concerning. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

View our latest analysis for A-Smart Holdings

How Long Is A-Smart Holdings' Cash Runway?

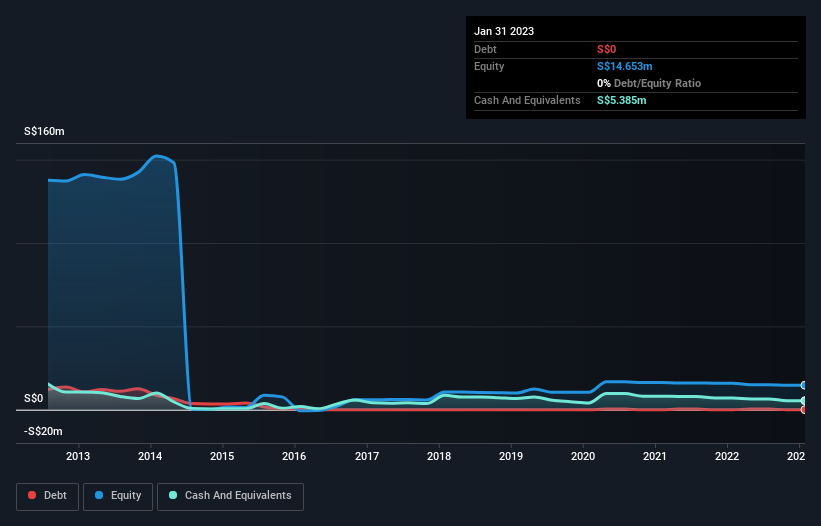

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. As at January 2023, A-Smart Holdings had cash of S$5.4m and no debt. Importantly, its cash burn was S$784k over the trailing twelve months. Therefore, from January 2023 it had 6.9 years of cash runway. While this is only one measure of its cash burn situation, it certainly gives us the impression that holders have nothing to worry about. Depicted below, you can see how its cash holdings have changed over time.

How Well Is A-Smart Holdings Growing?

A-Smart Holdings boosted investment sharply in the last year, with cash burn ramping by 61%. As if that's not bad enough, the operating revenue also dropped by 4.7%, making us very wary indeed. Taken together, we think these growth metrics are a little worrying. Of course, we've only taken a quick look at the stock's growth metrics, here. You can take a look at how A-Smart Holdings has developed its business over time by checking this visualization of its revenue and earnings history.

Can A-Smart Holdings Raise More Cash Easily?

Even though it seems like A-Smart Holdings is developing its business nicely, we still like to consider how easily it could raise more money to accelerate growth. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

A-Smart Holdings has a market capitalisation of S$42m and burnt through S$784k last year, which is 1.9% of the company's market value. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

How Risky Is A-Smart Holdings' Cash Burn Situation?

It may already be apparent to you that we're relatively comfortable with the way A-Smart Holdings is burning through its cash. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. While its increasing cash burn wasn't great, the other factors mentioned in this article more than make up for weakness on that measure. Considering all the factors discussed in this article, we're not overly concerned about the company's cash burn, although we do think shareholders should keep an eye on how it develops. On another note, we conducted an in-depth investigation of the company, and identified 5 warning signs for A-Smart Holdings (2 can't be ignored!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:BQC

A-Smart Holdings

An investment holding company, provides various print management services in Singapore and internationally.

Mediocre balance sheet low.

Market Insights

Community Narratives