- Singapore

- /

- Commercial Services

- /

- SGX:BEZ

Investors Still Aren't Entirely Convinced By Beng Kuang Marine Limited's (SGX:BEZ) Revenues Despite 29% Price Jump

Despite an already strong run, Beng Kuang Marine Limited (SGX:BEZ) shares have been powering on, with a gain of 29% in the last thirty days. The last month tops off a massive increase of 195% in the last year.

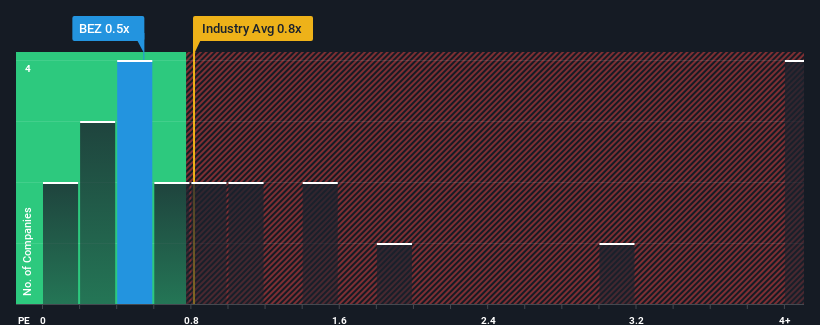

Although its price has surged higher, it's still not a stretch to say that Beng Kuang Marine's price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" compared to the Commercial Services industry in Singapore, where the median P/S ratio is around 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Beng Kuang Marine

What Does Beng Kuang Marine's P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, Beng Kuang Marine has been doing very well. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Beng Kuang Marine's earnings, revenue and cash flow.How Is Beng Kuang Marine's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Beng Kuang Marine's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 34% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 86% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is only predicted to deliver 15% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we find it interesting that Beng Kuang Marine is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On Beng Kuang Marine's P/S

Its shares have lifted substantially and now Beng Kuang Marine's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To our surprise, Beng Kuang Marine revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Beng Kuang Marine, and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Beng Kuang Marine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:BEZ

Beng Kuang Marine

An investment holding company, provides infrastructure engineering and corrosion prevention services in Singapore, Asia, Europe, the Middle East, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives