- Singapore

- /

- Commercial Services

- /

- SGX:BEZ

Beng Kuang Marine Limited's (SGX:BEZ) Stock Retreats 33% But Revenues Haven't Escaped The Attention Of Investors

Beng Kuang Marine Limited (SGX:BEZ) shares have retraced a considerable 33% in the last month, reversing a fair amount of their solid recent performance. The good news is that in the last year, the stock has shone bright like a diamond, gaining 169%.

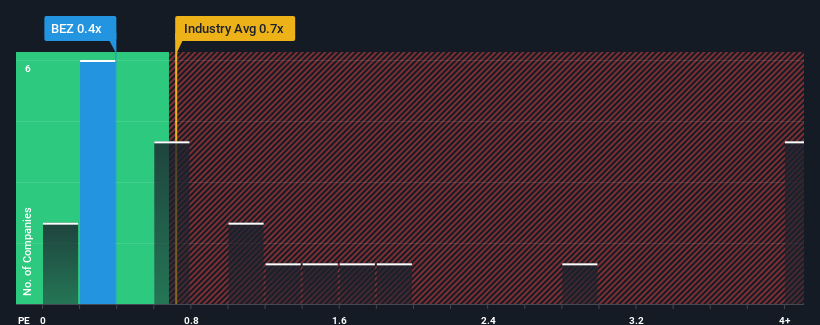

Although its price has dipped substantially, it's still not a stretch to say that Beng Kuang Marine's price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" compared to the Commercial Services industry in Singapore, where the median P/S ratio is around 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Beng Kuang Marine

How Beng Kuang Marine Has Been Performing

Recent times have been advantageous for Beng Kuang Marine as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Beng Kuang Marine's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

Beng Kuang Marine's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 73% last year. The latest three year period has also seen an excellent 119% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 14% during the coming year according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 14%, which is not materially different.

In light of this, it's understandable that Beng Kuang Marine's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Following Beng Kuang Marine's share price tumble, its P/S is just clinging on to the industry median P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A Beng Kuang Marine's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Commercial Services industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

Before you settle on your opinion, we've discovered 3 warning signs for Beng Kuang Marine (1 is potentially serious!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Beng Kuang Marine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:BEZ

Beng Kuang Marine

An investment holding company, provides infrastructure engineering and corrosion prevention services in Singapore, Asia, Europe, the Middle East, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives