- Singapore

- /

- Commercial Services

- /

- SGX:BEZ

Beng Kuang Marine Limited's (SGX:BEZ) Shares Leap 38% Yet They're Still Not Telling The Full Story

Beng Kuang Marine Limited (SGX:BEZ) shares have continued their recent momentum with a 38% gain in the last month alone. The last month tops off a massive increase of 186% in the last year.

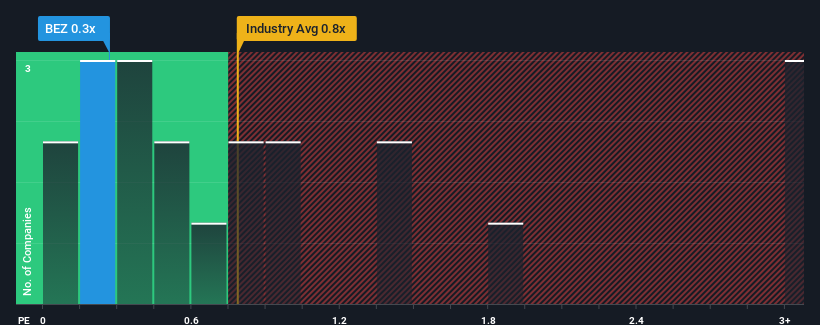

In spite of the firm bounce in price, Beng Kuang Marine's price-to-sales (or "P/S") ratio of 0.3x might still make it look like a buy right now compared to the Commercial Services industry in Singapore, where around half of the companies have P/S ratios above 0.8x and even P/S above 3x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Beng Kuang Marine

How Has Beng Kuang Marine Performed Recently?

Beng Kuang Marine certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Although there are no analyst estimates available for Beng Kuang Marine, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Beng Kuang Marine's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 34%. The strong recent performance means it was also able to grow revenue by 86% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is only predicted to deliver 15% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we find it odd that Beng Kuang Marine is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What Does Beng Kuang Marine's P/S Mean For Investors?

Beng Kuang Marine's stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Beng Kuang Marine revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

It is also worth noting that we have found 3 warning signs for Beng Kuang Marine that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Beng Kuang Marine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:BEZ

Beng Kuang Marine

An investment holding company, provides infrastructure engineering and corrosion prevention services in Singapore, Asia, Europe, the Middle East, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives