- Singapore

- /

- Commercial Services

- /

- SGX:5NV

Do Insiders Own Lots Of Shares In Chasen Holdings Limited (SGX:5NV)?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

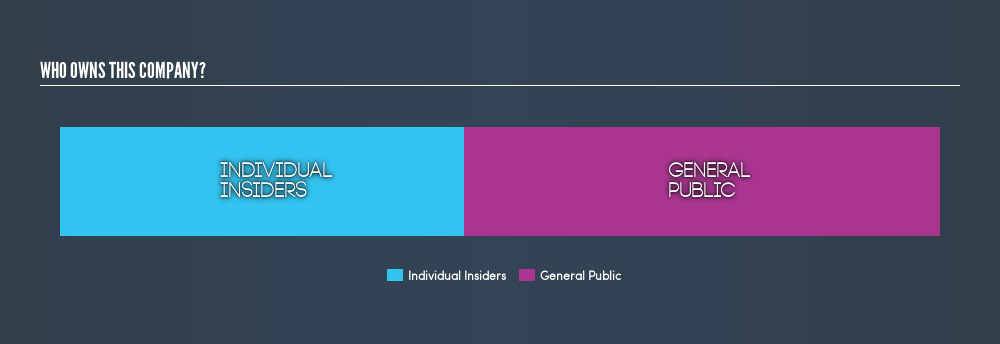

If you want to know who really controls Chasen Holdings Limited (SGX:5NV), then you'll have to look at the makeup of its share registry. Generally speaking, as a company grows, institutions will increase their ownership. Conversely, insiders often decrease their ownership over time. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.'

Chasen Holdings is a smaller company with a market capitalization of S$29m, so it may still be flying under the radar of many institutional investors. In the chart below below, we can see that institutional investors have not yet purchased shares. Let's take a closer look to see what the different types of shareholder can tell us about 5NV.

See our latest analysis for Chasen Holdings

What Does The Lack Of Institutional Ownership Tell Us About Chasen Holdings?

Institutional investors often avoid companies that are too small, too illiquid or too risky for their tastes. But it's unusual to see larger companies without any institutional investors.

There are multiple explanations for why institutions don't own a stock. The most common is that the company is too small relative to fund under management, so the institition does not bother to look closely at the company. Alternatively, there might be something about the company that has kept institutional investors away. Chasen Holdings might not have the sort of past performance institutions are looking for, or perhaps they simply have not studied the business closely.

Chasen Holdings is not owned by hedge funds. As far I can tell there isn't analyst coverage of the company, so it is probably flying under the radar.

Insider Ownership Of Chasen Holdings

The definition of company insiders can be subjective, and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our most recent data indicates that insiders own a reasonable proportion of Chasen Holdings Limited. It has a market capitalization of just S$29m, and insiders have S$13m worth of shares in their own names. This may suggest that the founders still own a lot of shares. You can click here to see if they have been buying or selling.

General Public Ownership

The general public, who are mostly retail investors, collectively hold 54% of Chasen Holdings shares. With this size of ownership, retail investors can collectively play a role in decisions that affect shareholder returns, such as dividend policies and the appointment of directors. They can also exercise the power to decline an acquisition or merger that may not improve profitability.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Chasen Holdings better, we need to consider many other factors.

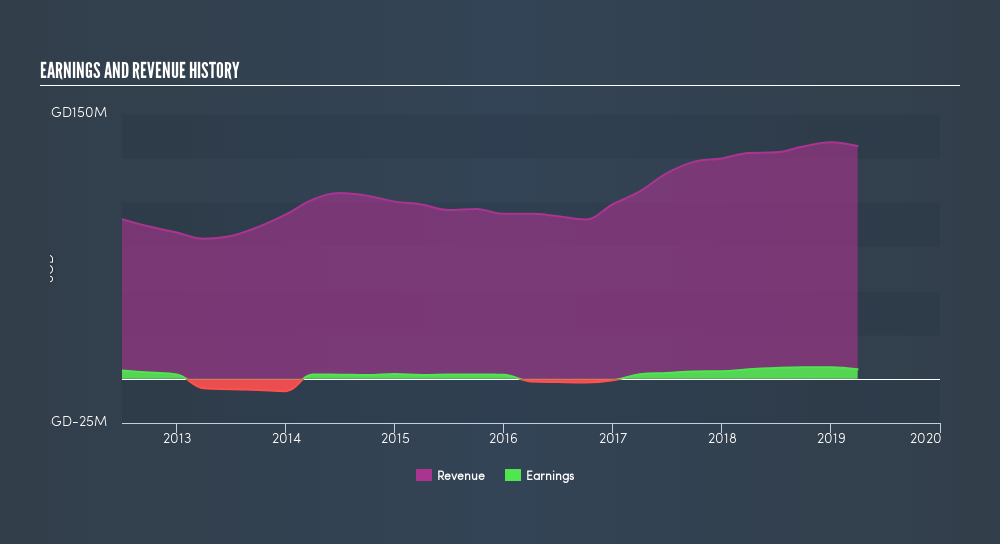

I like to dive deeper into how a company has performed in the past. You can find historic revenue and earnings in this detailed graph.

Of course this may not be the best stock to buy. So take a peek at this free free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SGX:5NV

Chasen Holdings

An investment holding company, provides logistics, and technical and engineering services in Singapore, Malaysia, Thailand, Vietnam, the People’s Republic of China, India, and the United States.

Mediocre balance sheet low.

Similar Companies

Market Insights

Community Narratives