- Singapore

- /

- Construction

- /

- SGX:MR7

Top 3 Dividend Stocks For January 2025

Reviewed by Simply Wall St

As global markets react to easing core inflation and robust bank earnings, major U.S. stock indexes have rebounded, with value stocks outpacing growth shares, particularly in the energy sector. This positive momentum is echoed across Europe and China, where slowing inflation and economic recovery are fostering optimism for potential rate cuts later in the year. In this dynamic environment, dividend stocks can offer a compelling option for investors seeking steady income streams amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.34% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.50% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.18% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.59% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.02% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.05% | ★★★★★★ |

Click here to see the full list of 1983 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

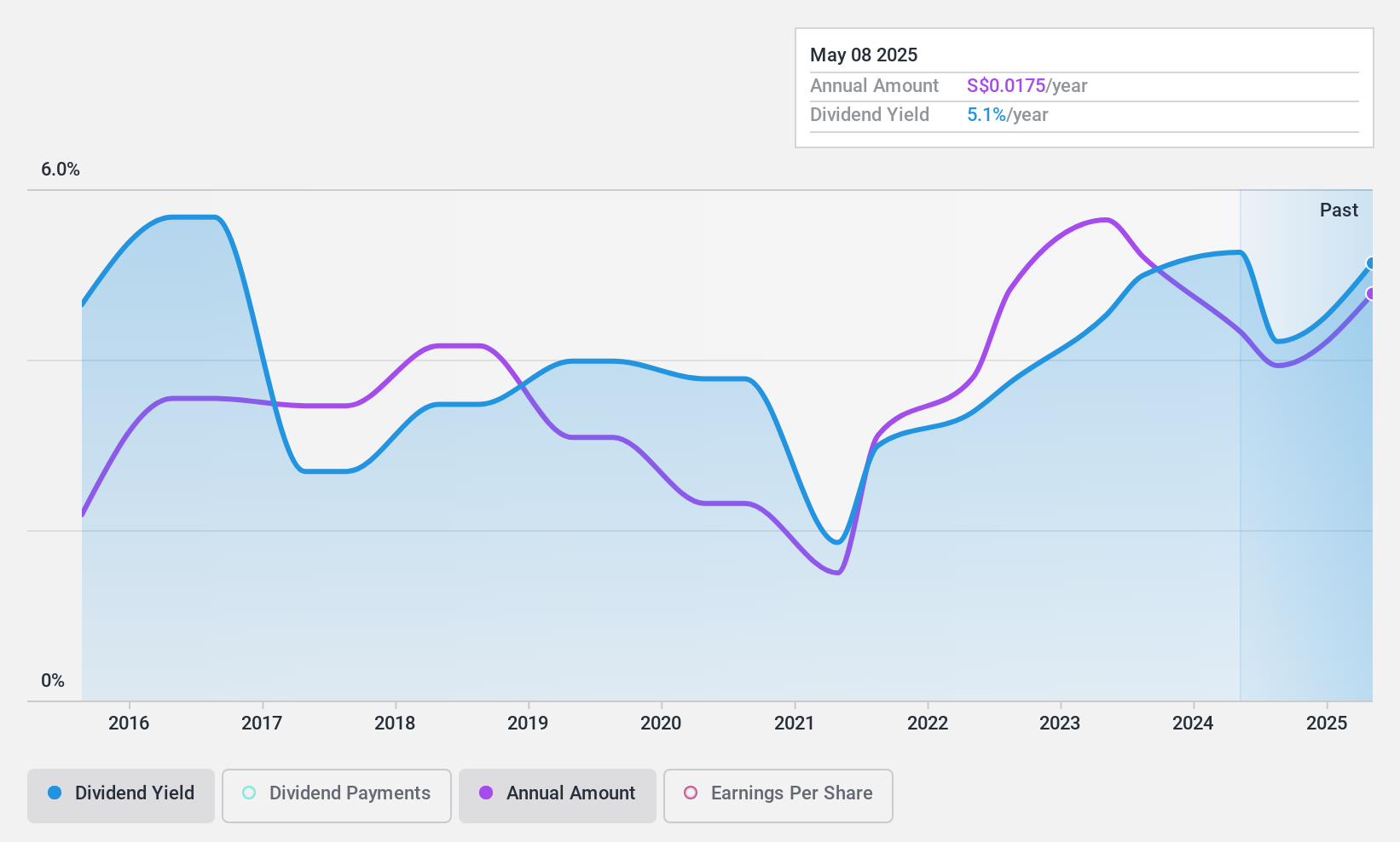

Nordic Group (SGX:MR7)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nordic Group Limited is an investment holding company that provides solutions in system integration, maintenance, repair, overhaul, trading, precision engineering, scaffolding, insulation, petrochemical and environmental engineering as well as cleanroom and air and water engineering globally; it has a market cap of SGD139.66 million.

Operations: Nordic Group Limited generates revenue primarily from its Project Services segment, which accounts for SGD69.93 million, and its Maintenance Services segment, contributing SGD83.13 million.

Dividend Yield: 4.1%

Nordic Group's dividends are well-covered by earnings and cash flows, with a payout ratio of 40% and a cash payout ratio of 29.6%. However, the dividend payments have been volatile over the past decade, showing an annual drop exceeding 20%. Trading at 42.5% below its estimated fair value, the stock offers a dividend yield of 4.12%, which is lower than the top quartile in Singapore's market.

- Navigate through the intricacies of Nordic Group with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Nordic Group shares in the market.

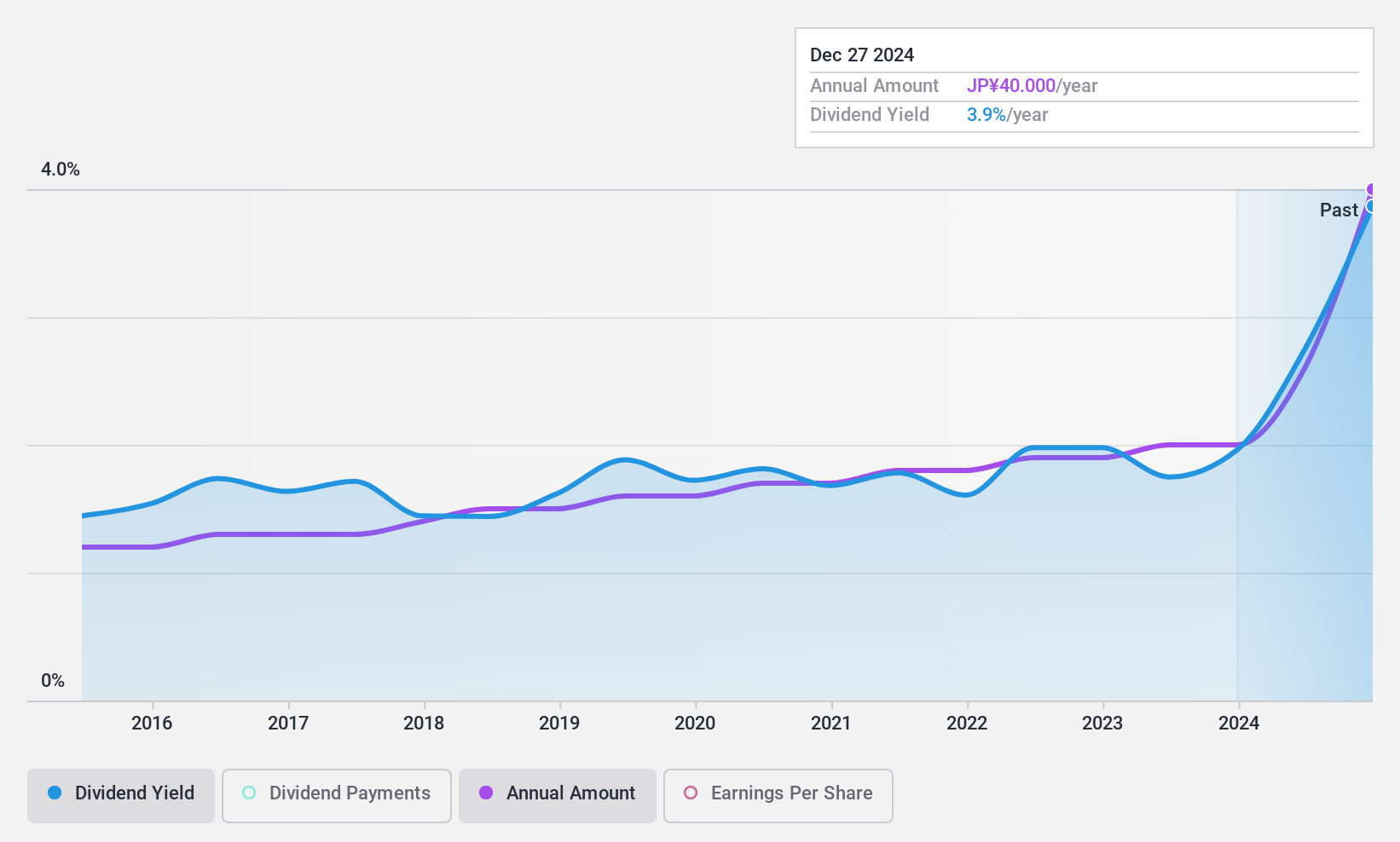

Shizuoka Gas (TSE:9543)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Shizuoka Gas Co., Ltd. is a Japanese company that produces, supplies, and sells city gas, with a market cap of ¥77.67 billion.

Operations: Shizuoka Gas Co., Ltd. generates revenue primarily through the production, supply, and sale of city gas in Japan.

Dividend Yield: 3.9%

Shizuoka Gas offers a stable dividend profile with payments that have grown consistently over the past decade and are well-covered by earnings, given its low payout ratio of 28.9%. Despite a recent decline in profit margins, the dividend yield of 3.88% remains attractive in Japan's market. The stock is trading at 37.3% below estimated fair value, indicating potential undervaluation. Recent guidance suggests solid financial performance with expected net sales of ¥203 billion for 2024.

- Click here to discover the nuances of Shizuoka Gas with our detailed analytical dividend report.

- Our valuation report unveils the possibility Shizuoka Gas' shares may be trading at a discount.

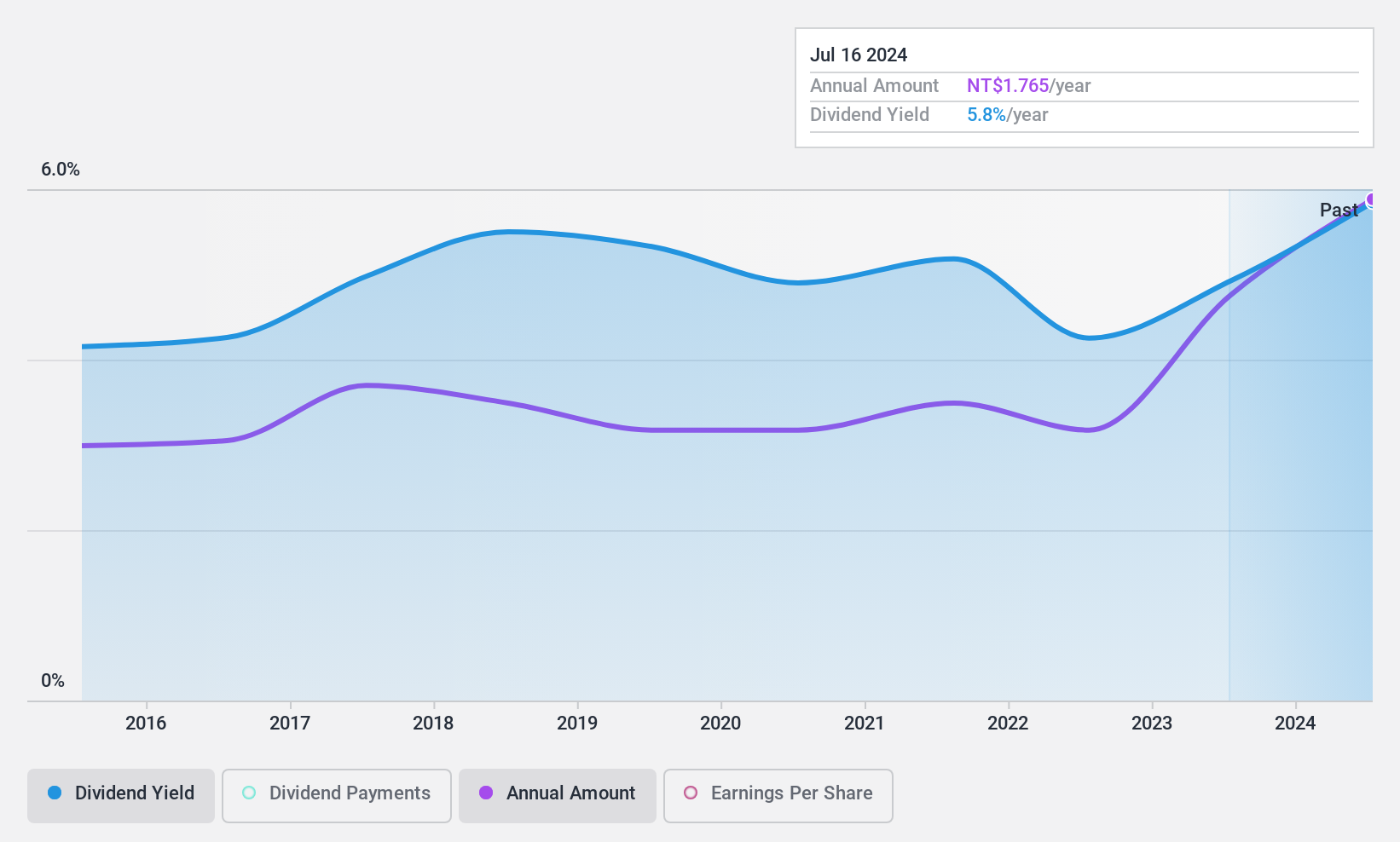

Universal Cement (TWSE:1104)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Universal Cement Corporation, with a market cap of NT$19.54 billion, operates in Taiwan through the manufacturing and sale of cement, ready-mixed concrete, gypsum board panels, and other building materials.

Operations: Universal Cement Corporation generates revenue primarily from its Construction Materials segment, including concrete, amounting to NT$8.04 billion.

Dividend Yield: 6.2%

Universal Cement maintains a strong dividend profile with consistent growth and stability over the past decade. Despite a decline in net profit margin from 29.6% to 19.5%, dividends remain well-covered by earnings (77.4% payout ratio) and cash flows (78.2% cash payout ratio). The dividend yield of 6.2% ranks in the top quarter of Taiwan's market, though recent earnings show decreased profitability, with net income dropping to TWD 474.48 million for Q3 2024 from TWD 956.31 million a year prior.

- Click to explore a detailed breakdown of our findings in Universal Cement's dividend report.

- Our expertly prepared valuation report Universal Cement implies its share price may be lower than expected.

Summing It All Up

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1980 more companies for you to explore.Click here to unveil our expertly curated list of 1983 Top Dividend Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordic Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:MR7

Nordic Group

An investment holding company, provides solutions in the areas of system integration, maintenance, repair, overhaul, trading, precision engineering, scaffolding, insulation, petrochemical and environmental engineering, cleanroom, air and water engineering, and engineering and construction services worldwide.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives