As the Singapore market navigates a dynamic economic landscape, investors are increasingly looking towards dividend stocks as a source of stable returns amidst fluctuating indices. In this environment, identifying stocks with strong fundamentals and attractive yields can offer a reliable income stream, making them an appealing choice for those seeking to bolster their portfolios.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 6.87% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.11% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.50% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.30% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.11% | ★★★★★☆ |

| QAF (SGX:Q01) | 5.99% | ★★★★★☆ |

| Aztech Global (SGX:8AZ) | 9.71% | ★★★★☆☆ |

| Oversea-Chinese Banking (SGX:O39) | 5.73% | ★★★★☆☆ |

| Delfi (SGX:P34) | 6.56% | ★★★★☆☆ |

| Nordic Group (SGX:MR7) | 4.30% | ★★★★☆☆ |

Click here to see the full list of 19 stocks from our Top SGX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Aztech Global (SGX:8AZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aztech Global Ltd. operates in the research, development, engineering, and manufacturing of IoT devices, data-communication products, and LED lighting products across Singapore, North America, China, Europe, and other international markets with a market cap of SGD794.95 million.

Operations: Aztech Global Ltd. generates its revenue from the research, development, engineering, and manufacturing of IoT devices, data-communication products, and LED lighting products across various international markets.

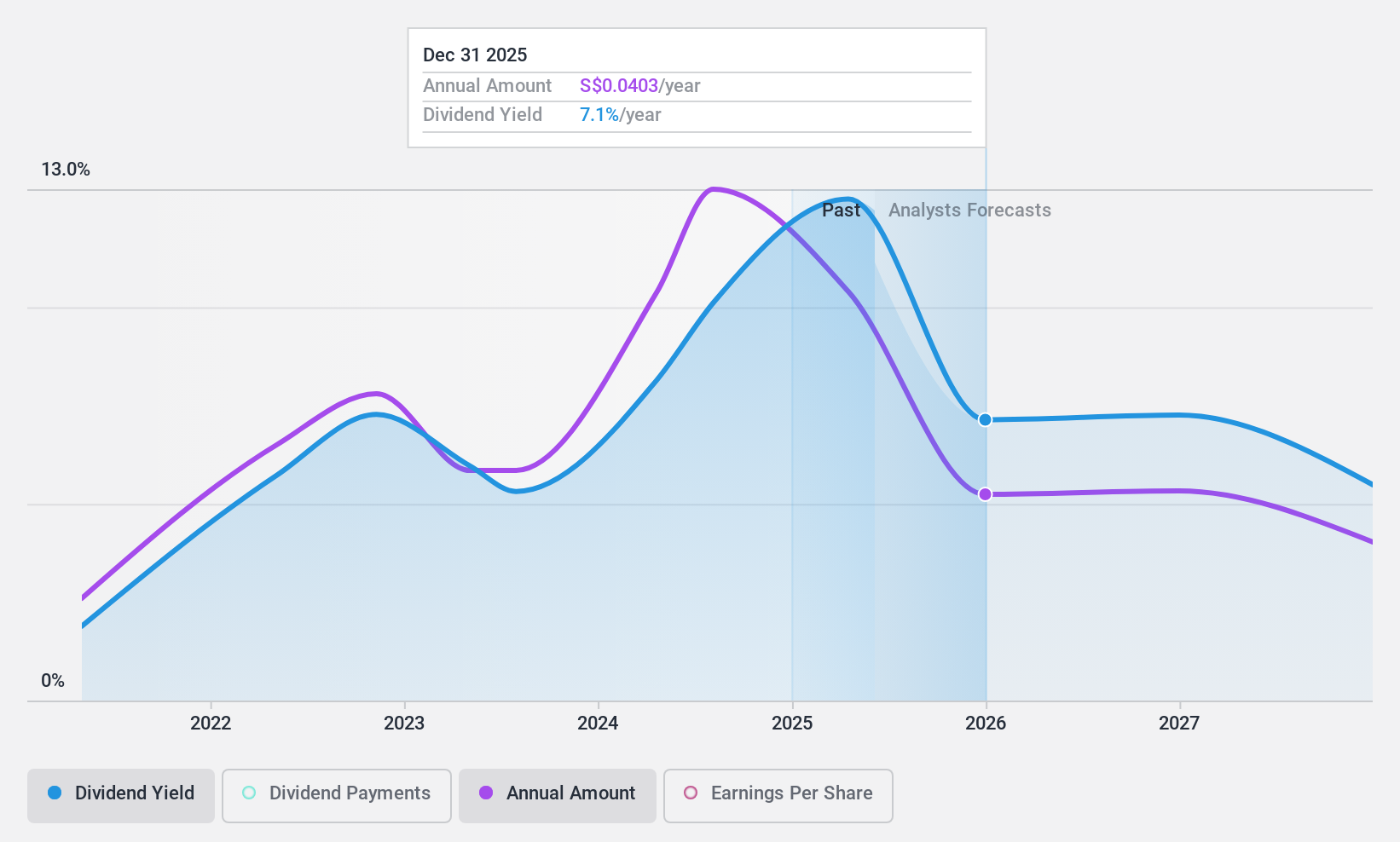

Dividend Yield: 9.7%

Aztech Global recently announced a share buyback program and increased its interim dividend to S$0.05, reflecting strong earnings growth with net income rising to S$46.66 million for H1 2024. Despite only three years of dividend payments, Aztech's current yield is among the top in Singapore's market, supported by a reasonable payout ratio of 74.4%. However, its dividend history is volatile and not yet stable over the long term.

- Delve into the full analysis dividend report here for a deeper understanding of Aztech Global.

- Upon reviewing our latest valuation report, Aztech Global's share price might be too pessimistic.

Nordic Group (SGX:MR7)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nordic Group Limited, with a market cap of SGD133.70 million, operates as an investment holding company providing solutions in system integration, maintenance, repair, overhaul, trading, precision engineering, scaffolding, insulation, petrochemical and environmental engineering as well as cleanroom and air and water engineering globally.

Operations: Nordic Group Limited generates revenue from Project Services amounting to SGD69.93 million and Maintenance Services totaling SGD83.13 million.

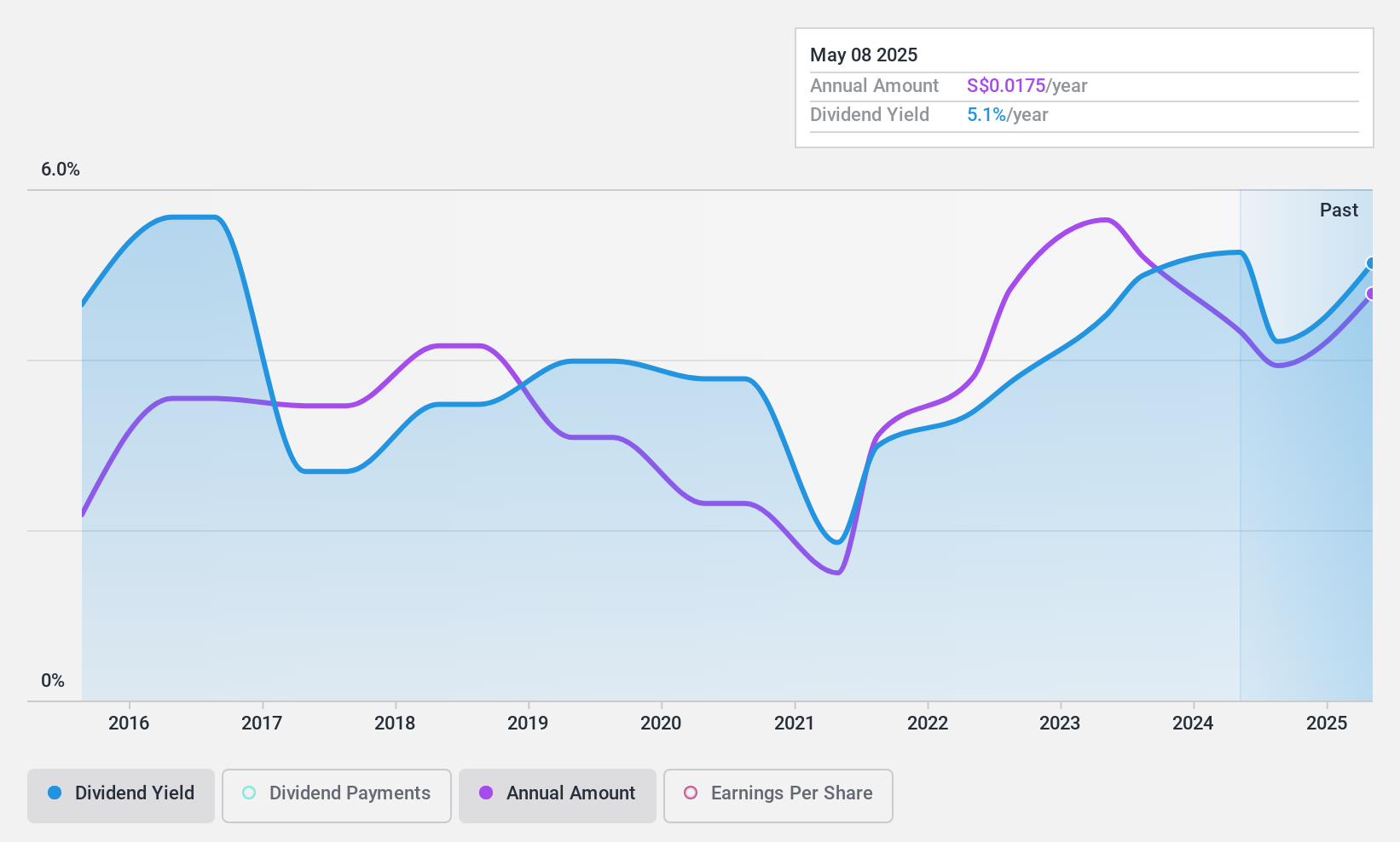

Dividend Yield: 4.3%

Nordic Group's recent interim dividend of S$0.008526 reflects a decrease, highlighting its historically volatile dividend payments. Despite this, dividends remain well-covered by earnings and cash flows with payout ratios of 40% and 29.6%, respectively. The company's net income for H1 2024 was S$8.53 million, down from the previous year, impacting its ability to sustain higher dividends. Trading below fair value estimates suggests potential value but with a lower-than-market-average yield of 4.3%.

- Unlock comprehensive insights into our analysis of Nordic Group stock in this dividend report.

- The valuation report we've compiled suggests that Nordic Group's current price could be quite moderate.

Bumitama Agri (SGX:P8Z)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bumitama Agri Ltd. is an investment holding company involved in the production and trade of crude palm oil, palm kernel, and related products for refineries in Indonesia, with a market cap of SGD1.36 billion.

Operations: Bumitama Agri Ltd. generates its revenue primarily from its Plantations and Palm Oil Mills segment, which accounted for IDR15.55 trillion.

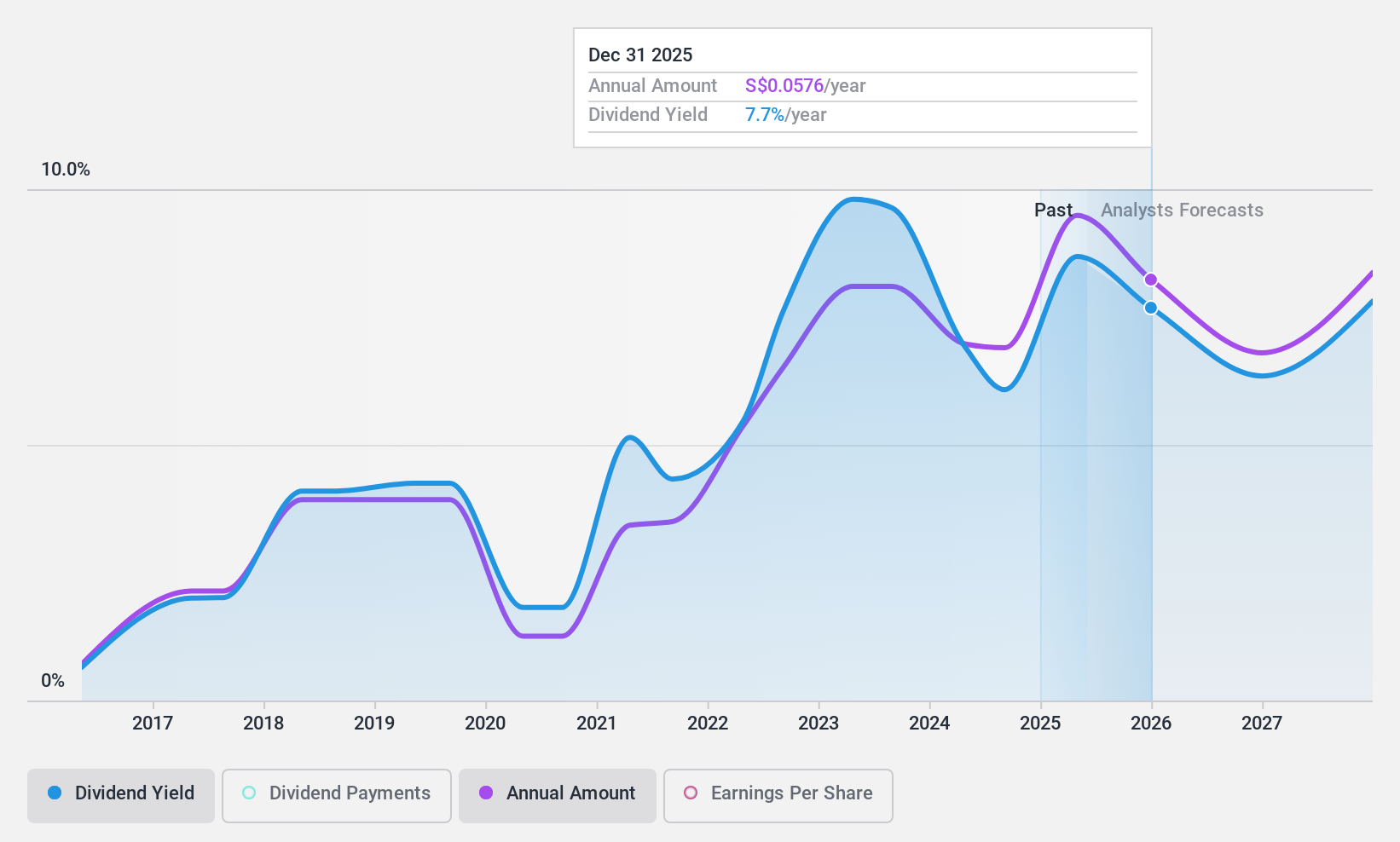

Dividend Yield: 6.1%

Bumitama Agri's dividend yield is among the top 25% in Singapore, though its track record shows volatility with recent decreases. Dividends are covered by earnings and cash flows, with payout ratios of 47.2% and 54.8%. Despite trading significantly below fair value, recent earnings have declined year-on-year from IDR 1.19 trillion to IDR 856.79 billion for H1 2024, impacting dividend sustainability amidst executive changes in the company secretariat.

- Click to explore a detailed breakdown of our findings in Bumitama Agri's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Bumitama Agri shares in the market.

Taking Advantage

- Take a closer look at our Top SGX Dividend Stocks list of 19 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:8AZ

Aztech Global

Engages in the research, development, design, engineering, manufacture, and sale of IoT devices, data-communication products, and LED lighting products in Singapore, North America, China, Europe, Oceania, rest of ASEAN countries, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives