- Singapore

- /

- Industrials

- /

- SGX:J36

The Bull Case For Jardine Matheson Holdings (SGX:J36) Could Change Following Return to Profit and Strong Shareholder Returns

Reviewed by Sasha Jovanovic

- Jardine Matheson Holdings recently reported a shift from loss to profit and delivered strong total shareholder returns, including dividends, over the past year.

- This turnaround reflects an improvement in underlying business performance, suggesting recent initiatives to enhance profitability and reward shareholders have gained traction.

- We'll examine how Jardine Matheson's move back to profitability may affect assumptions around its future earnings growth and valuation.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Jardine Matheson Holdings Investment Narrative Recap

To invest in Jardine Matheson Holdings, you need to believe in the conglomerate’s ability to unlock value through improved profitability in its core Asian businesses, ongoing capital recycling, and disciplined portfolio management. The company's recent shift from loss to profit and strong shareholder returns are encouraging but don’t fundamentally change the immediate catalyst: whether the group’s underlying businesses can sustain profitable growth amidst ongoing challenges in Greater China’s property market and structural headwinds in Astra’s automotive and coal operations. The biggest near-term risk remains persistent weakness in the Greater China property sector, which could restrain margin improvements even if short-term results show progress.

Of this year’s developments, Jardine Matheson's solid net income turnaround and 25% annual earnings growth, as highlighted in its July 2025 earnings release, are most relevant. These numbers support positive sentiment, but also reflect the impact of earlier large one-off losses and highlight that future results will depend on the durability of this improved business performance, rather than a repeat of last year's rebound.

However, investors should pay close attention to persistent risks in Greater China’s property market, as...

Read the full narrative on Jardine Matheson Holdings (it's free!)

Jardine Matheson Holdings is projected to achieve $37.4 billion in revenue and $2.7 billion in earnings by 2028. This outlook is based on an assumed annual revenue growth rate of 1.7% and indicates a $2.6 billion increase in earnings from the current level of $100 million.

Uncover how Jardine Matheson Holdings' forecasts yield a $65.67 fair value, in line with its current price.

Exploring Other Perspectives

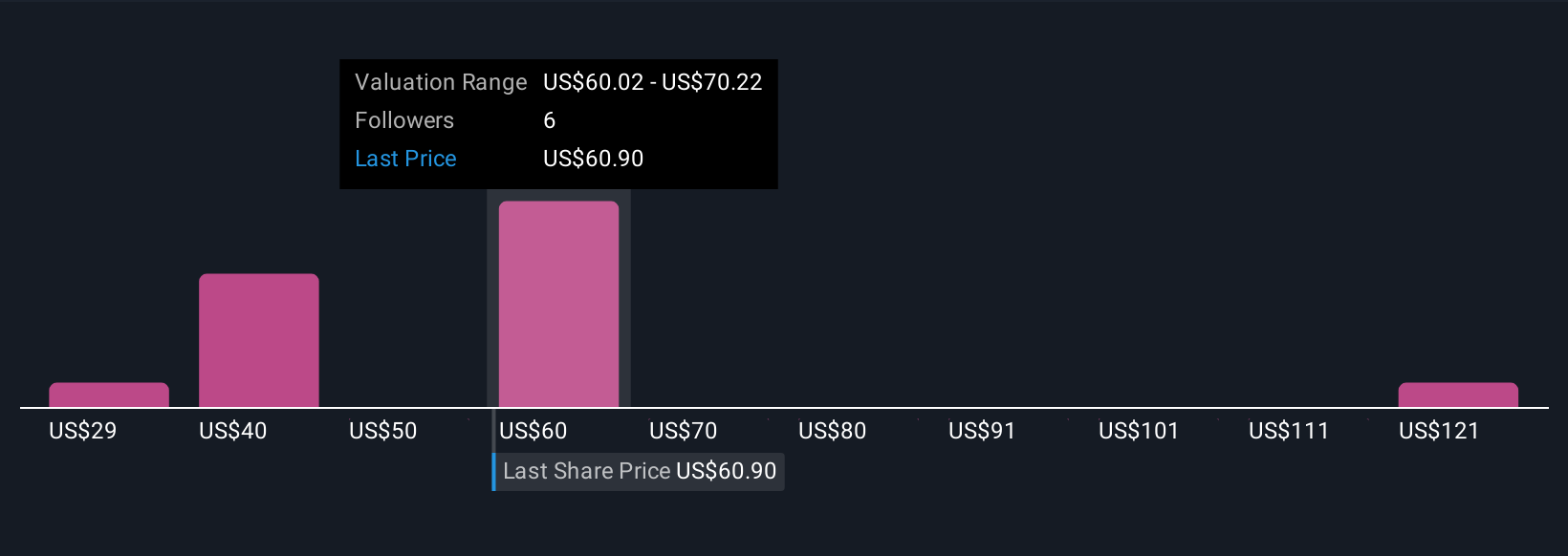

Simply Wall St Community members estimate Jardine Matheson’s fair value from as low as US$29.44 up to US$131.38, based on five different models. This wide range highlights how investor views diverge in the context of risks tied to property market uncertainty in the group’s largest asset segment, worth considering as you weigh your outlook.

Explore 5 other fair value estimates on Jardine Matheson Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Jardine Matheson Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jardine Matheson Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Jardine Matheson Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jardine Matheson Holdings' overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:J36

Jardine Matheson Holdings

Operates in motor vehicles and related operations, property investment and development, food retailing, health and beauty, home furnishings, engineering and construction, and transport businesses in China, Southeast Asia, and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives