- Singapore

- /

- Industrials

- /

- SGX:J36

Getting In Cheap On Jardine Matheson Holdings Limited (SGX:J36) Might Be Difficult

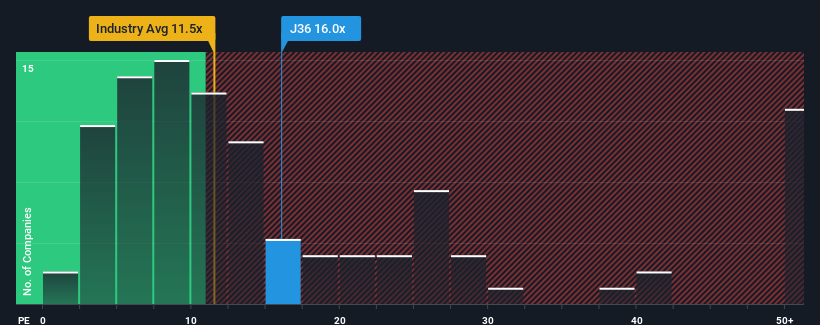

With a price-to-earnings (or "P/E") ratio of 16x Jardine Matheson Holdings Limited (SGX:J36) may be sending bearish signals at the moment, given that almost half of all companies in Singapore have P/E ratios under 11x and even P/E's lower than 7x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Jardine Matheson Holdings certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Jardine Matheson Holdings

Is There Enough Growth For Jardine Matheson Holdings?

The only time you'd be truly comfortable seeing a P/E as high as Jardine Matheson Holdings' is when the company's growth is on track to outshine the market.

If we review the last year of earnings growth, the company posted a terrific increase of 93%. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 39% each year as estimated by the four analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 8.5% per annum, which is noticeably less attractive.

In light of this, it's understandable that Jardine Matheson Holdings' P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Jardine Matheson Holdings' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Jardine Matheson Holdings you should know about.

If these risks are making you reconsider your opinion on Jardine Matheson Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:J36

Jardine Matheson Holdings

Through its subsidiaries, operates in motor vehicles and related operations, property investment and development, food retailing, health and beauty, home furnishings, engineering and construction, and transport businesses in China, Southeast Asia, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives