- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:2517

Undiscovered Gems To Explore In January 2025

Reviewed by Simply Wall St

As global markets continue to respond to recent political developments and economic indicators, small-cap stocks have been navigating a landscape marked by optimism around AI investments and potential trade policy shifts. While large-cap indices have generally outperformed, the S&P 600 for small-cap stocks presents unique opportunities for investors seeking growth in this dynamic environment. In this context, identifying promising stocks involves looking for companies with strong fundamentals that can capitalize on emerging trends and adapt to changing market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Namuga | 14.66% | -1.45% | 33.57% | ★★★★★★ |

| ONEJOON | 9.85% | 24.95% | 4.85% | ★★★★★☆ |

| Giant Heavy Machinery Service | 17.81% | 21.88% | 48.77% | ★★★★★☆ |

| Primadaya Plastisindo | 10.46% | 15.41% | 23.92% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

| Shandong Longquan Pipe IndustryLtd | 34.82% | 2.24% | -22.15% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Guoquan Food (Shanghai) (SEHK:2517)

Simply Wall St Value Rating: ★★★★★☆

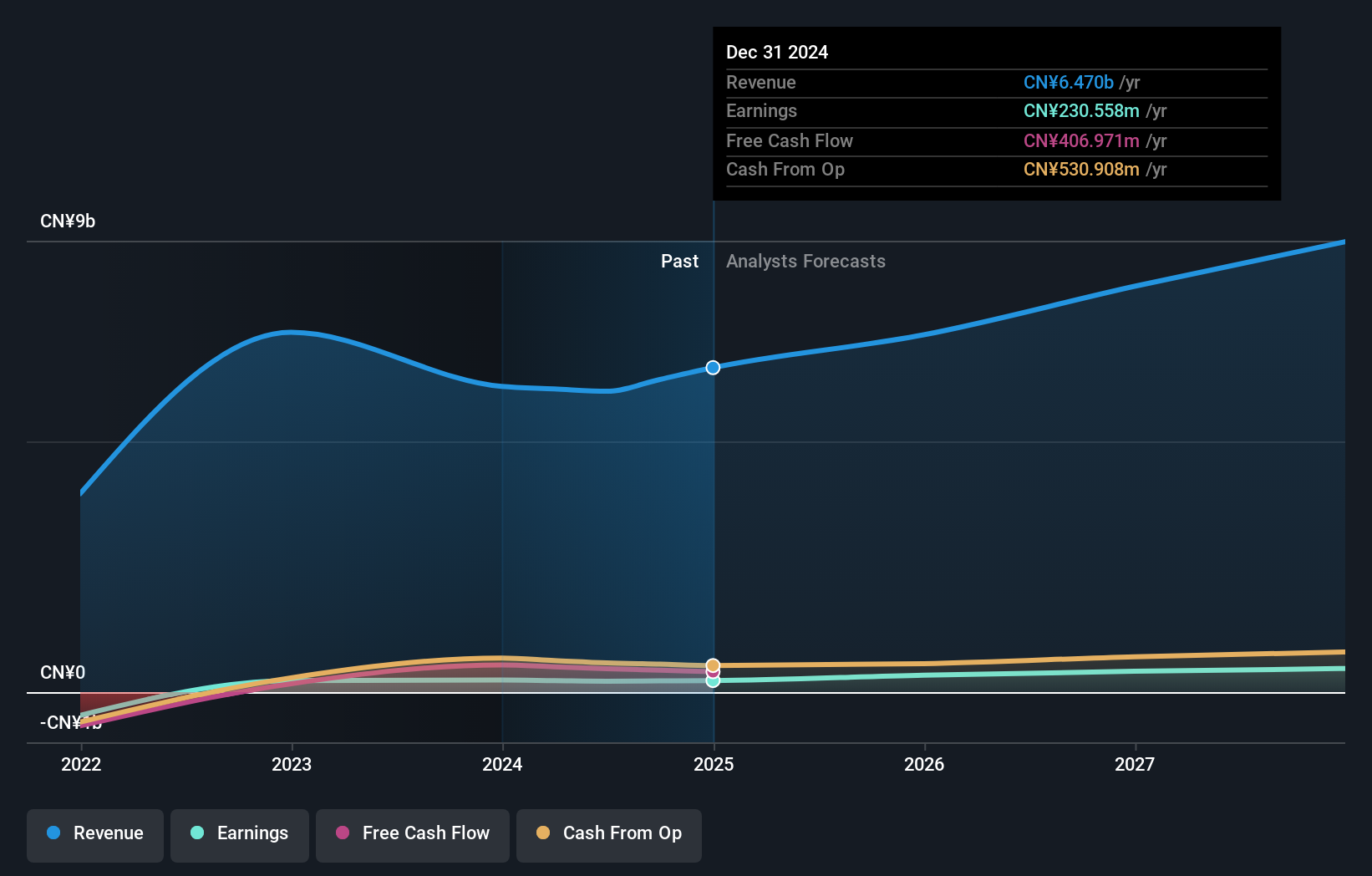

Overview: Guoquan Food (Shanghai) Co., Ltd. is a Chinese company specializing in home meal products, with a market capitalization of HK$5.13 billion.

Operations: Guoquan Food generates its revenue primarily from retail sales through grocery stores, amounting to CN¥5.998 billion.

Guoquan Food, a small player in the market, is trading at 75% below its estimated fair value, suggesting potential undervaluation. Despite experiencing negative earnings growth of 7.2% last year, it maintains high-quality past earnings and has more cash than total debt, indicating sound financial health. The company recently initiated a share repurchase program authorized to buy back up to 179 million shares or about 6.54% of its issued share capital, which could enhance net asset value per share and earnings per share. However, its highly volatile stock price over recent months might concern some investors.

- Delve into the full analysis health report here for a deeper understanding of Guoquan Food (Shanghai).

Evaluate Guoquan Food (Shanghai)'s historical performance by accessing our past performance report.

Thai President Foods (SET:TFMAMA)

Simply Wall St Value Rating: ★★★★★★

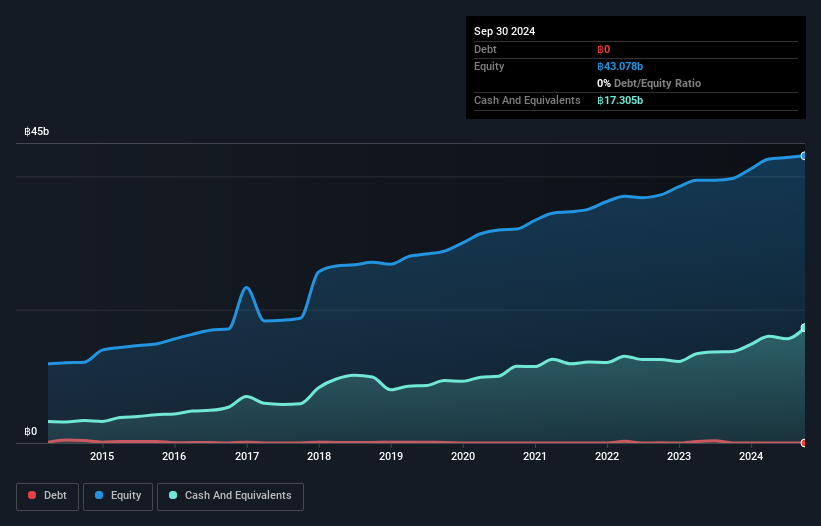

Overview: Thai President Foods Public Company Limited, along with its subsidiaries, is involved in the production and global distribution of instant noodles, semi-instant foods, and biscuits, with a market capitalization of THB65.28 billion.

Operations: Thai President Foods generates revenue primarily from instant noodles and semi-instant foods, contributing THB18.78 billion, followed by bakery products at THB7.57 billion. The company also earns from packaging and biscuits with revenues of THB3.61 billion and THB1.02 billion, respectively.

Thai President Foods, a notable player in the food sector, showcases a promising profile with no debt and high-quality earnings. Despite a 1.6% annual earnings reduction over five years, recent figures indicate improvement. For Q3 2024, sales reached THB 7.62 billion compared to THB 6.9 billion previously, while net income rose to THB 1.05 billion from THB 980 million last year. The company trades at an attractive valuation—71% below its estimated fair value—suggesting potential upside for investors seeking undervalued opportunities in the industry despite not outpacing the broader food sector's growth rate of 29%.

- Get an in-depth perspective on Thai President Foods' performance by reading our health report here.

Explore historical data to track Thai President Foods' performance over time in our Past section.

Hong Leong Asia (SGX:H22)

Simply Wall St Value Rating: ★★★★★☆

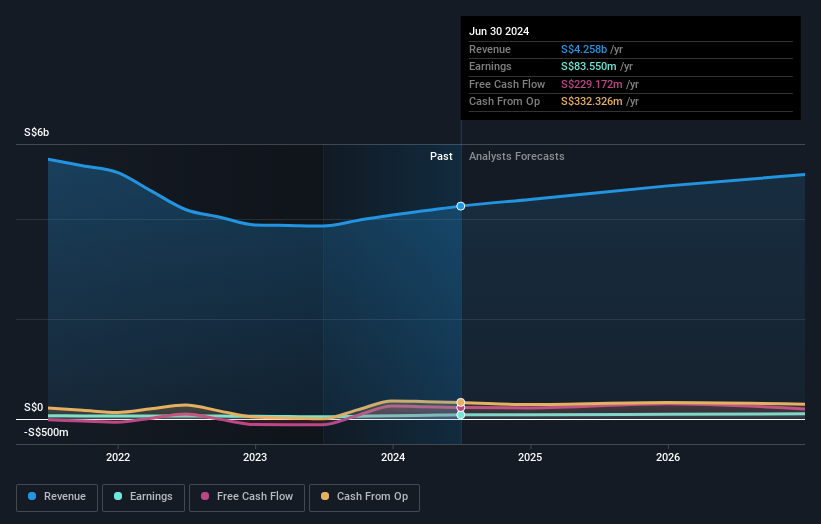

Overview: Hong Leong Asia Ltd. is an investment holding company that operates in the manufacturing and distribution of powertrain solutions, building materials, and rigid packaging products across China, Singapore, Malaysia, and other international markets with a market capitalization of SGD721.80 million.

Operations: Hong Leong Asia derives its revenue primarily from powertrain solutions, contributing SGD3.57 billion, and building materials, adding SGD665.81 million. The company's financial performance is significantly influenced by these segments, with powertrain solutions being the dominant revenue stream.

Hong Leong Asia, a smaller player in the machinery sector, has demonstrated impressive earnings growth of 94% over the past year, significantly outpacing its industry peers. The company's debt is well-managed with interest payments covered 3.4 times by EBIT and more cash than total debt, indicating financial stability. Trading at nearly half its estimated fair value suggests potential undervaluation in the market. Recent board changes include Ng Chee Khern's appointment as an Independent Non-Executive Director, which might enhance governance and sustainability efforts. These factors combined position Hong Leong Asia as an intriguing opportunity for investors seeking undervalued stocks with solid fundamentals.

- Navigate through the intricacies of Hong Leong Asia with our comprehensive health report here.

Understand Hong Leong Asia's track record by examining our Past report.

Next Steps

- Click here to access our complete index of 4671 Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2517

Guoquan Food (Shanghai)

Operates as a home meal products company in Mainland China.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives