- Singapore

- /

- Construction

- /

- SGX:F9D

Here's Why We Think Boustead Singapore (SGX:F9D) Is Well Worth Watching

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Boustead Singapore (SGX:F9D). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Boustead Singapore

Boustead Singapore's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Boustead Singapore managed to grow EPS by 14% per year, over three years. That's a pretty good rate, if the company can sustain it.

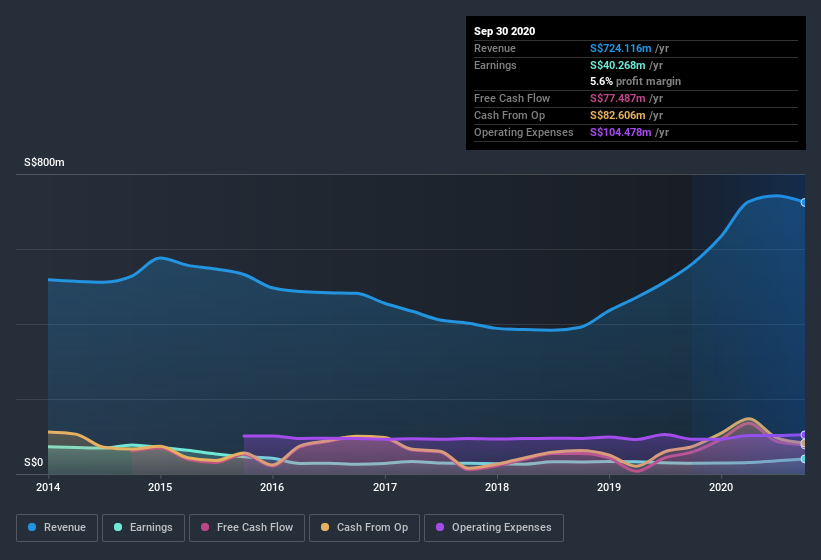

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Boustead Singapore maintained stable EBIT margins over the last year, all while growing revenue 29% to S$724m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Boustead Singapore is no giant, with a market capitalization of S$391m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Boustead Singapore Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The first bit of good news is that no Boustead Singapore insiders reported share sales in the last twelve months. Even better, though, is that the Chairman & Group CEO, Fong Fui Wong, bought a whopping S$454k worth of shares, paying about S$0.60 per share, on average. Big buys like that give me a sense of opportunity; actions speak louder than words.

On top of the insider buying, we can also see that Boustead Singapore insiders own a large chunk of the company. In fact, they own 46% of the shares, making insiders a very influential shareholder group. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. In terms of absolute value, insiders have S$180m invested in the business, using the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Is Boustead Singapore Worth Keeping An Eye On?

One positive for Boustead Singapore is that it is growing EPS. That's nice to see. On top of that, we've seen insiders buying shares even though they already own plenty. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. You should always think about risks though. Case in point, we've spotted 2 warning signs for Boustead Singapore you should be aware of, and 1 of them is a bit unpleasant.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Boustead Singapore, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Boustead Singapore, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Boustead Singapore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SGX:F9D

Boustead Singapore

An investment holding company, provides energy engineering, real estate, geospatial, and healthcare technology solutions in Singapore, Australia, Malaysia, the United States, Europe, rest of the Asia Pacific, North and South America, the Middle East, and Africa.

Flawless balance sheet and good value.

Market Insights

Community Narratives