Can Fu Yu Corporation Limited's (SGX:F13) Weak Financials Pull The Plug On The Stock's Current Momentum On Its Share Price?

Most readers would already be aware that Fu Yu's (SGX:F13) stock increased significantly by 14% over the past three months. However, we decided to pay close attention to its weak financials as we are doubtful that the current momentum will keep up, given the scenario. Specifically, we decided to study Fu Yu's ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

View our latest analysis for Fu Yu

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Fu Yu is:

9.2% = S$15m ÷ S$164m (Based on the trailing twelve months to June 2020).

The 'return' is the income the business earned over the last year. So, this means that for every SGD1 of its shareholder's investments, the company generates a profit of SGD0.09.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of Fu Yu's Earnings Growth And 9.2% ROE

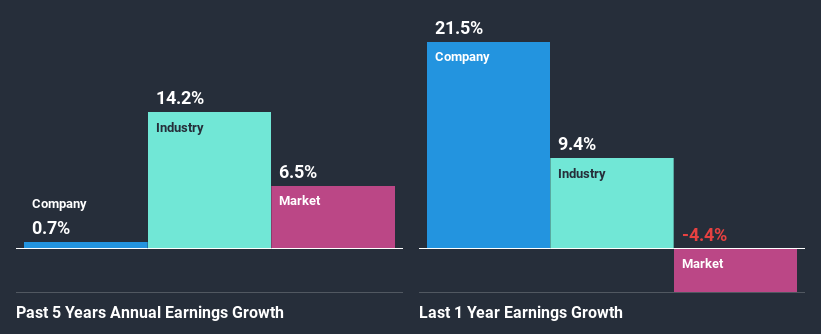

When you first look at it, Fu Yu's ROE doesn't look that attractive. However, the fact that the company's ROE is higher than the average industry ROE of 6.9%, is definitely interesting. Still, Fu Yu has seen a flat net income growth over the past five years. Bear in mind, the company does have a slightly low ROE. It is just that the industry ROE is lower. So that could be one of the factors that are causing earnings growth to stay flat.

We then compared Fu Yu's net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 14% in the same period, which is a bit concerning.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. What is F13 worth today? The intrinsic value infographic in our free research report helps visualize whether F13 is currently mispriced by the market.

Is Fu Yu Using Its Retained Earnings Effectively?

Fu Yu has a three-year median payout ratio as high as 101% meaning that the company is paying a dividend which is beyond its means. The absence in growth is therefore not surprising. Paying a dividend higher than reported profits is not a sustainable move. That's a huge risk in our books. To know the 2 risks we have identified for Fu Yu visit our risks dashboard for free.

Moreover, Fu Yu has been paying dividends for five years, which is a considerable amount of time, suggesting that management must have perceived that the shareholders prefer dividends over earnings growth. Our latest analyst data shows that the future payout ratio of the company is expected to drop to 72% over the next three years. Accordingly, the expected drop in the payout ratio explains the expected increase in the company's ROE to 11%, over the same period.

Conclusion

On the whole, Fu Yu's performance is quite a big let-down. Its earnings growth particularly is not much to talk about even though it does have a pretty respectable ROE. The lack of growth can be blamed on its poor earnings retention. As discussed earlier, the company is retaining hardly any of its profits. Having said that, looking at the current analyst estimates, we found that the company's earnings are expected to gain momentum. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

If you’re looking to trade Fu Yu, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:F13

Fu Yu

An investment holding company, engages in the manufacture and sub-assembly of precision plastic parts and components in Singapore, Malaysia, and China.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives