- Singapore

- /

- Construction

- /

- SGX:C06

CSC Holdings (SGX:C06) Has Us Worried With Its Last Reported Debt Levels

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies. CSC Holdings Limited (SGX:C06) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for CSC Holdings

How Much Debt Does CSC Holdings Carry?

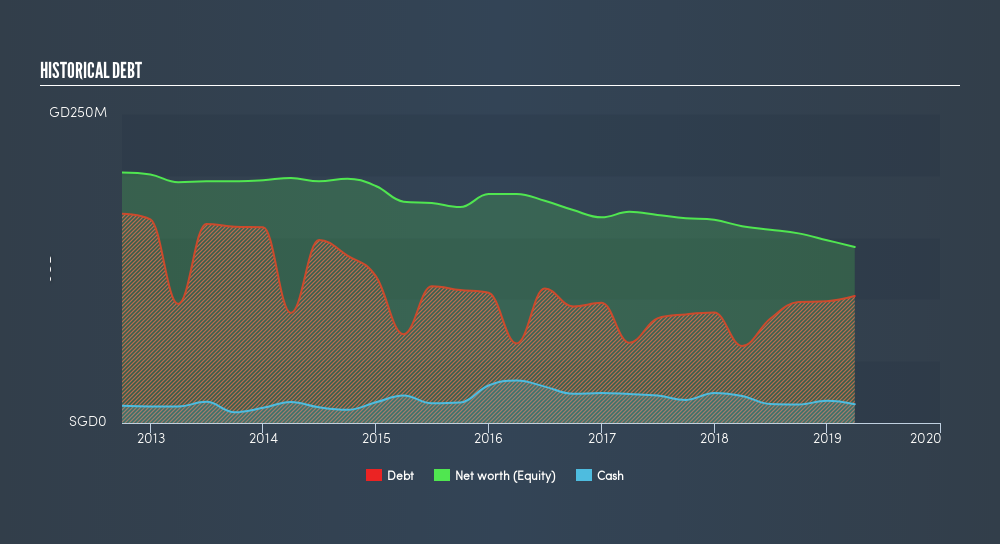

You can click the graphic below for the historical numbers, but it shows that as of March 2019 CSC Holdings had S$102.7m of debt, an increase on S$80.4m, over one year. On the flip side, it has S$15.2m in cash leading to net debt of about S$87.5m.

How Strong Is CSC Holdings's Balance Sheet?

According to the last reported balance sheet, CSC Holdings had liabilities of S$191.5m due within 12 months, and liabilities of S$19.5m due beyond 12 months. Offsetting these obligations, it had cash of S$15.2m as well as receivables valued at S$135.1m due within 12 months. So its liabilities total S$60.6m more than the combination of its cash and short-term receivables.

Given this deficit is actually higher than the company's market capitalization of S$48.8m, we think shareholders really should watch CSC Holdings's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution. Either way, since CSC Holdings does have more debt than cash, it's worth keeping an eye on its balance sheet. The balance sheet is clearly the area to focus on when you are analysing debt. But it is CSC Holdings's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, CSC Holdings saw its revenue drop to S$323m, which is a fall of 5.1%. We would much prefer see growth.

Caveat Emptor

Over the last twelve months CSC Holdings produced an earnings before interest and tax (EBIT) loss. Its EBIT loss was a whopping S$15m. When we look at that alongside the significant liabilities, we're not particularly confident about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. Not least because it burned through S$14m in negative free cash flow over the last year. So suffice it to say we consider the stock to be risky. For riskier companies like CSC Holdings I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SGX:C06

CSC Holdings

An investment holding company, provides foundation and geotechnical, and ground engineering solutions in Singapore, Malaysia, India, Thailand, the Philippines, Vietnam, and internationally.

Moderate second-rate dividend payer.

Market Insights

Community Narratives