- Singapore

- /

- Trade Distributors

- /

- SGX:BTG

Does HG Metal Manufacturing (SGX:BTG) Have A Healthy Balance Sheet?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, HG Metal Manufacturing Limited (SGX:BTG) does carry debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for HG Metal Manufacturing

How Much Debt Does HG Metal Manufacturing Carry?

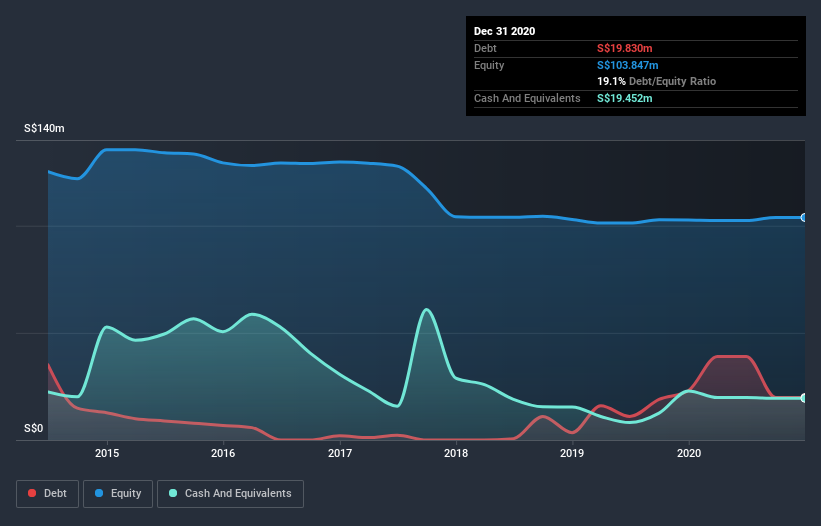

As you can see below, HG Metal Manufacturing had S$19.8m of debt at December 2020, down from S$23.0m a year prior. However, because it has a cash reserve of S$19.5m, its net debt is less, at about S$378.0k.

How Strong Is HG Metal Manufacturing's Balance Sheet?

The latest balance sheet data shows that HG Metal Manufacturing had liabilities of S$17.1m due within a year, and liabilities of S$26.1m falling due after that. Offsetting this, it had S$19.5m in cash and S$37.1m in receivables that were due within 12 months. So it can boast S$13.4m more liquid assets than total liabilities.

This surplus liquidity suggests that HG Metal Manufacturing's balance sheet could take a hit just as well as Homer Simpson's head can take a punch. With this in mind one could posit that its balance sheet means the company is able to handle some adversity. Carrying virtually no net debt, HG Metal Manufacturing has a very light debt load indeed.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

HG Metal Manufacturing's net debt to EBITDA ratio is very low, at 0.081, suggesting the debt is only trivial. But EBIT was only 2.7 times the interest expense last year, so the borrowing is clearly weighing on the business somewhat. Pleasingly, HG Metal Manufacturing is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 282% gain in the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since HG Metal Manufacturing will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. Over the last two years, HG Metal Manufacturing saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

HG Metal Manufacturing's EBIT growth rate suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But the stark truth is that we are concerned by its conversion of EBIT to free cash flow. Taking all this data into account, it seems to us that HG Metal Manufacturing takes a pretty sensible approach to debt. While that brings some risk, it can also enhance returns for shareholders. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 2 warning signs for HG Metal Manufacturing that you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade HG Metal Manufacturing, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if HG Metal Manufacturing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:BTG

HG Metal Manufacturing

An investment holding company, primarily trades in steel products in Indonesia, Malaysia, Myanmar, and Singapore.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives