- China

- /

- Metals and Mining

- /

- SHSE:601168

3 Asian Dividend Stocks Offering Yields Up To 4.1%

Reviewed by Simply Wall St

As Asian markets navigate a complex landscape marked by economic shifts and policy changes, investors are increasingly focusing on dividend stocks as a source of steady income amid market volatility. In this context, selecting companies with strong fundamentals and reliable dividend yields can offer stability and potential returns, making them an attractive consideration for those looking to balance growth with income.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.27% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.01% | ★★★★★★ |

| NCD (TSE:4783) | 4.28% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.03% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| Daicel (TSE:4202) | 4.29% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.48% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.70% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.60% | ★★★★★★ |

Click here to see the full list of 1043 stocks from our Top Asian Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

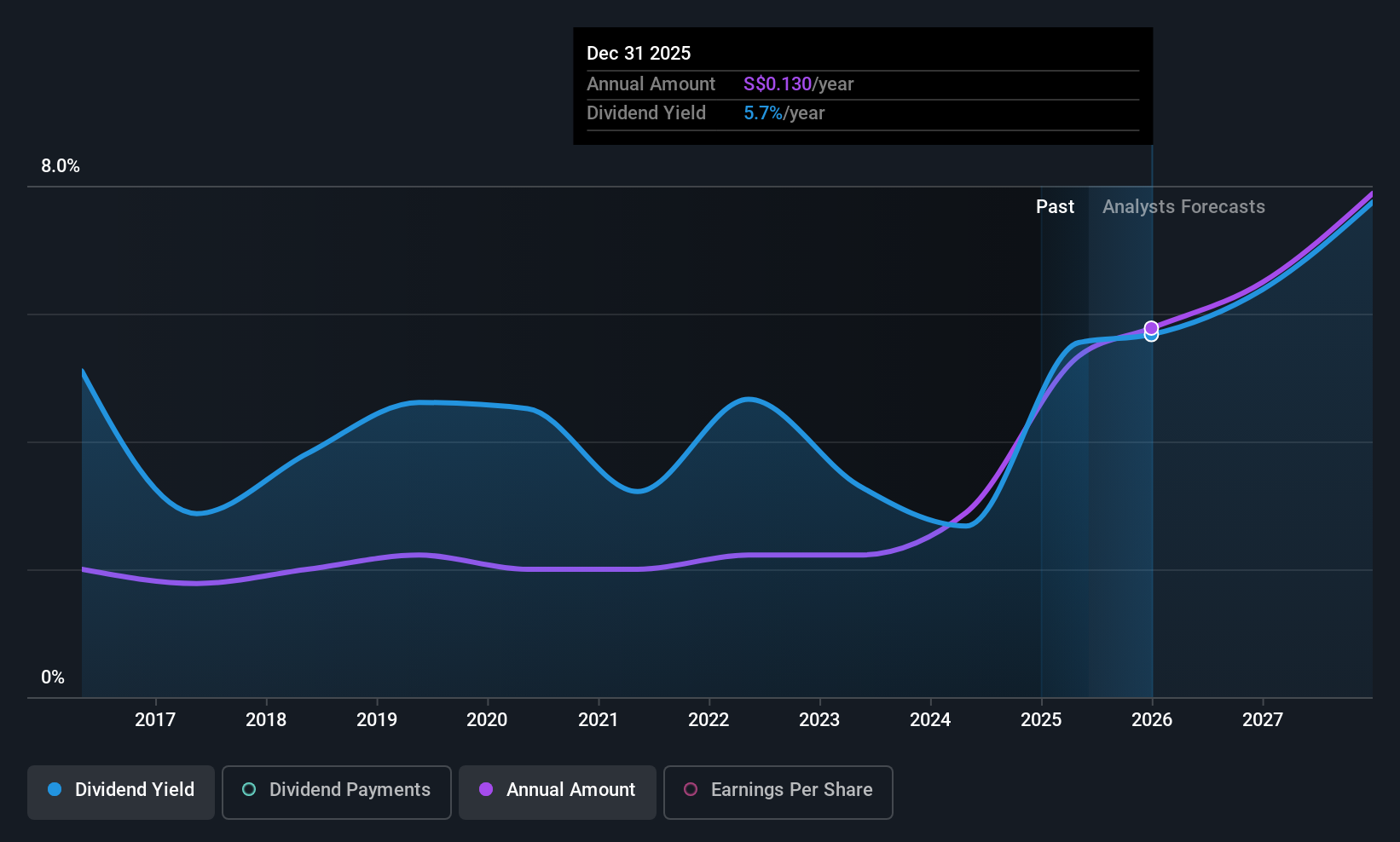

Yangzijiang Shipbuilding (Holdings) (SGX:BS6)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yangzijiang Shipbuilding (Holdings) Ltd. is an investment holding company involved in shipbuilding activities across Greater China and various international markets, with a market cap of SGD13.66 billion.

Operations: Yangzijiang Shipbuilding (Holdings) Ltd. generates its revenue primarily from shipbuilding, amounting to CN¥25.07 billion, and shipping activities, contributing CN¥1.15 billion.

Dividend Yield: 3.5%

Yangzijiang Shipbuilding's dividends are well-supported by its earnings and cash flows, with a payout ratio of 32.7% and a cash payout ratio of 45.7%. The company has maintained stable and reliable dividend payments over the past decade, although its yield of 3.46% is lower than the top quartile in Singapore's market. Recent contract wins totaling US$1.90 billion enhance future revenue prospects but don't impact current earnings significantly, ensuring continued dividend sustainability without immediate growth pressure.

- Click here and access our complete dividend analysis report to understand the dynamics of Yangzijiang Shipbuilding (Holdings).

- In light of our recent valuation report, it seems possible that Yangzijiang Shipbuilding (Holdings) is trading behind its estimated value.

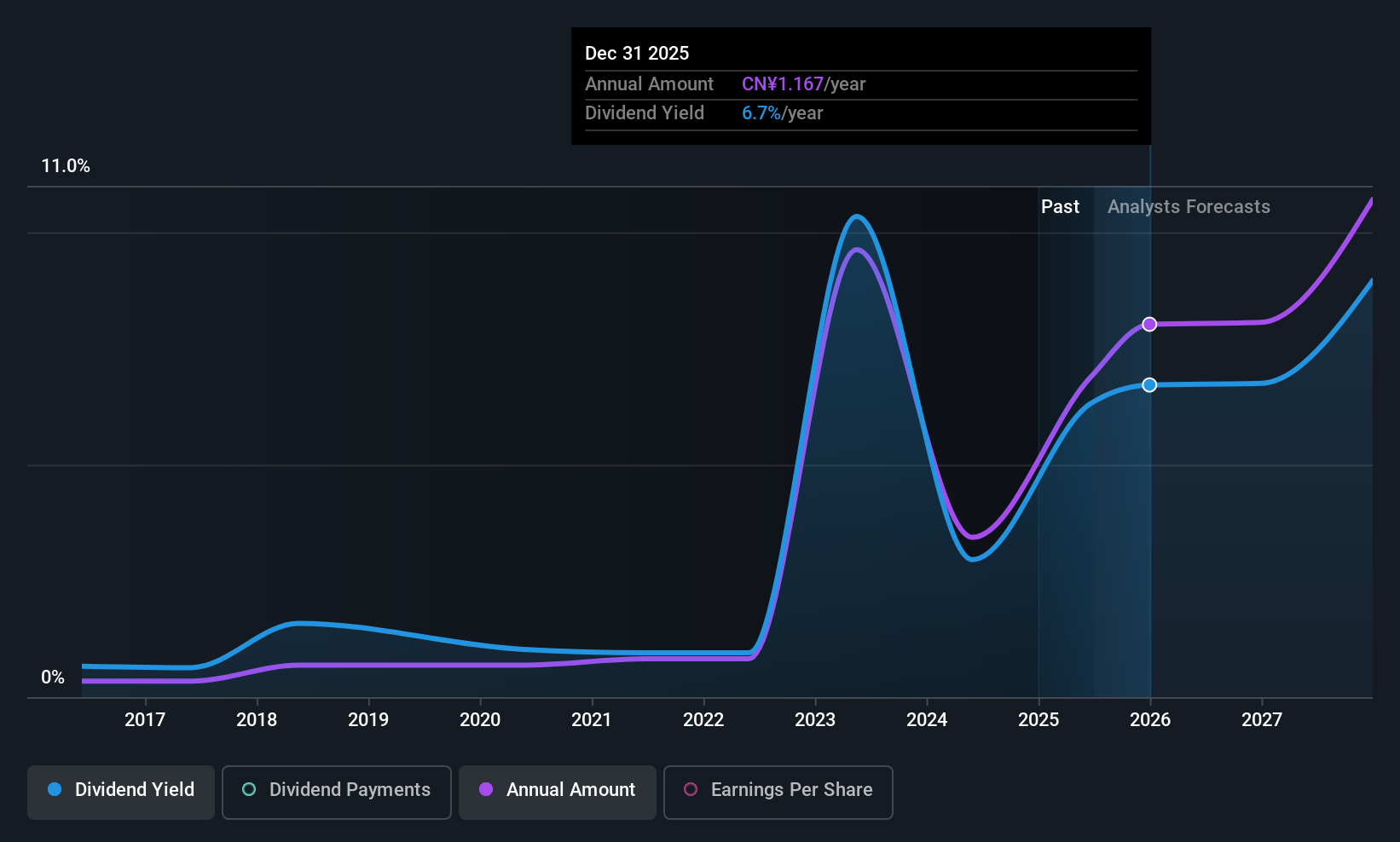

Western MiningLtd (SHSE:601168)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Western Mining Co., Ltd. and its subsidiaries are involved in the mining, smelting, and trading of metals both in Mainland China and internationally, with a market cap of CN¥57.67 billion.

Operations: Western Mining Ltd's revenue is primarily derived from its activities in mining, smelting, and trading of metals across Mainland China and international markets.

Dividend Yield: 4.1%

Western Mining Ltd. offers a high dividend yield of 4.13%, placing it in the top 25% of CN market payers, although its dividends have been volatile over the past decade. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 75.8% and 42.7%, respectively, despite a high debt level. Recent earnings show significant sales growth to CNY 48.44 billion, supporting its ability to maintain dividend payments amidst revenue increases.

- Take a closer look at Western MiningLtd's potential here in our dividend report.

- The valuation report we've compiled suggests that Western MiningLtd's current price could be quite moderate.

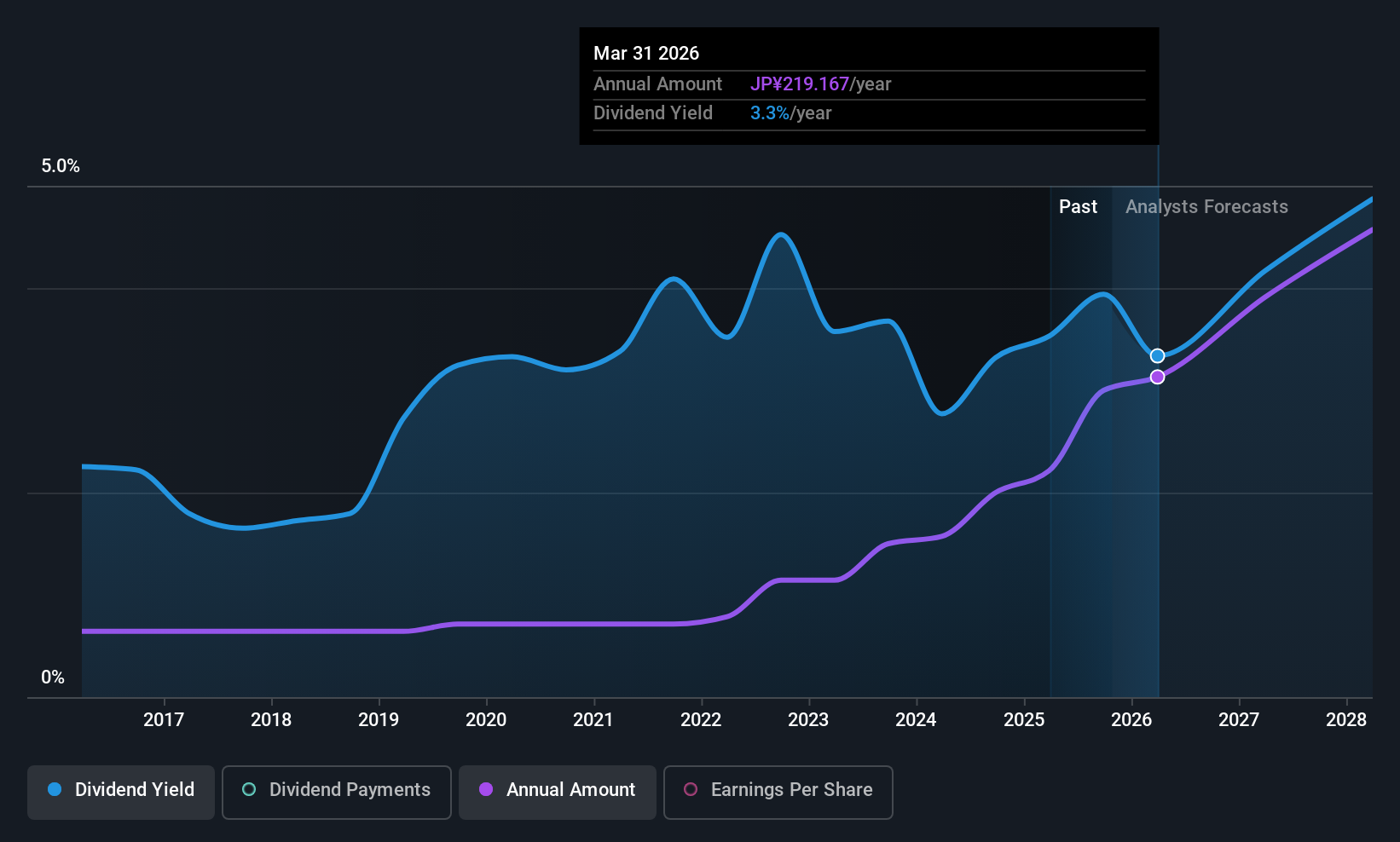

77 Bank (TSE:8341)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The 77 Bank, Ltd., along with its subsidiaries, offers banking products and services to both corporate and individual customers in Japan, with a market cap of ¥462.91 billion.

Operations: The 77 Bank, Ltd. generates revenue primarily from its Banking Business segment, which amounts to ¥161.60 billion.

Dividend Yield: 3.4%

77 Bank offers a stable dividend yield of 3.37%, though it falls short of the top tier in Japan. The bank's dividends are well-covered by a low payout ratio of 32.3% and have shown reliability and growth over the past decade. Despite a high level of bad loans at 2%, recent strategic expansions, including the establishment of an investment subsidiary, aim to address regional business challenges and could bolster future financial stability.

- Click to explore a detailed breakdown of our findings in 77 Bank's dividend report.

- Our valuation report here indicates 77 Bank may be overvalued.

Where To Now?

- Unlock our comprehensive list of 1043 Top Asian Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western MiningLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601168

Western MiningLtd

Engages in the mining, smelting, and trading of metals in Mainland China and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives