Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, BH Global Corporation Limited (SGX:BQN) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for BH Global

What Is BH Global's Debt?

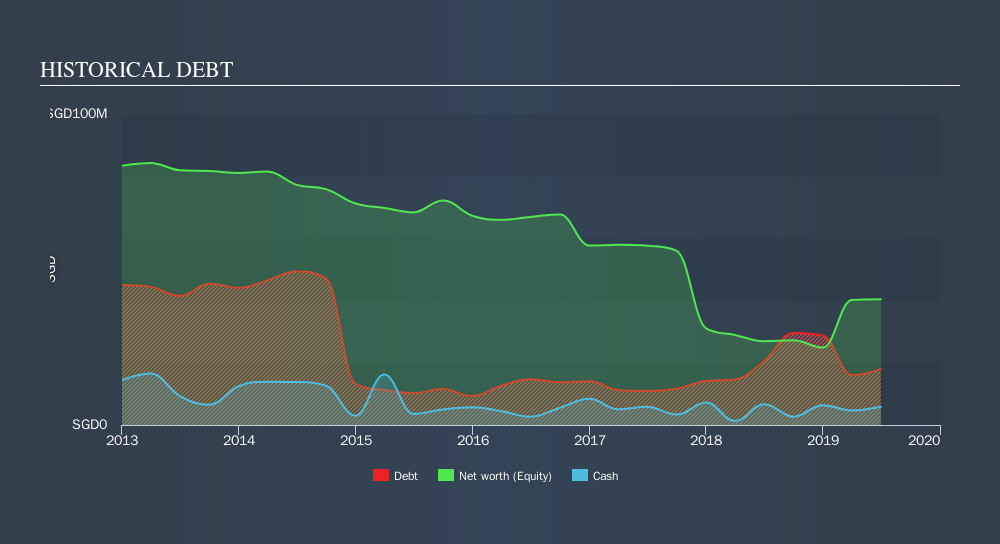

The image below, which you can click on for greater detail, shows that BH Global had debt of S$18.0m at the end of June 2019, a reduction from S$20.7m over a year. However, it also had S$5.86m in cash, and so its net debt is S$12.1m.

How Strong Is BH Global's Balance Sheet?

We can see from the most recent balance sheet that BH Global had liabilities of S$24.3m falling due within a year, and liabilities of S$12.4m due beyond that. On the other hand, it had cash of S$5.86m and S$16.4m worth of receivables due within a year. So its liabilities total S$14.5m more than the combination of its cash and short-term receivables.

This deficit is considerable relative to its market capitalization of S$21.3m, so it does suggest shareholders should keep an eye on BH Global's use of debt. This suggests shareholders would heavily diluted if the company needed to shore up its balance sheet in a hurry.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

BH Global has a debt to EBITDA ratio of 3.9 and its EBIT covered its interest expense 2.5 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. One redeeming factor for BH Global is that it turned last year's EBIT loss into a gain of S$2.1m, over the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since BH Global will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. During the last year, BH Global burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

Mulling over BH Global's attempt at converting EBIT to free cash flow, we're certainly not enthusiastic. Having said that, its ability to grow its EBIT isn't such a worry. We're quite clear that we consider BH Global to be really rather risky, as a result of its balance sheet health. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. While BH Global didn't make a statutory profit in the last year, its positive EBIT suggests that profitability might not be far away.Click here to see if its earnings are heading in the right direction, over the medium term.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SGX:BQN

BH Global

An investment holding company, provides a suite of solutions in electrical and technical supply, cyber security, green LED lighting, infrared thermal sensing technology, and integration engineering fields in Singapore and internationally.

Excellent balance sheet low.

Market Insights

Community Narratives