With Darco Water Technologies Limited (SGX:BLR) It Looks Like You'll Get What You Pay For

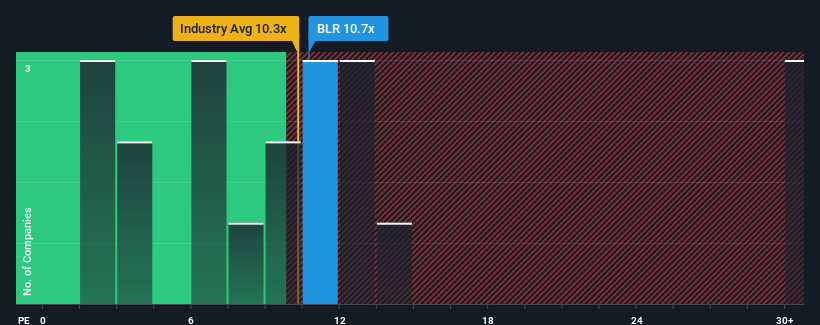

It's not a stretch to say that Darco Water Technologies Limited's (SGX:BLR) price-to-earnings (or "P/E") ratio of 10.7x right now seems quite "middle-of-the-road" compared to the market in Singapore, where the median P/E ratio is around 12x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

It looks like earnings growth has deserted Darco Water Technologies recently, which is not something to boast about. It might be that many expect the uninspiring earnings performance to only match most other companies at best over the coming period, which has kept the P/E from rising. If not, then existing shareholders may be feeling hopeful about the future direction of the share price.

Check out our latest analysis for Darco Water Technologies

How Is Darco Water Technologies' Growth Trending?

The only time you'd be comfortable seeing a P/E like Darco Water Technologies' is when the company's growth is tracking the market closely.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Likewise, not much has changed from three years ago as earnings have been stuck during that whole time. So it seems apparent to us that the company has struggled to grow earnings meaningfully over that time.

Comparing that to the market, which is predicted to deliver 1.5% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised earnings results.

With this information, we can see why Darco Water Technologies is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

What We Can Learn From Darco Water Technologies' P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Darco Water Technologies revealed its three-year earnings trends are contributing to its P/E, given they look similar to current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

It is also worth noting that we have found 2 warning signs for Darco Water Technologies that you need to take into consideration.

If these risks are making you reconsider your opinion on Darco Water Technologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:BLR

Darco Water Technologies

An investment holding company, provides engineering, and water and wastewater treatment solutions in Singapore, Malaysia, the People’s Republic of China, and Vietnam.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives