- Singapore

- /

- Real Estate

- /

- SGX:W05

Steer Clear Of Wing Tai Holdings On SGX With One Better Dividend Stock Option

Reviewed by Sasha Jovanovic

Investing in dividend stocks is often pursued for the potential of steady income. However, the allure of dividends can be misleading if not carefully evaluated, especially when a company's dividend history shows a decline, as with Wing Tai Holdings. This article will compare two dividend stocks on the Singapore Exchange (SGX), highlighting why consistent dividend growth matters and pointing out where caution should be exercised.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 7.11% | ★★★★★☆ |

| Multi-Chem (SGX:AWZ) | 8.44% | ★★★★★☆ |

| China Sunsine Chemical Holdings (SGX:QES) | 6.32% | ★★★★★☆ |

| Civmec (SGX:P9D) | 5.88% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.53% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.81% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.81% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.66% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 6.85% | ★★★★★☆ |

| Sing Investments & Finance (SGX:S35) | 6.00% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top SGX Dividend Stocks screener.

Let's dive into one of the prime choices out of the screener and one to possibly skip over.

Top Pick

BRC Asia (SGX:BEC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: BRC Asia Limited is a company that specializes in the prefabrication of steel reinforcement for concrete, operating across Singapore, Australia, Brunei, Hong Kong, Indonesia, Malaysia, Thailand, India and other international markets with a market capitalization of SGD 617.29 million.

Operations: The company generates revenue through two primary segments: Trading, which brought in SGD 319.71 million, and Fabrication and Manufacturing, accounting for SGD 1.35 billion.

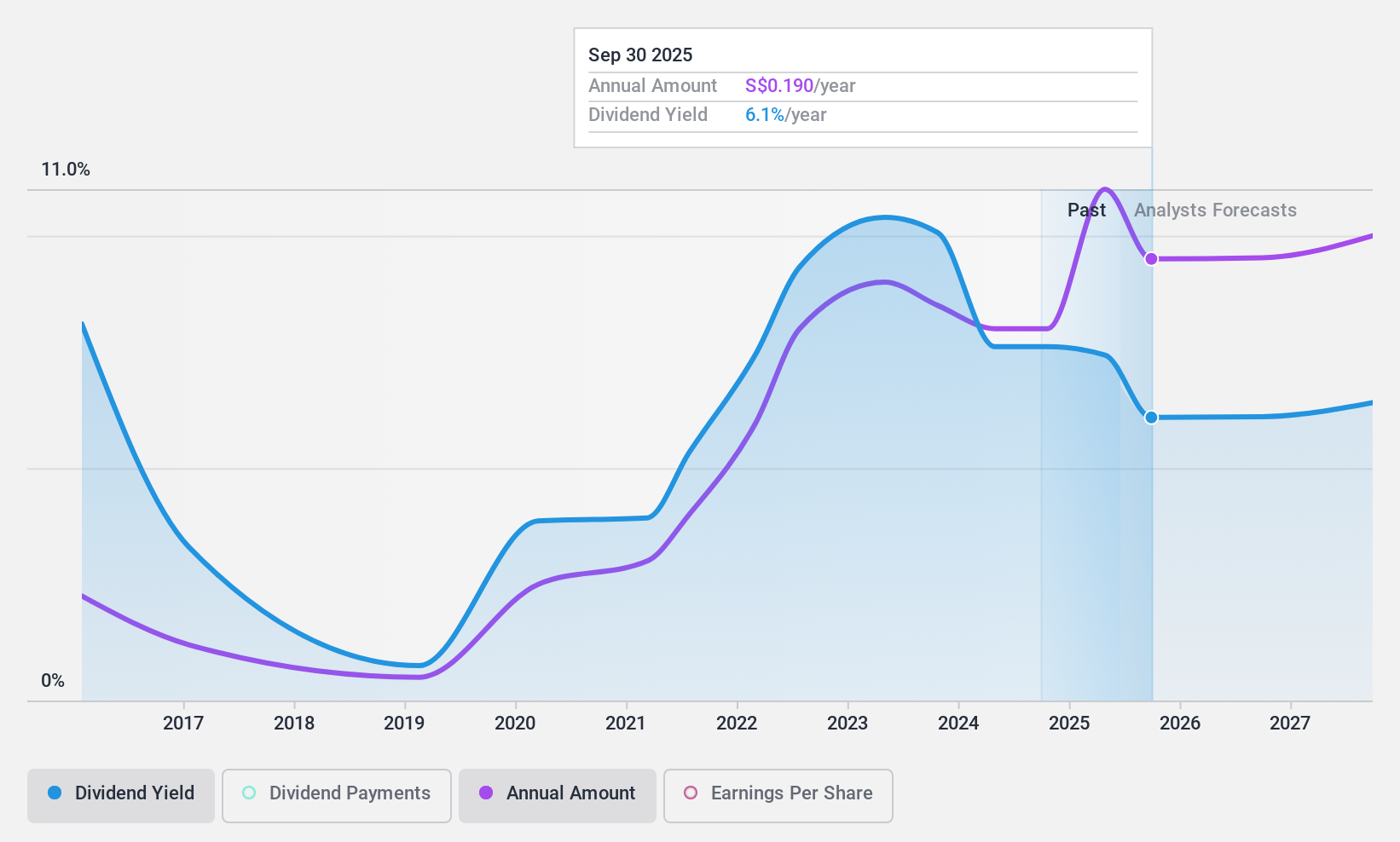

Dividend Yield: 7.1%

BRC Asia Limited, trading at S$0.56 below estimated fair value, offers a compelling dividend yield of 7.11%, ranking in the top 25% of Singaporean dividend payers. Despite a volatile history, recent trends show improvement with an interim tax-exempt dividend announced for November 2024 at S$0.06 per share, reflecting confidence in sustained payouts supported by a payout ratio of 35.9% and cash flow coverage at 85.3%. This stability contrasts with competitors experiencing declining dividends, positioning BRC as a more reliable choice for consistent income.

- Click to explore a detailed breakdown of our findings in BRC Asia's dividend report.

- Our valuation report here indicates BRC Asia may be undervalued.

One To Reconsider

Wing Tai Holdings (SGX:W05)

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Wing Tai Holdings Limited operates as an investment holding company primarily focused on property investment and development across Singapore, Malaysia, Australia, Japan, China, and Hong Kong, with a market capitalization of approximately SGD 1.07 billion.

Operations: The company generates revenue through retail operations at SGD 43.20 million, investment properties at SGD 41.96 million, and development properties at SGD 217.03 million.

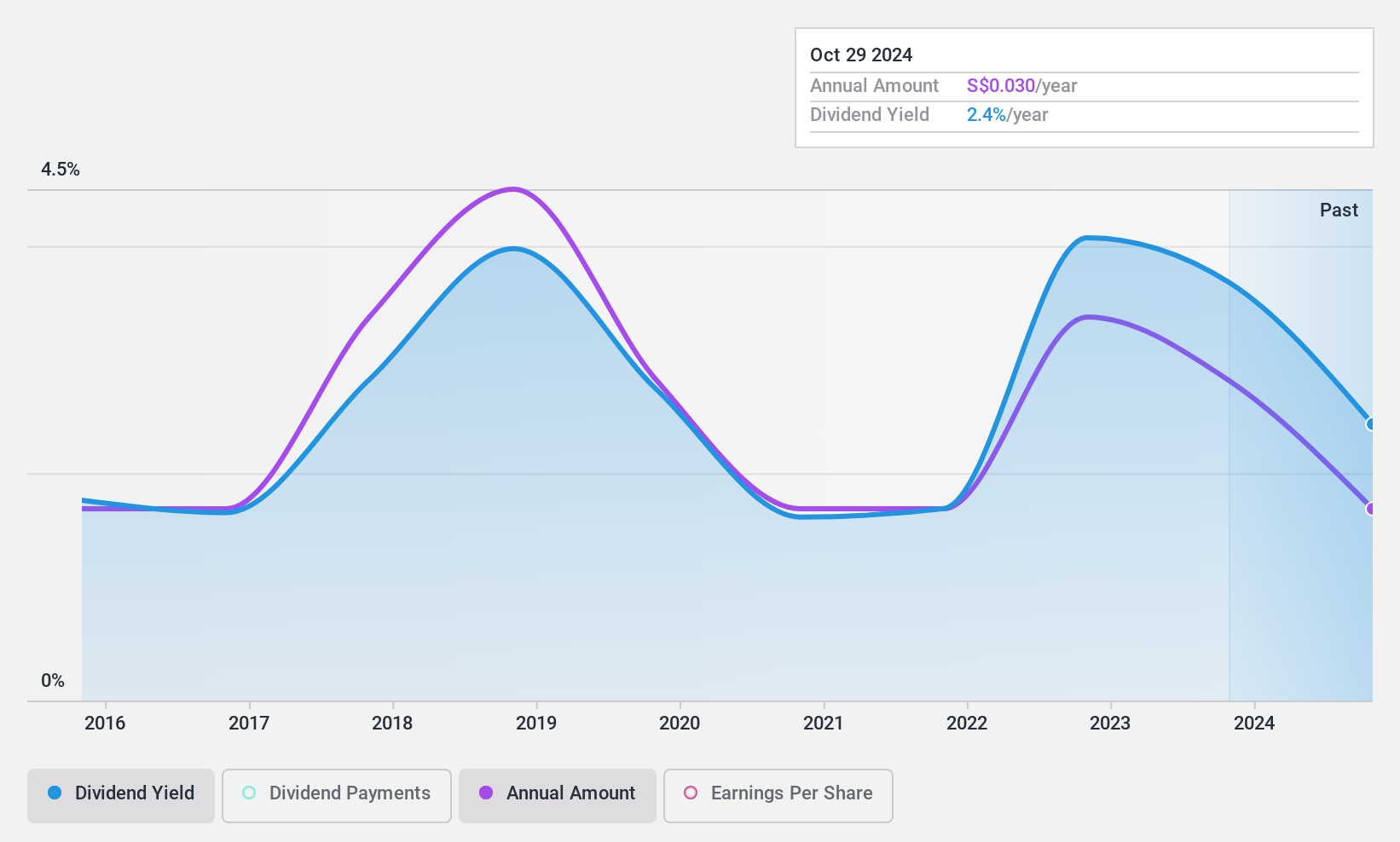

Dividend Yield: 3.6%

Wing Tai Holdings has shown a declining trend in dividend payouts over the past decade, marked by a significant annual drop exceeding 20%. Currently, its dividend yield stands at 3.6%, which is low relative to Singapore's top dividend payers. Furthermore, these dividends are not sufficiently covered by earnings or cash flows, indicating potential sustainability issues. Despite recent business expansions like acquiring a prime residential site, financial fundamentals such as a 20.1% annual decrease in earnings over five years and trading 77.2% below estimated fair value suggest caution for dividend-focused investors.

Next Steps

- Reveal the 20 hidden gems among our Top SGX Dividend Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wing Tai Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:W05

Wing Tai Holdings

An investment holding company, engages in the property investment and development business in Singapore, Malaysia, Australia, Japan, Hong Kong, and China.

Mediocre balance sheet with minimal risk.

Market Insights

Community Narratives