- Singapore

- /

- Trade Distributors

- /

- SGX:AWC

Should Brook Crompton Holdings Ltd. (SGX:AWC) Be Part Of Your Dividend Portfolio?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Is Brook Crompton Holdings Ltd. (SGX:AWC) a good dividend stock? How would you know? Dividend paying companies with growing earnings can be highly rewarding in the long term. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

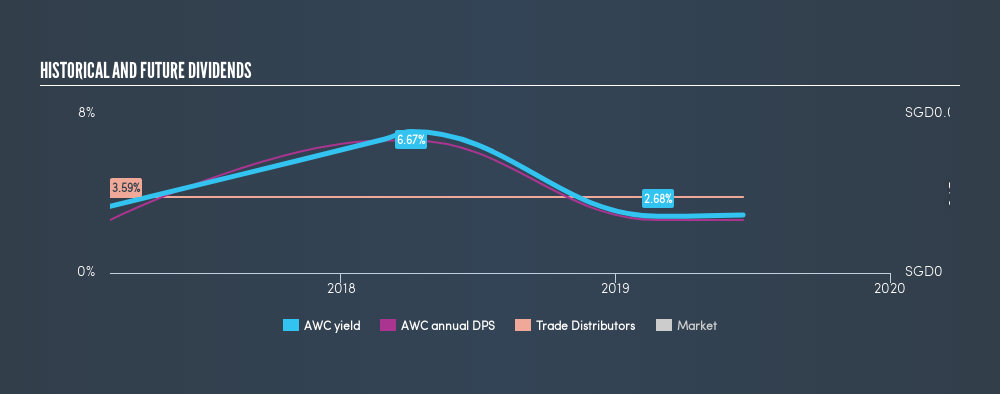

With only a two-year payment history, and a 2.7% yield, investors probably think Brook Crompton Holdings is not much of a dividend stock. Many of the best dividend stocks typically start out paying a low yield, so we wouldn't automatically cut it from our list of prospects. Some simple research can reduce the risk of buying Brook Crompton Holdings for its dividend - read on to learn more.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Looking at the data, we can see that 15% of Brook Crompton Holdings's profits were paid out as dividends in the last 12 months. We'd say its dividends are thoroughly covered by earnings.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. Brook Crompton Holdings paid out a conservative 41% of its free cash flow as dividends last year. It's positive to see that Brook Crompton Holdings's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

While the above analysis focuses on dividends relative to a company's earnings, we do note Brook Crompton Holdings's strong net cash position, which will let it pay larger dividends for a time, should it choose.

Consider getting our latest analysis on Brook Crompton Holdings's financial position here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. This company's dividend has been unstable, and with a relatively short history, we think it's a little soon to draw strong conclusions about its long term dividend potential. Its most recent annual dividend was S$0.02 per share, effectively flat on its first payment two years ago.

It's good to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth, anyway. We're not that enthused by this.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share (EPS) are growing. Why take the risk of a dividend getting cut, unless there's a good chance of bigger dividends in future? In the last five years, Brook Crompton Holdings's earnings per share have shrunk at approximately 12% per annum. If earnings continue to decline, the dividend may come under pressure. Every investor should make an assessment of whether the company is taking steps to stabilise the situation.

Conclusion

To summarise, shareholders should always check that Brook Crompton Holdings's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. It's great to see that Brook Crompton Holdings is paying out a low percentage of its earnings and cash flow. Second, earnings per share have been in decline, and its dividend has been cut at least once in the past. In sum, we find it hard to get excited about Brook Crompton Holdings from a dividend perspective. It's not that we think it's a bad business; just that there are other companies that perform better on these criteria.

Are management backing themselves to deliver performance? Check their shareholdings in Brook Crompton Holdings in our latest insider ownership analysis.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SGX:AWC

Brook Crompton Holdings

An investment holding company, distributes electric motors in the United Kingdom and Continental Europe, the Asia Pacific, and North America.

Flawless balance sheet and good value.

Market Insights

Community Narratives