- Singapore

- /

- Water Utilities

- /

- SGX:5GD

The Returns At Sunpower Group (SGX:5GD) Provide Us With Signs Of What's To Come

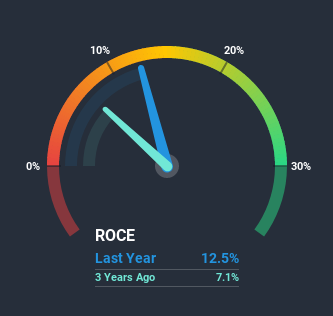

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. So, when we ran our eye over Sunpower Group's (SGX:5GD) trend of ROCE, we liked what we saw.

Return On Capital Employed (ROCE): What is it?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Sunpower Group:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.13 = CN¥655m ÷ (CN¥8.1b - CN¥2.8b) (Based on the trailing twelve months to September 2020).

So, Sunpower Group has an ROCE of 13%. On its own, that's a standard return, however it's much better than the 6.3% generated by the Machinery industry.

See our latest analysis for Sunpower Group

Above you can see how the current ROCE for Sunpower Group compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

What Does the ROCE Trend For Sunpower Group Tell Us?

While the current returns on capital are decent, they haven't changed much. The company has employed 597% more capital in the last five years, and the returns on that capital have remained stable at 13%. 13% is a pretty standard return, and it provides some comfort knowing that Sunpower Group has consistently earned this amount. Stable returns in this ballpark can be unexciting, but if they can be maintained over the long run, they often provide nice rewards to shareholders.

One more thing to note, even though ROCE has remained relatively flat over the last five years, the reduction in current liabilities to 35% of total assets, is good to see from a business owner's perspective. Effectively suppliers now fund less of the business, which can lower some elements of risk.Our Take On Sunpower Group's ROCE

In the end, Sunpower Group has proven its ability to adequately reinvest capital at good rates of return. On top of that, the stock has rewarded shareholders with a remarkable 146% return to those who've held over the last five years. So while the positive underlying trends may be accounted for by investors, we still think this stock is worth looking into further.

If you'd like to know more about Sunpower Group, we've spotted 2 warning signs, and 1 of them shouldn't be ignored.

While Sunpower Group may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

If you’re looking to trade Sunpower Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:5GD

Sunpower Group

An investment holding company, engages in the investment, development, and operation of centralized heat, steam, and electricity generation plants in the People’s Republic of China.

Fair value with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026