Asian Penny Stock Picks: Global Green Chemicals And Two Others To Monitor

Reviewed by Simply Wall St

As global markets navigate a landscape of uncertainty, Asian stocks have been capturing the attention of investors seeking fresh opportunities. Penny stocks, although considered niche and somewhat outdated in terminology, continue to offer intriguing prospects for growth when backed by solid financial health. In this article, we will explore several promising penny stocks in Asia that stand out for their potential to combine affordability with long-term growth opportunities.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Interlink Telecom (SET:ITEL) | THB1.41 | THB1.96B | ✅ 4 ⚠️ 5 View Analysis > |

| Chumporn Palm Oil Industry (SET:CPI) | THB2.82 | THB1.78B | ✅ 2 ⚠️ 2 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.21 | SGD41.83M | ✅ 4 ⚠️ 3 View Analysis > |

| Hong Leong Asia (SGX:H22) | SGD1.02 | SGD763.04M | ✅ 3 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.47 | SGD9.76B | ✅ 5 ⚠️ 0 View Analysis > |

| Jiumaojiu International Holdings (SEHK:9922) | HK$3.08 | HK$4.3B | ✅ 3 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$3.99 | HK$45.73B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.29 | HK$813.93M | ✅ 3 ⚠️ 1 View Analysis > |

| China Zheshang Bank (SEHK:2016) | HK$2.57 | HK$82.89B | ✅ 4 ⚠️ 1 View Analysis > |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥3.10 | CN¥3.59B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,166 stocks from our Asian Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

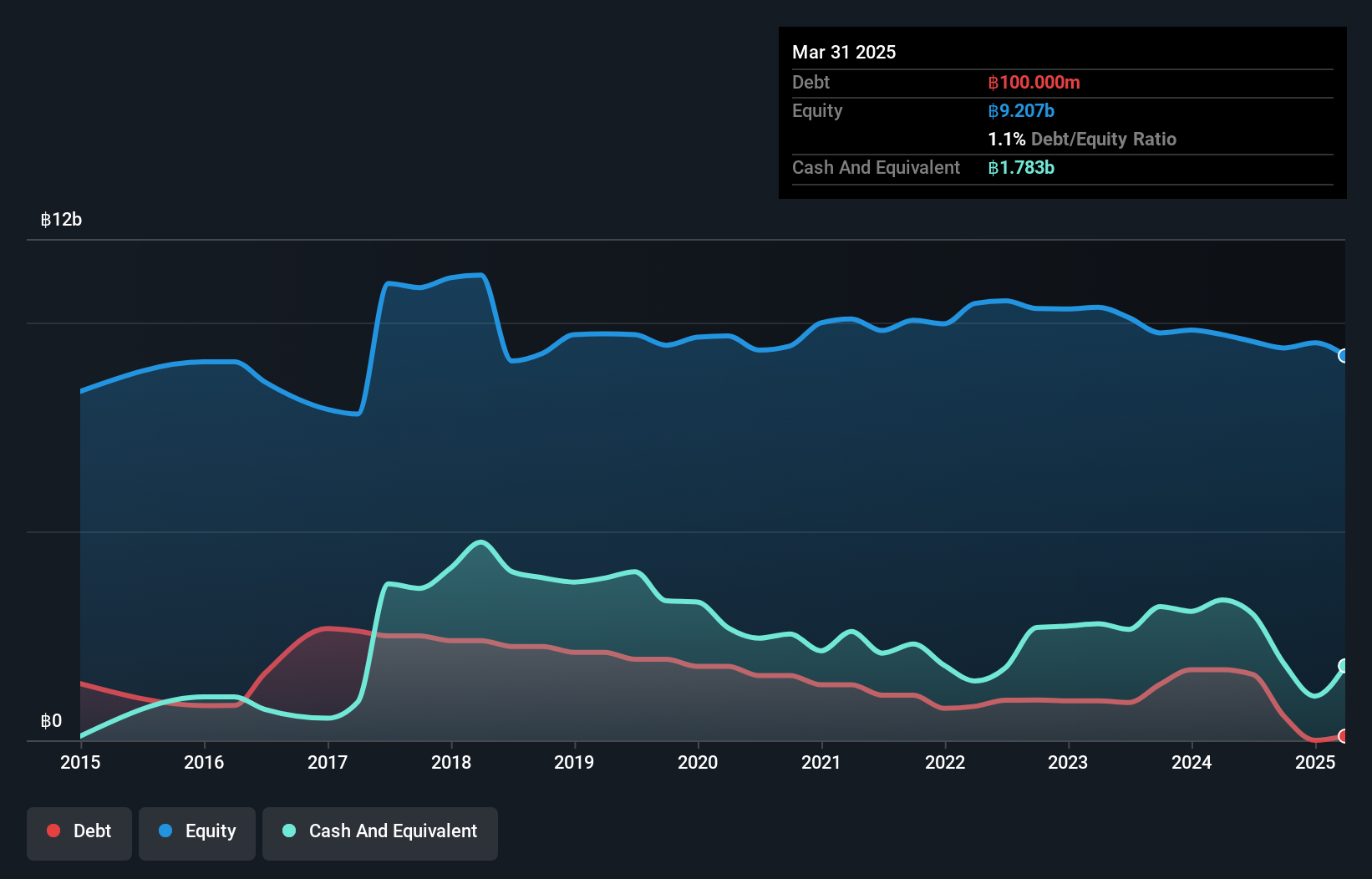

Global Green Chemicals (SET:GGC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Global Green Chemicals Public Company Limited is involved in the production, distribution, and transportation of oleochemical products across Thailand, China, India, Korea, and other international markets with a market cap of THB4.65 billion.

Operations: The company's revenue is primarily derived from its Methyl Ester segment, which generated THB12.32 billion, and its Fatty Alcohols segment, contributing THB6.59 billion.

Market Cap: THB4.65B

Global Green Chemicals Public Company Limited, with a market cap of THB4.65 billion, is navigating challenges typical of penny stocks. Despite generating significant revenue from its Methyl Ester and Fatty Alcohols segments, the company remains unprofitable, reporting a net loss of THB264.93 million for 2024. Its share price has been highly volatile recently and trades at 52% below estimated fair value. Positively, GGC is debt-free with strong asset coverage over liabilities but faces governance challenges due to an inexperienced board with an average tenure of 2.8 years. Recent dividend proposals indicate efforts to enhance shareholder value amidst financial hurdles.

- Dive into the specifics of Global Green Chemicals here with our thorough balance sheet health report.

- Understand Global Green Chemicals' track record by examining our performance history report.

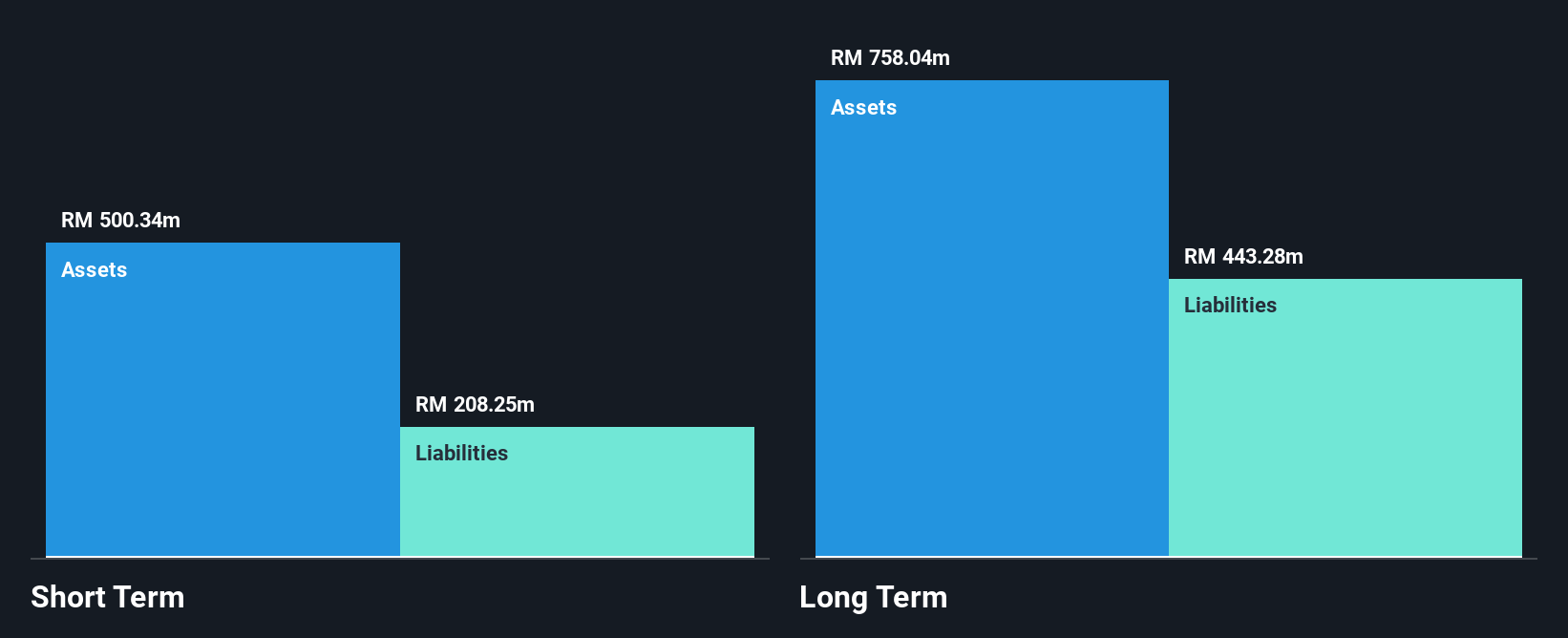

Nam Cheong (SGX:1MZ)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nam Cheong Limited is an investment holding company engaged in shipbuilding and vessel chartering, with a market capitalization of SGD278.50 million.

Operations: The company generates revenue from its chartering segment, which amounts to MYR689.41 million.

Market Cap: SGD278.5M

Nam Cheong Limited, with a market cap of SGD278.50 million, has shown remarkable earnings growth, increasing by 402.4% over the past year and surpassing industry averages. The company's return on equity is outstanding at 141.1%, though it carries a high net debt to equity ratio of 59.9%. Short-term assets exceed both short and long-term liabilities, indicating solid liquidity management despite the high debt level. While its management team is experienced with an average tenure of five years, the board lacks experience with less than a year in tenure. The stock trades significantly below estimated fair value amidst stable but elevated volatility levels compared to peers in Singapore.

- Take a closer look at Nam Cheong's potential here in our financial health report.

- Explore historical data to track Nam Cheong's performance over time in our past results report.

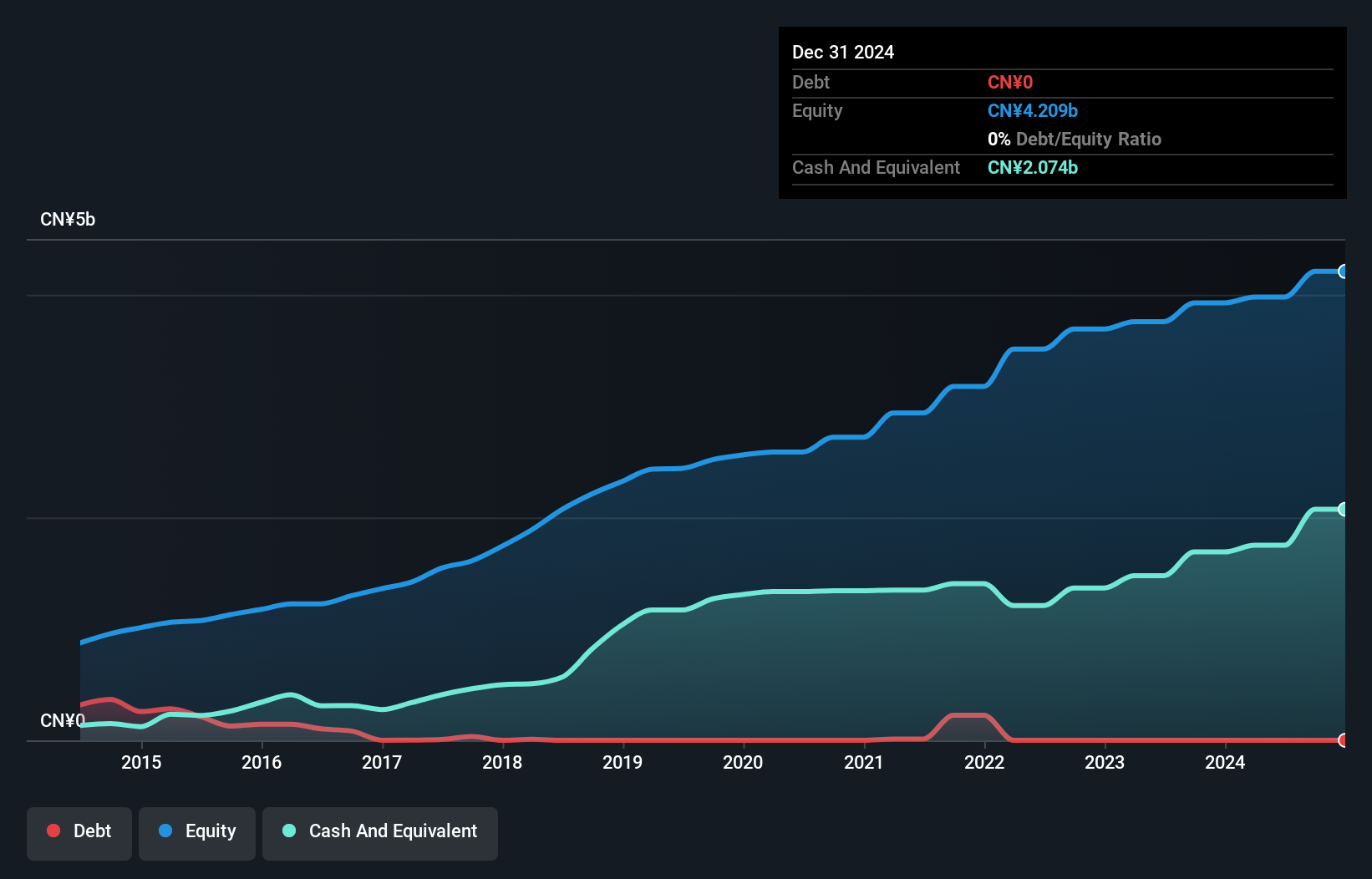

China Sunsine Chemical Holdings (SGX:QES)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Sunsine Chemical Holdings Ltd. is an investment holding company that manufactures and sells specialty chemicals globally, with a market capitalization of SGD500.53 million.

Operations: The company's revenue is primarily derived from its Rubber Chemicals segment, generating CN¥4.38 billion, complemented by contributions of CN¥196.1 million from Heating Power and CN¥23.4 million from Waste Treatment.

Market Cap: SGD500.53M

China Sunsine Chemical Holdings, with a market cap of SGD500.53 million, demonstrates stable financial health and value potential in the penny stock arena. The company reported sales of CN¥3.52 billion for 2024, with net income rising to CN¥423.9 million, reflecting improved profit margins from 10.7% to 12.1%. Despite a forecasted earnings decline of 0.4% annually over the next three years, it remains debt-free and covers short-term liabilities comfortably with CN¥3.6 billion in assets against CN¥470.3 million in liabilities. Trading significantly below its estimated fair value enhances its appeal despite an inexperienced board averaging three years tenure.

- Click here and access our complete financial health analysis report to understand the dynamics of China Sunsine Chemical Holdings.

- Understand China Sunsine Chemical Holdings' earnings outlook by examining our growth report.

Seize The Opportunity

- Embark on your investment journey to our 1,166 Asian Penny Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nam Cheong might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:1MZ

Nam Cheong

An investment holding company, provides shipbuilding and vessel chartering.

Excellent balance sheet and good value.

Market Insights

Community Narratives