- Singapore

- /

- Construction

- /

- SGX:1L2

What Hiap Seng Industries Limited's (SGX:1L2) 50% Share Price Gain Is Not Telling You

The Hiap Seng Industries Limited (SGX:1L2) share price has done very well over the last month, posting an excellent gain of 50%. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

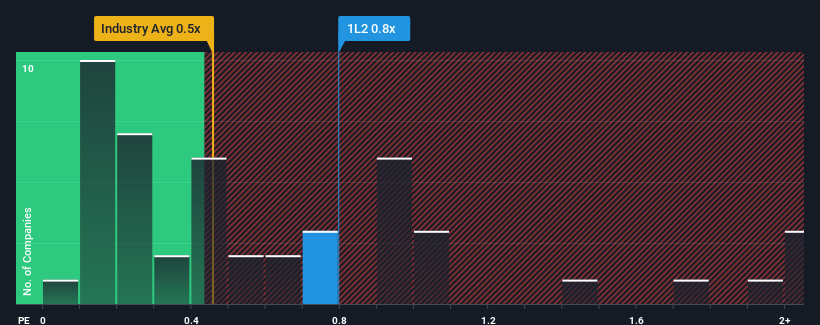

Although its price has surged higher, you could still be forgiven for feeling indifferent about Hiap Seng Industries' P/S ratio of 0.8x, since the median price-to-sales (or "P/S") ratio for the Construction industry in Singapore is also close to 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Hiap Seng Industries

How Hiap Seng Industries Has Been Performing

Revenue has risen firmly for Hiap Seng Industries recently, which is pleasing to see. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Hiap Seng Industries will help you shine a light on its historical performance.How Is Hiap Seng Industries' Revenue Growth Trending?

Hiap Seng Industries' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 17% last year. Although, its longer-term performance hasn't been as strong with three-year revenue growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 12% shows it's noticeably less attractive.

With this information, we find it interesting that Hiap Seng Industries is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What Does Hiap Seng Industries' P/S Mean For Investors?

Its shares have lifted substantially and now Hiap Seng Industries' P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Hiap Seng Industries revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

Plus, you should also learn about these 3 warning signs we've spotted with Hiap Seng Industries (including 1 which shouldn't be ignored).

If you're unsure about the strength of Hiap Seng Industries' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hiap Seng Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:1L2

Hiap Seng Industries

An investment holding company, provides engineering, procurement, construction, and plant maintenance services for oil and gas, and energy sectors in Singapore.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives