- Hong Kong

- /

- Diversified Financial

- /

- SEHK:3903

Koh Brothers Eco Engineering And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

Global markets have recently experienced a rally, with major benchmarks reaching record highs as investors anticipate economic growth and regulatory changes following the U.S. election results. For those looking to invest in smaller or newer companies, penny stocks—despite their vintage name—can still offer surprising value. These stocks, often characterized by their lower price points and market caps, can provide investors with opportunities for significant returns when built on solid financial foundations.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Rexit Berhad (KLSE:REXIT) | MYR0.79 | MYR136.84M | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.25 | MYR351.85M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.46 | MYR2.29B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$552.27M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| Seafco (SET:SEAFCO) | THB2.06 | THB1.67B | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.25 | £864.67M | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR2.93 | MYR2.02B | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.75 | £384.89M | ★★★★☆☆ |

Click here to see the full list of 5,752 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Koh Brothers Eco Engineering (Catalist:5HV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Koh Brothers Eco Engineering Limited is an investment holding company that offers engineering, procurement, and construction services for infrastructure, water and wastewater treatment, building, bio-refinery, and renewable energy projects across Singapore, Malaysia, Indonesia, Africa, and internationally with a market cap of SGD76.09 million.

Operations: The company generates revenue from two main segments: Engineering and Construction, contributing SGD88.70 million, and Bio-Refinery and Renewable Energy, with SGD64.88 million.

Market Cap: SGD76.09M

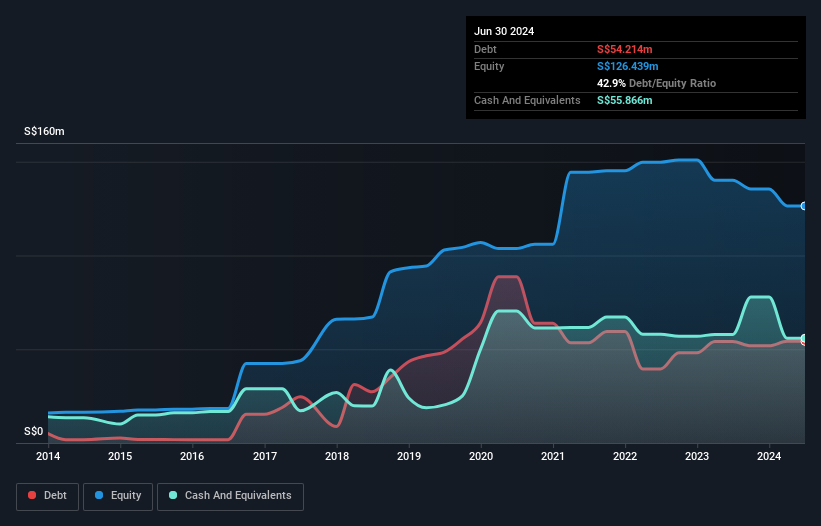

Koh Brothers Eco Engineering Limited, with a market cap of SGD76.09 million, operates in engineering and construction as well as bio-refinery and renewable energy sectors. Despite generating significant revenue from these segments, the company remains unprofitable with increasing losses over the past five years at a rate of 39.8% annually. While its short-term assets exceed both long-term and short-term liabilities, suggesting some financial stability, its operating cash flow covers only 11% of debt obligations. The management team is experienced; however, the board is relatively new. The stock has exhibited high volatility recently ahead of its Q3 results announcement on November 12, 2024.

- Get an in-depth perspective on Koh Brothers Eco Engineering's performance by reading our balance sheet health report here.

- Gain insights into Koh Brothers Eco Engineering's historical outcomes by reviewing our past performance report.

Image Systems (OM:IS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Image Systems AB develops software and systems for non-contact measurement technology and advanced image processing globally, with a market cap of SEK180.20 million.

Operations: Image Systems does not report distinct revenue segments.

Market Cap: SEK180.2M

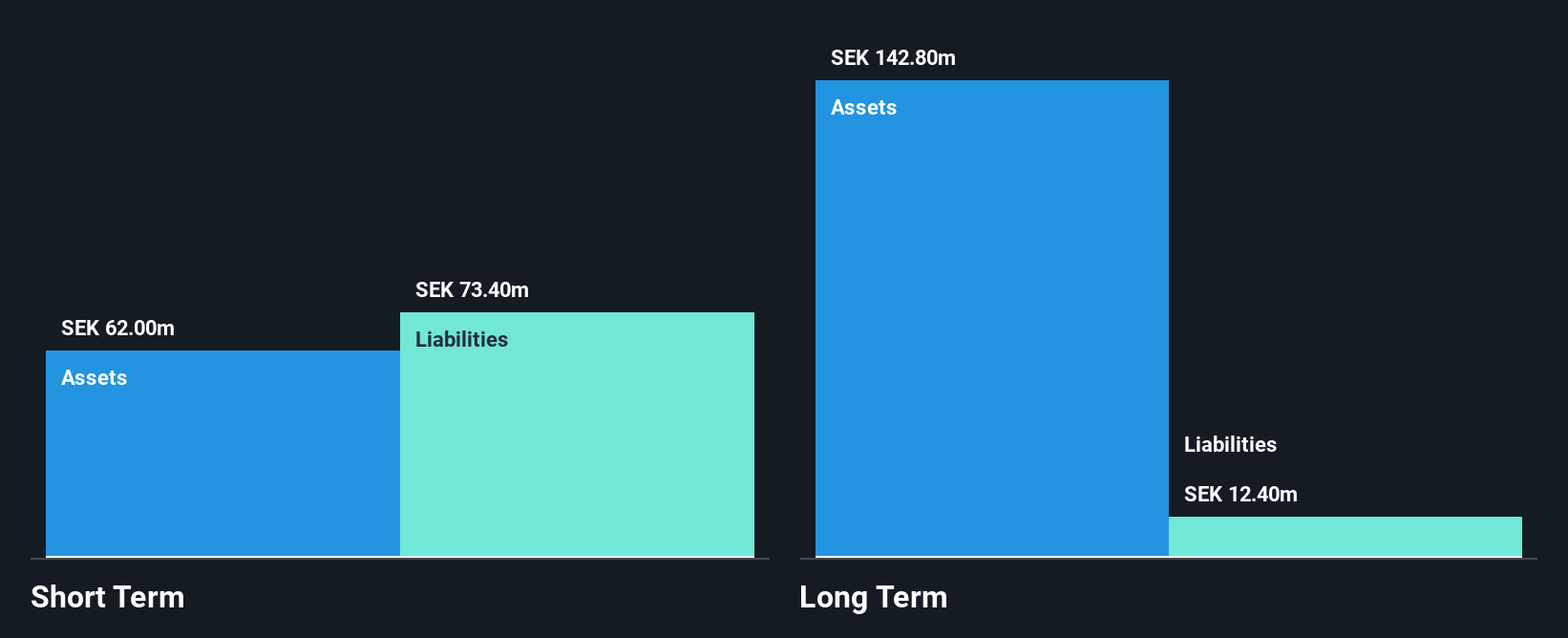

Image Systems AB, with a market cap of SEK180.20 million, has shown significant financial improvement recently. The company reported a strong third quarter with revenue of SEK60.2 million and net income of SEK12.8 million, marking a substantial increase from the previous year. Its debt is well covered by operating cash flow, and interest payments are comfortably managed by EBIT at 39 times coverage. Despite this progress, the company's stock remains volatile and its board lacks experience with an average tenure of 2.8 years. Image Systems' price-to-earnings ratio suggests it may be undervalued compared to the broader Swedish market.

- Dive into the specifics of Image Systems here with our thorough balance sheet health report.

- Evaluate Image Systems' prospects by accessing our earnings growth report.

Hanhua Financial Holding (SEHK:3903)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hanhua Financial Holding Co., Ltd., along with its subsidiaries, offers financial services in the People’s Republic of China and has a market capitalization of approximately HK$841.80 million.

Operations: The company's revenue is derived from Digital Finance (CN¥109.79 million), Digital Services (CN¥137.55 million), and Capital Investment and Management (CN¥36.49 million).

Market Cap: HK$841.8M

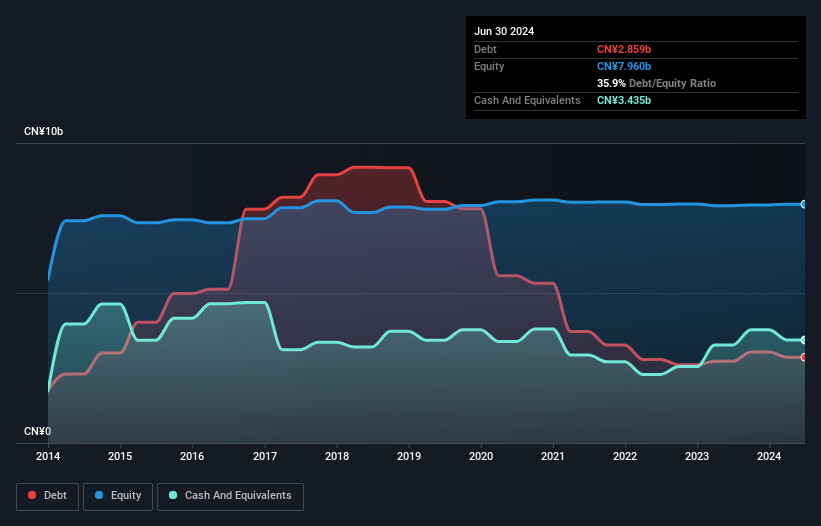

Hanhua Financial Holding Co., Ltd. has demonstrated significant earnings growth, with net income rising to CN¥21.77 million for the first half of 2024, up from CN¥11.15 million the previous year. Despite this, the company anticipates a 50% decrease in net profit due to reduced gains on long-term investments and increased impairment provisions. The company's financial structure shows improvement; its debt-to-equity ratio has decreased over five years, and short-term assets significantly exceed liabilities. However, Hanhua's operating cash flow remains negative, impacting its ability to cover debt effectively. Additionally, its share price has been highly volatile recently.

- Click to explore a detailed breakdown of our findings in Hanhua Financial Holding's financial health report.

- Review our historical performance report to gain insights into Hanhua Financial Holding's track record.

Summing It All Up

- Unlock more gems! Our Penny Stocks screener has unearthed 5,749 more companies for you to explore.Click here to unveil our expertly curated list of 5,752 Penny Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Hanhua Financial Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hanhua Financial Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3903

Hanhua Financial Holding

Provides financial services in the People’s Republic of China.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives