- Singapore

- /

- Industrials

- /

- SGX:C07

Top 3 SGX Dividend Stocks To Watch In August 2024

Reviewed by Simply Wall St

As the Singapore market navigates a period of cautious optimism amidst global economic shifts, dividend stocks continue to attract attention for their potential to provide steady income. In light of recent market dynamics, including significant moves by major players like Tencent, it's crucial to identify stocks that offer reliable dividends and resilience in a fluctuating environment.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 7.44% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.76% | ★★★★★☆ |

| China Sunsine Chemical Holdings (SGX:QES) | 6.61% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.77% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.68% | ★★★★★☆ |

| Civmec (SGX:P9D) | 5.40% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.68% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 8.14% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.77% | ★★★★★☆ |

| Oversea-Chinese Banking (SGX:O39) | 6.36% | ★★★★☆☆ |

Click here to see the full list of 19 stocks from our Top SGX Dividend Stocks screener.

We'll examine a selection from our screener results.

Multi-Chem (SGX:AWZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Multi-Chem Limited, with a market cap of SGD254.97 million, is an investment holding company that distributes information technology products in Singapore, Greater China, Australia, India, and internationally.

Operations: Multi-Chem Limited generates revenue through the distribution of information technology products across Singapore, Greater China, Australia, India, and various international markets.

Dividend Yield: 8.6%

Multi-Chem Limited recently announced an interim tax-exempt dividend of 11.10 Singapore cents per share, payable on 13 September 2024. The company reported a significant increase in earnings for the half year ended June 30, 2024, with net income rising to S$16.42 million from S$11.41 million a year ago. Despite this growth and trading below fair value, its high cash payout ratio indicates that dividends are not well covered by free cash flows and have been volatile over the past decade.

- Unlock comprehensive insights into our analysis of Multi-Chem stock in this dividend report.

- In light of our recent valuation report, it seems possible that Multi-Chem is trading behind its estimated value.

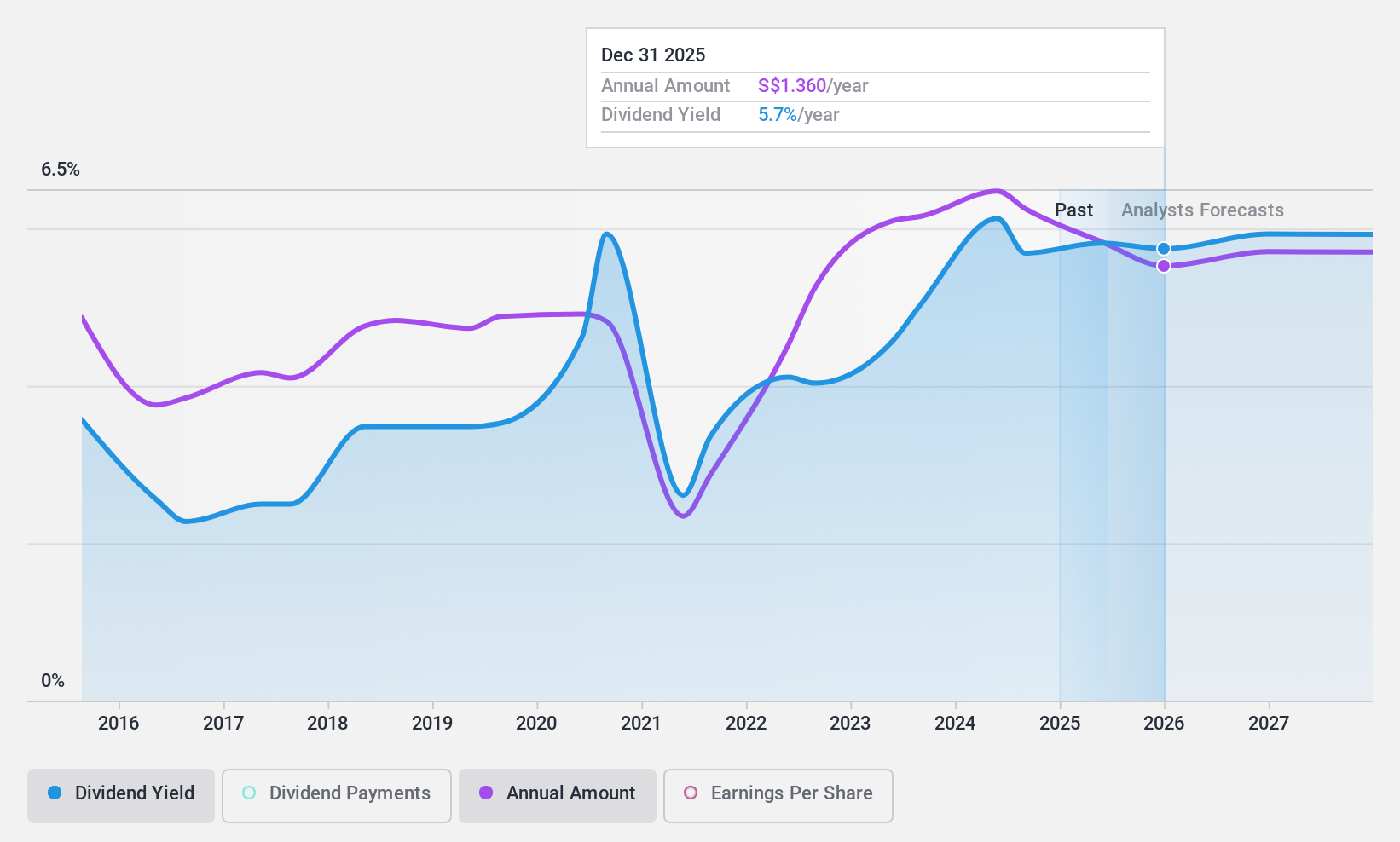

Jardine Cycle & Carriage (SGX:C07)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jardine Cycle & Carriage Limited is an investment holding company involved in financial services, heavy equipment, mining, construction and energy, agribusiness, infrastructure and logistics, information technology, and property businesses in Indonesia and internationally with a market cap of SGD10.29 billion.

Operations: Jardine Cycle & Carriage Limited generates revenue from its diverse operations in financial services, heavy equipment, mining, construction and energy, agribusiness, infrastructure and logistics, information technology, and property businesses.

Dividend Yield: 6%

Jardine Cycle & Carriage declared an interim dividend of US$0.28 per share, payable on 4 October 2024. Despite a volatile dividend history, the company's payouts are well-covered by earnings (payout ratio: 44.4%) and cash flows (cash payout ratio: 30.8%). Recent H1 2024 results showed a decline in sales to US$9.77 billion and net income to US$483.3 million compared to the previous year, reflecting potential challenges ahead for consistent dividend growth.

- Click here and access our complete dividend analysis report to understand the dynamics of Jardine Cycle & Carriage.

- Our valuation report unveils the possibility Jardine Cycle & Carriage's shares may be trading at a discount.

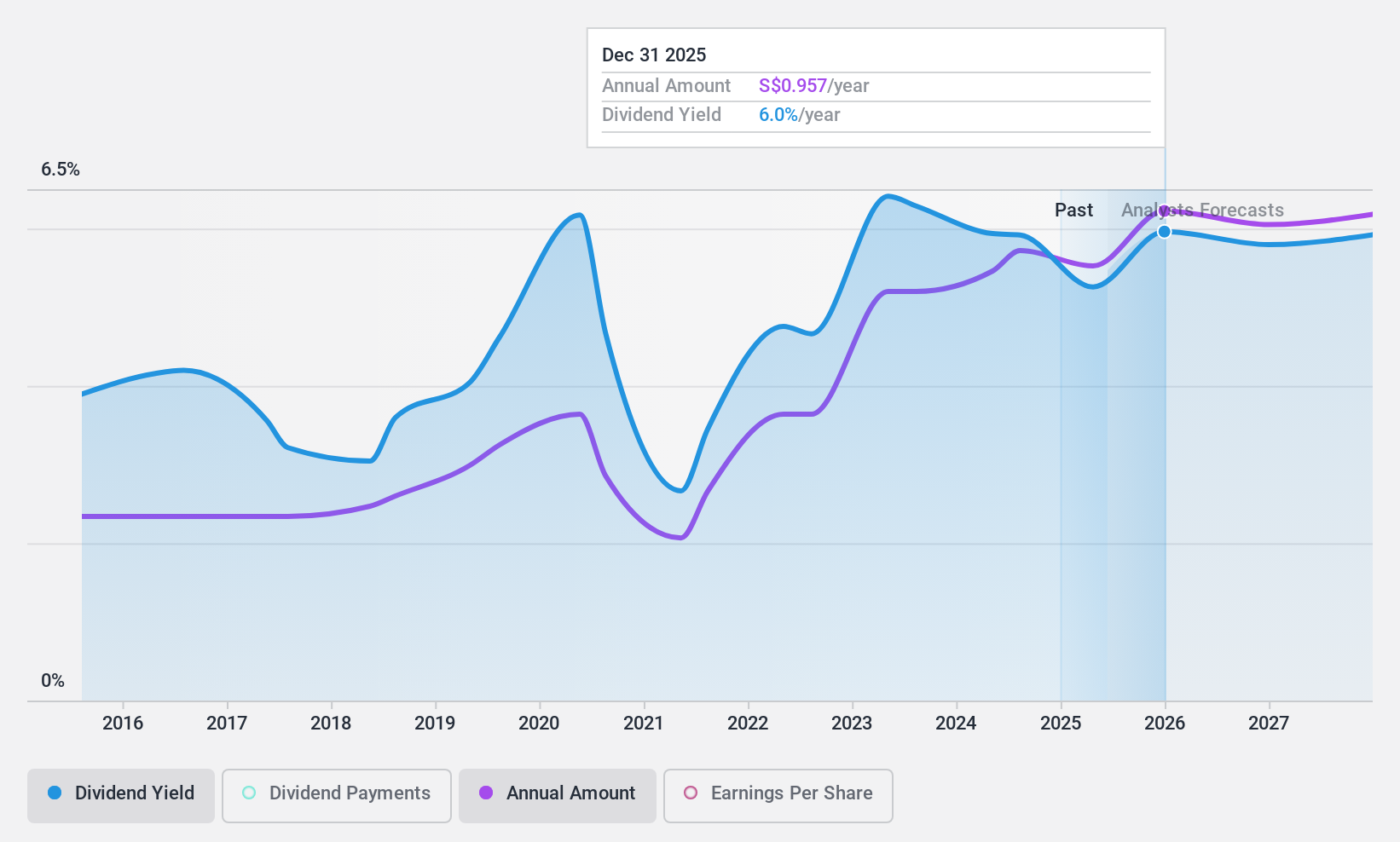

Oversea-Chinese Banking (SGX:O39)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oversea-Chinese Banking Corporation Limited, along with its subsidiaries, provides financial services across Singapore, Malaysia, Indonesia, Greater China, the rest of the Asia Pacific region and internationally; it has a market cap of SGD 62.17 billion.

Operations: Oversea-Chinese Banking Corporation Limited generates revenue primarily from Global Wholesale Banking (SGD 5.23 billion), Global Consumer/Private Banking (SGD 5.19 billion), Insurance (SGD 1.27 billion), and Global Markets (SGD 512 million).

Dividend Yield: 6.4%

Oversea-Chinese Banking Corporation's recent dividend increase to S$0.44 per share, payable on 23 August 2024, reflects strong earnings growth with H1 net income rising to S$3.93 billion from S$3.59 billion a year ago. The payout ratio of 52.8% ensures dividends are well-covered by earnings, though the dividend history has been volatile over the past decade. This stability in coverage indicates a sustainable but potentially inconsistent dividend outlook for investors.

- Dive into the specifics of Oversea-Chinese Banking here with our thorough dividend report.

- Our expertly prepared valuation report Oversea-Chinese Banking implies its share price may be lower than expected.

Next Steps

- Click here to access our complete index of 19 Top SGX Dividend Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:C07

Jardine Cycle & Carriage

An investment holding company, engages in providing the financial services, heavy equipment, mining, construction and energy, agribusiness, infrastructure and logistics, information technology, and property businesses in Indonesia, Singapore, and Malaysia.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives